1. Iyini i-Stochastic RSI?

Ukuqonda Stochastic RSI Dynamics

I-Stochastic RSI (StochRSI) isebenza ngomgomo wokuthi ku-a imakethe ye-bullish, amanani azovala eduze nokuphakama kwawo, futhi ngesikhathi se- Imakethe ye-bearish, amanani avame ukuvala eduze nokuphansi kwawo. Ukubalwa kwe-StochRSI kuhilela ukuthatha i-RSI yempahla nokusebenzisa ifomula ye-Stochastic, ethi:

StochRSI = (RSI - Lowest Low RSI) / (Highest High RSI - Lowest Low RSI)

Amapharamitha angukhiye we-StochRSI:

- I-RSI: The Isihlobo Amandla Inkomba ikala ubukhulu bezinguquko zakamuva zentengo ukuze kuhlolwe izimo ezithengiwe kakhulu noma ezidayiswe kakhulu.

- I-RSI Ephansi Kakhulu: Inani eliphansi kakhulu le-RSI esikhathini sokubheka emuva.

- I-RSI ephezulu kakhulu: Inani eliphakeme kakhulu le-RSI esikhathini sokubheka emuva.

Ukuhumusha Izimpawu ze-StochRSI

- I-Overbought Territory: Uma i-StochRSI ingaphezu kuka-0.8, impahla ibhekwa njengethengiwe ngokweqile. Iphakamisa ukuthi intengo ingahle ibangelwe ukuhlehla noma ukuhlehla.

- I-Oversold Territory: Uma i-StochRSI ingaphansi kuka-0.2, impahla ibhekwa njengedayiswe ngokweqile. Lokhu kukhombisa amandla okunyuka kwentengo noma ukuguqulwa.

Ilungiselela Izilungiselelo ze-StochRSI

Traders imvamisa ukulungisa izilungiselelo ze-StochRSI ukuze zihambisane namasu abo okuhweba:

- Isikhathi: Isilungiselelo esivamile yi-StochRSI yenkathi engu-14, kodwa lokhu kungafushaniswa ukuze kube nokuzwela okwengeziwe noma kunwetshwe ngamasignali ambalwa, kodwa athembeke kakhulu.

- Ukushelela: Ukufaka isicelo se- isilinganiso esihambayo, njengezinsuku ezi-3 isilinganiso esihambayo esilula, ingasiza ukushelela i-StochRSI futhi ihlunge umsindo.

Ukuhlanganisa i-StochRSI nezinye izinkomba

Ukunciphisa i- ingozi yezimpawu ezingamanga, traders ingase ihlanganise i-StochRSI nezinye izinkomba:

- Izilinganiso ezihambayo: Ingasiza ukuqinisekisa isiqondiso sethrendi.

- I-MACD: The Ukuhambisa Isilinganiso Sokwehluka Okuphakathi inganikeza isiqinisekiso esengeziwe ku- umfutho kanye nesitayela.

- I-Bollinger Amabhande: Uma isetshenziswa ne-StochRSI, ingasiza ekuhlonzeni ukuguquguquka kwentengo kanye nokwephulwa kwentengo okungaba khona.

Amathiphu Awusizo we Traders Ukusebenzisa i-StochRSI

- Bheka ama-Divergences: Uma inani lenza ukuphakama okusha noma okuphansi okungafanekiswanga yi-StochRSI, kungabonisa ithrendi entengantengayo kanye nokuguqulwa okungenzeka.

- I-StochRSI Crossovers: I-crossover ye-StochRSI ngaphezu kweleveli engu-0.8 noma engu-0.2 ingabonisa ithuba lokuthenga noma lokuthengisa, ngokulandelanayo.

- Sebenzisa Ezimweni Ezihlukile Zemakethe: I-StochRSI ingasebenza kuzo zombili izimakethe ezithrendayo nezihambisana nobubanzi, kodwa kubalulekile ukulungisa indlela ngendlela efanele.

I-StochRSI – Ithuluzi Lesikhathi Esithuthukisiwe Semakethe

I-StochRSI ithuthukisa a trader amandla okufaka isikhathi sokungena emakethe nokuphuma ngokugxila ejubaneni nasekushintsheni komnyakazo wentengo. Ukuzwela kwayo kuyenza ithuluzi elibalulekile kulabo abafuna ukuphendula ngokushesha ezinguqukweni zemakethe. Nokho, amathuba okuba izimpawu zamanga kudinga ukusetshenziswa kokuqinisekisa okwengeziwe okuvela kwabanye analysis technical izindlela zokuqinisekisa amasiginali anikezwe iStochRSI.

2. Indlela Yokusetha I-RSI ye-Stochastic ku-Platform Yakho Yokuhweba?

Lapho ulungiselela i- I-Stochastic rsi, traders kufanele iqaphele izingxenye zayo ezimbili eziyinhloko: i %K umugqa futhi %D umugqa. Ulayini %K uyinani langempela le-RSI ye-stochastic, kuyilapho ulayini we-%D uyisilinganiso esinyakazayo somugqa we-%K, osebenza njengomugqa wesiginali. Umkhuba ojwayelekile uwukusetha umugqa we-%D ube ngu-a Izikhathi ezihambayo ezingama-3 yomugqa %K.

Ukutolika i-Stochastic RSI kuhlanganisa ukubheka izimo ezithengwe kakhulu nezidayiswe kakhulu. Ngokuvamile, amanani angenhla 0.80 khombisa izimo ezithengiwe ngokweqile, eziphakamisa isignali yokuthengisa engase ibe khona, kuyilapho amanani angezansi 0.20 khombisa izimo ezidayiswe kakhulu, ukhomba isignali yokuthenga okungenzeka. Nokho, tradeI-rs kufanele iqaphe futhi ibheke ukuqinisekiswa kwezinye izinkomba noma amaphethini entengo ukugwema amasiginali angamanga.

I-Divergence omunye umqondo obalulekile uma usebenzisa i-Stochastic RSI. Uma intengo yenza ukuphakama okusha kuyilapho i-Stochastic RSI ihluleka ukwenza kanjalo, yaziwa ngokuthi a divergence ye-bearish futhi ingabonisa ukuhlehla okungaba khona kokwehla. Ngokuphambene, a umehluko we-bullish kwenzeka lapho intengo yenza ukwehla okusha, kodwa i-Stochastic RSI ayikho, okubonisa umfutho ongase ube phezulu.

Iziphambano phakathi komugqa we-%K nomugqa we-%D nawo abalulekile. Isiphambano esingaphezu komugqa we-%D singabonakala njengesiginali ye-bullish, kuyilapho isiphambano esingezansi singabhekwa njenge-bearish. Kodwa-ke, kubalulekile ukuqinisekisa ukuthi lezi ziphambano zenzeka ngokuhambisana nezinye izici, njengamazinga okusekela nokumelana, ukuze kwandiswe ukwethembeka kwazo.

| I-Stochastic RSI Component | Incazelo |

|---|---|

| %K Ulayini | Imele inani langempela le-Stochastic RSI |

| %D Umugqa | Isilinganiso esinyakazayo somugqa we-%K, ovame ukusetshenziswa njengomugqa wesiginali |

| Ileveli Yokuthenga Ngokweqile | Ngokuvamile ukusetha ku-0.80, kungase kubonise ithuba lokuthengisa |

| Ileveli Edayisiwe | Ngokuvamile ukusetha ku-0.20, kungase kubonise ithuba lokuthenga |

| I-Divergence | Umehluko phakathi kwesenzo senani ne-Stochastic RSI, okubonisa ukuhlehla okungaba khona |

| Iziphambano | Ulayini we-%K oweqa noma ngaphansi komugqa we-%D, uhlinzeka ngamasiginali we-bullish noma we-bearish |

bawafaka isinyathelo intengo ukuhlaziywa, njengamaphethini ekhandlela kanye namazinga okusekela/ukumelana, nokufundwa kwe-Stochastic RSI kungathuthuka trade ukunemba. Isibonelo, iphethini ekhulayo ye-bullish ezingeni elidayiswe ngokweqile ku-Stochastic RSI ingaba isignali yokuthenga eqinile. Ngokufanayo, iphethini yenkanyezi yokudubula esezingeni eliphansi ingaba isignali eqinile yokuthengisa.

Ukuphathwa kweengozi kufanele njalo ihambisane nokusetshenziswa kwezinkomba zobuchwepheshe. Ukusetha ama-oda okulahleka kokuyeka kumaleveli abalulekile kanye nokuthola osayizi bezindawo ezifanele kungasiza ukuphatha ukulahlekelwa okungaba khona. Traders kufanele futhi iqaphele ukukhishwa kwezindaba zomnotho ezingabangela ukuntengantenga futhi kube nomthelela ekusebenzeni kahle kwezinkomba zokuhlaziywa kobuchwepheshe njenge-Stochastic RSI.

Ngokuhlanganisa i-RSI ye-Stochastic ne-comprehensive uhlelo lokuhweba kanye nezinqubo eziphusile zokulawula ubungozi, tradeI-rs ingahlose ukuthuthukisa ukunemba kokungenayo neziphumayo zemakethe, okungase kuholele emiphumeleni yokuhweba engaguquki.

2.1. Ukukhetha Isikhathi Esifanele

Ukukhetha Uhlaka Lwesikhathi lwe-Stochastic RSI:

| Trader Uhlobo | Isikhathi Esikhethwayo | Injongo |

|---|---|---|

| Day Traders | Umzuzu o-1 ukuya kumashadi wemizuzu engu-15 | Thatha ukunyakaza okusheshayo, kwansuku zonke |

| swing Traders | Ihora eli-1 ukuya kumashadi wamahora angu-4 | Imvamisa yesignali yokulinganisa ngokuhlunga komsindo wemakethe |

| Isikhundla Traders | Amashadi wansuku zonke | Thola okuthembekile umfutho kanye nezinkomba zokuhlehla komkhuba |

Ukuthuthukisa kanye nokubuyisela emuva:

- Lungisa izilungiselelo ze-Stochastic RSI ukufanisa isikhathi esikhethiwe.

- Emuva emuva amasu usebenzisa idatha yomlando.

- Khomba ibhalansi phakathi ukunemba kwesignali kanye nenombolo ye trade amathuba.

Ngokukhetha ngokucophelela nokwenza kahle uhlaka lwesikhathi kanye nezilungiselelo ze-Stochastic RSI, traders bangathuthukisa amathuba abo okusebenzisa ngempumelelo tradeezivunyelaniswe nomuntu wazo amasu ukuhweba kanye namazinga okubekezelela ingozi. Kubalulekile ukukhumbula ukuthi asikho isikhathi esisodwa noma isilungiselelo senkomba esizosebenza kubo bonke traders noma izimo zemakethe, ukwenziwa ukwenza kube ngokwakho kanye nokuhlola okuqhubekayo izingxenye ezibalulekile zesu eliqinile lokuhweba.

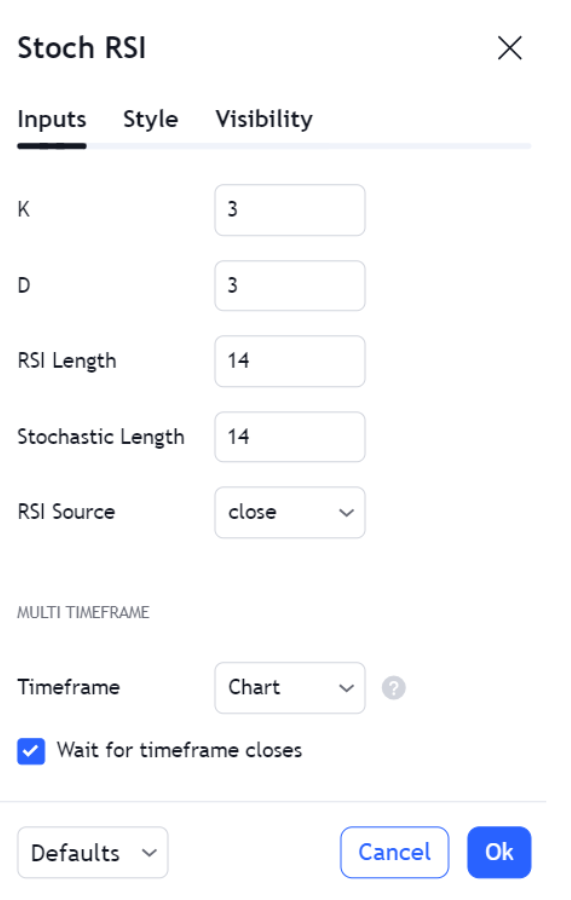

2.2. Ukulungisa Izilungiselelo Zenkomba

Lapho ulungiselela i- I-Stochastic rsi ukuze usebenze kahle, cabangela lezi zilungiselelo ezibalulekile:

- Isikhathi sokubheka emuva: Okuzenzakalelayo yizinkathi eziyi-14, kodwa lokhu kungalungiswa ukuze kube nokuzwela okuningi noma okuncane.

- Ukusheshisa ulayini we-%K: Ukushintsha isikhathi sokubala kuthinta ukusabela ezinguqukweni zemakethe.

- %D Ukushelela Komugqa: Ilungisa isilinganiso esinyakazayo somugqa we-%K ukuze ucule kahle ukuzwela kwesignali.

- I-Overbought/Oversold Thresholds: Ivamise ukusetha kokuthi 80/20, kodwa ingashintshwa ibe ngu-70/30 noma 85/15 ukuze ivumelane nezimo zemakethe.

| Setting | Okuzenzakalelayo | Ukulungiswa Kwesikhathi Esifushane | Ukulungiswa Kwesikhathi Eside |

|---|---|---|---|

| Isikhathi sokubheka emuva | 14 | 5-9 | 20-25 |

| Ukusheshisa ulayini we-%K | 3 | Nciphisa ukuze uthole impendulo esheshayo | Khulisa ukuze uthole impendulo ebushelelezi |

| %D Ukushelela Komugqa | 3 | Nciphisa ukuze uthole impendulo esheshayo | Khulisa ukuze uthole impendulo ebushelelezi |

| I-Overbought Threshold | 80 | 70 noma 85 | 70 noma 85 |

| I-Oversold Threshold | 20 | 30 noma 15 | 30 noma 15 |

Ukubuyela emuva kuyisinyathelo okungaxoxiswana ngaso enqubweni yokulungisa. Iqinisekisa ukusebenza kwezilungiselelo ezintsha futhi iqondanise ne- trader isu. Lokhu kubuyekezwa komlando kunciphisa ubungozi bokusebenzisa izilungiselelo ezingasebenzi kahle futhi kuthuthukisa ukuzethemba kokwenza izinqumo.

Traders kumele akhumbule ukuthi asikho isilungiselelo esisodwa esifanelana nazo zonke izimo zemakethe. Ukuhlola okuqhubekayo nokulungiswa kwamapharamitha we-Stochastic RSI kubalulekile ukuze kugcinwe ukuhambisana nokunemba kumasiginali ewanikezayo. Umgomo uwukuthola ukulingana phakathi kokuphendula ukunyakaza kwemakethe kanye nokunciphisa amasignali amanga, aklanyelwe trader indlela eqondile nendawo yemakethe.

2.3. Ukuhlanganisa namathuluzi wokushaja

Ukugcizelela Iqhaza Lezinkomba Zomthamo

bawafaka izinkomba zevolumu eceleni kwe-Stochastic RSI ingaqinisa kakhulu ukwethembeka kwamasiginali oyitholayo. Izinkomba zevolumu ezifana ne-On-Balance Volume (OBV) noma I-Average-weighted Average Price (I-VWAP) ingaqinisekisa umfutho otholwe yi-Stochastic RSI. Ivolumu ekhuphukayo ngesikhathi sesignali ye-Bullish ye-Stochastic RSI ingaqinisekisa inzalo yokuthenga, kuyilapho ivolumu ekhulayo ngesikhathi sesignali ye-bearish ingase iphakamise ingcindezi yokuthengisa eqinile.

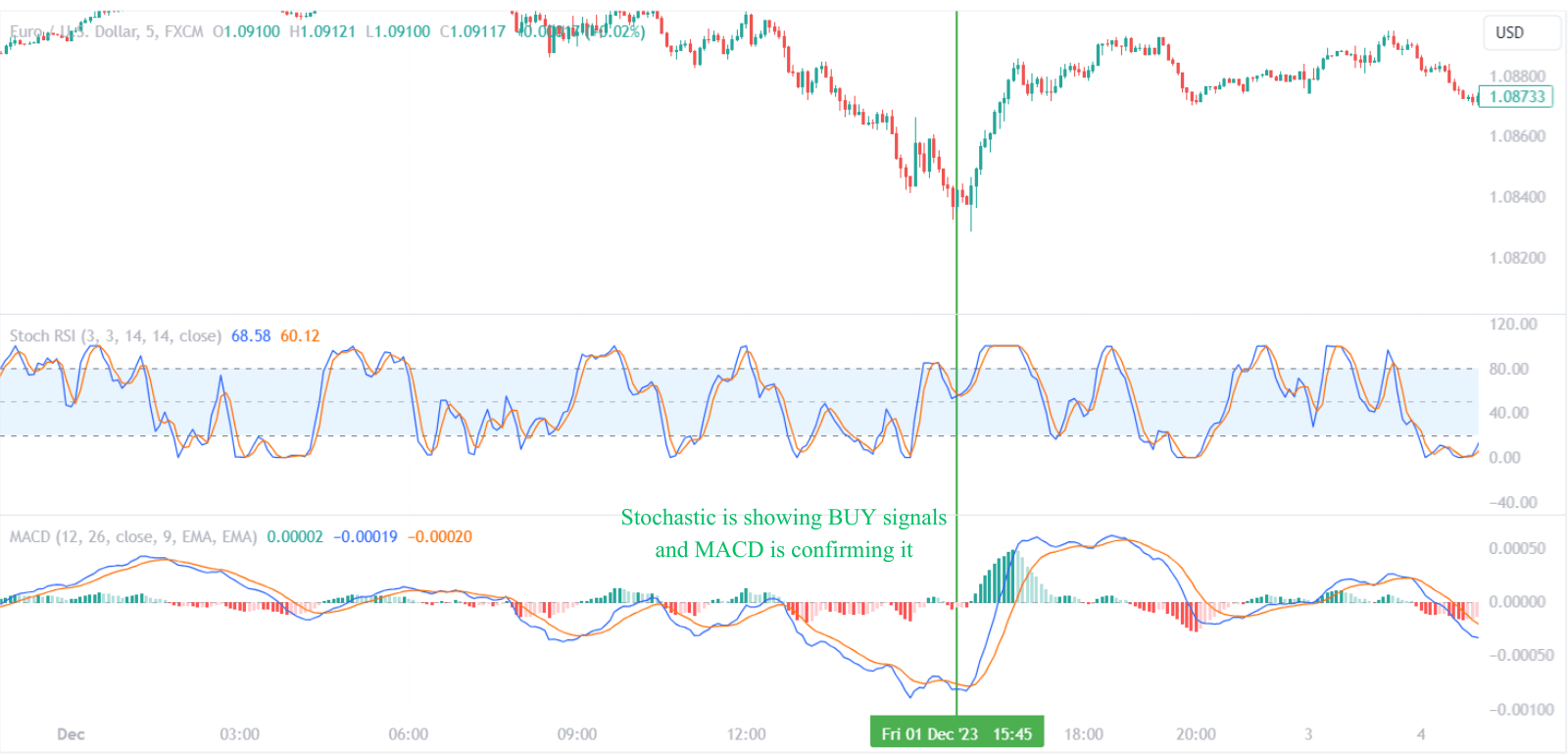

Ihlanganisa nama-Oscillator Okuqinisekisa I-Momentum

Izincwajana zemininingwane ama-oscillators, njenge-MACD (Moving Average Convergence Divergence) noma i-RSI (Relative Strength Index), uma isetshenziswa ngokuhambisana ne-Stochastic RSI, inganikeza ukuqinisekiswa okwengeziwe komfutho. I-bullish crossover ku-MACD noma ukuphakama ngaphezu kuka-50 ku-RSI ingaqinisa isignali yokuthenga evela ku-Stochastic RSI.

| I-Stochastic RSI Signal | Ukuqinisekisa Inkomba | Isenzo Esingenzeka |

|---|---|---|

| Kukweqile | I-Bearish MACD Crossover | Cabangela Ukuthengisa |

| Okuphindwe kabili | I-Bullish MACD Crossover | Cabangela Ukuthenga |

| sokungahlangene | I-RSI cishe ngama-50 | Bamba/Linda Ukuqinisekisa |

Ukusetshenziswa Kwamasu Amaphethini ekhandlela

Amaphethini wamakhandlela ingasebenza njengosizo olubonakalayo olunamandla ekuhlaziyweni kwe-Stochastic RSI. Amaphethini afana nekhandlela elivuthayo, isando, noma inkanyezi edubulayo anganikeza ukuqonda okusheshayo kumizwa yemakethe. Iphethini ekhulayo ye-bullish eduze neleveli ye-Stochastic RSI edayiswe ngokweqile ingaba isignali yokuthenga eqinile, kuyilapho inkanyezi edubulayo ezingeni elithengiwe ngokweqile ingase ibonise ithuba lokuthengisa elingase libe khona.

Ngokuhlanganisa i-RSI ye-Stochastic ngamathuluzi ahlukahlukene wokushadi nezinkomba zobuchwepheshe, traders ingakha uhlaka lokuhlaziya oluphelele noluguquguqukayo. Lokhu kuhlanganiswa akugcini nje ngokuthuthukisa amandla okubikezela e-Stochastic RSI kodwa futhi kuvumela ukuqonda okune-nuanced ye-dynamics yemakethe, okuholela ezinqumweni zokuhweba ezinamasu nezinolwazi.

3. Isetshenziswa kanjani i-Stochastic RSI ye Trade Amasignali?

Lapho usebenzisa i- I-Stochastic rsi, traders kufanele ikhumbule amaphuzu abalulekile alandelayo ukuze ikhulise ukusebenza kwayo kahle:

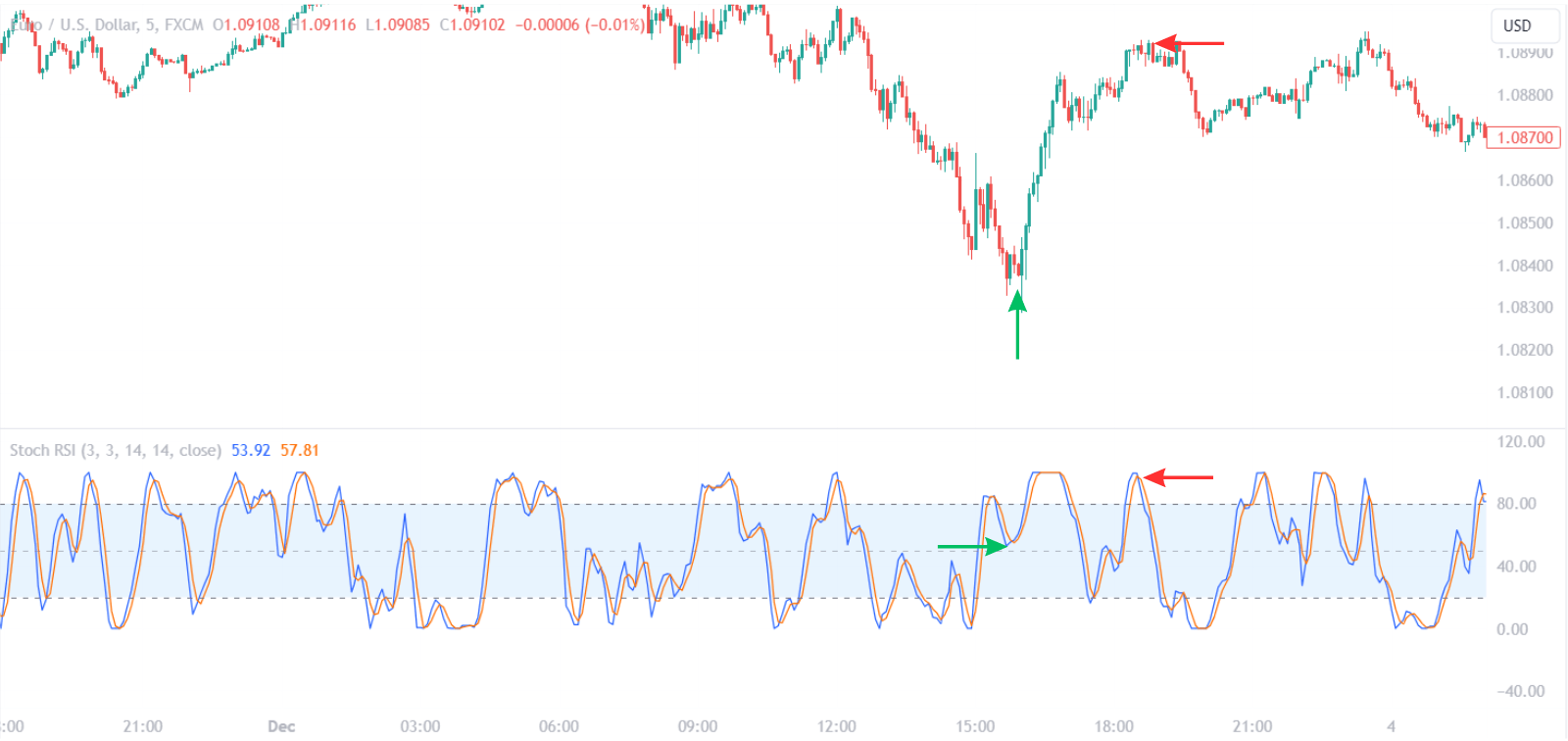

- Izimo ezithengwa kakhulu/ezidalwe ngokwedlulele: Umkhawulo ojwayelekile ongu-0.80 wokuthengwa ngokweqile kanye no-0.20 wezimo ezidayiswe kakhulu yizindawo zokuqala. Lungisa lawa maleveli ukuze afaneleke kangcono ukuziphatha komlando kwempahla kanye nezimo zamanje zemakethe.

- I-Signal Line Crossovers: Naka umugqa %K owela umugqa %D. I-crossover engaphezu kolayini we-%D ingase ibe yithuba lokuthenga, kuyilapho i-crossover engezansi ingase iphakamise ukuthi sekuyisikhathi sokuthengisa.

- Ukuhlukana: Hlala njalo ubheke ukwehlukana phakathi kwe-StochRSI nentengo njengoba ingaba izandulela zokuhlehla. Nokho, qinisekisa ngezinkomba ezengeziwe ukuze ugweme amaphuzu angamanga.

- Ukuqinisekisa Nezinye Izinkomba: Sebenzisa amathuluzi engeziwe okuhlaziya ezobuchwepheshe njengama-avareji ahambayo, i-MACD, noma amaphethini wekhandlela ukuze uqinisekise amasiginali we-StochRSI, okungaholela ezinqumweni zokuhweba eziqinile.

- Ukulungiswa Kokuguquguquka: Ezimakethe eziguquguqukayo kakhulu, i-StochRSI inganikeza amasignali avamile futhi ngezinye izikhathi adukisayo. Lungisa ukuzwela kwe-StochRSI noma imikhawulo ethengwe ngokweqile/edayiswe kakhulu ukuze ivumelane nokuntengantenga kwemakethe.

- Ukuphathwa Kobungozi: Ngisho nenkomba ethembekile efana ne-StochRSI, kubalulekile ukuzijwayeza ukulawula ubungozi obuzwakalayo. Setha ama-oda okulahleka kokuyeka futhi ubeke engcupheni iphesenti elincane lemali yokuhweba kunoma yikuphi okunikeziwe trade.

| Ukucatshangelwa Okubalulekile | Incazelo |

|---|---|

| Amazinga athengwa ngokwedlulele/ama-Oversold | Lungisa imikhawulo ukuze ilingane nempahla futhi Ukukhishwa kwemakethe. |

| Crossovers | Gada i-%K kanye ne-%D yolayini obuphambanayo ukuze uthole amasiginali okuthenga/ukuthengisa okungenzeka. |

| I-Divergence | Bheka ukwehluka kwesikhombi sentengo futhi uqinisekise ngamanye amathuluzi. |

| Izinkomba Ezengeziwe | Qinisekisa amasignali ngezinye izindlela zokuhlaziya lobuchwepheshe. |

| Ukulungiswa Kwezinto Ezishintshashintshayo | Shintsha ukuzwela kanye nemingcele ezimakethe eziguquguqukayo. |

| Risk Management | Sebenzisa ama-stop-loss orders futhi uphathe trade usayizi. |

Ngokuhlanganisa i-StochRSI ibe isu eliphelele lokuhweba nokulihlanganisa namanye amathuluzi okuhlaziya ezobuchwepheshe, traders angakwazi ukuzulazula kangcono ezinkingeni zemakethe futhi enze izinqumo ezinolwazi.

3.1. Ukuhlonza Izimo Ezithengwa Kakhulu Nezithengiswa Kakhulu

I-Divergence omunye umqondo obalulekile uma usebenzisa i-StochRSI. Kwenzeka lapho intengo yempahla ihamba iye kolunye uhlangothi lwenkomba. A umehluko we-bullish kwenzeka uma inani lirekhoda eliphansi eliphansi, kodwa i-StochRSI yenza okuphansi okuphezulu. Lokhu kusikisela ukwehlisa umfutho, futhi traders angase alindele umnyakazo wentengo okhuphukayo ozayo. Ngakolunye uhlangothi, a divergence ye-bearish kulapho intengo ifika phezulu kakhulu kuyilapho i-StochRSI isetha ukuphakama okuphansi, okubonisa isenzo sentengo esingaba khona esingaphambili.

| Uhlobo Lokuhlukana | Price Action | Isenzo se-StochRSI | Isiginali engaba khona |

|---|---|---|---|

| Isi-Bullish | Ngaphansi okuphansi | Phezulu Phansi | Ukunyakaza Kwaphezulu |

| Bearish | Phezulu Phezulu | Phansi Phezulu | Ukunyakaza Kwaphansi |

The Isilungiselelo se-StochRSI ngesinye isici lokho traders ingase ilungise ukuze ivumelane nesitayela sabo sokuhweba nezinjongo. Ukulungiselelwa okuzenzakalelayo kuvame ukubandakanya isikhathi sesikhathi esiyizinkathi eziyi-14, kodwa lokhu kungashintshwa ukuze kube nokuzwela okwengeziwe noma ukushelela. Isikhathi esifushane singanikeza amasignali angaphambili kodwa futhi singanyusa ingcuphe yemiphumela engamanga. Ngokuphambene, isikhathi eside singase sinikeze amasiginali athembeke kakhulu ngezindleko zokufika ngesikhathi.

bawafaka ukuhlaziywa komkhuba ingathuthukisa ukusebenza kahle kwe-StochRSI. Ekukhuphukeni okuqinile, izimo ezithengiwe kakhulu zingase zibonise ukuguqulwa okubalulekile, njengoba imakethe ingaqhubeka nokukhuphuka. Ngokufanayo, ku-downtrend, izimo ezidayiswe ngokweqile zingase zingabonisi ukuguqulwa okusheshayo. Ukuqaphela ukuthambekela okukhona kungasiza traders inquma ukuthi ihumusha kanjani futhi isebenze ngokufundwa kweStochRSI.

- Ku-Uptrends: Izimo ezithengiwe ngokweqile zingase zingabaluleki kangako; bheka amadiphu njengamathuba okuthenga.

- Ku-Downtrends: Izimo ezidayiswa kakhulu zingase ziqhubeke; amarali angaba namathuba amancane.

Ukuphathwa kweengozi kubaluleke kakhulu lapho uhweba ngokusekelwe kumasiginali we-StochRSI. Traders kufanele asebenzise njalo ama-oda wokuyeka ukulahleka ukuvikela umnyakazo wemakethe ophambana nezikhundla zabo. Ukwengeza, ubukhulu be-a trade kufanele ilinganiswe ngokusho kwe- trader ukubekezelela ubungozi kanye nokuntengantenga kwemakethe.

Okokugcina, kubalulekile ukuqaphela ukuthi i-StochRSI iyithuluzi elilodwa ku-a trader's arsenal. Ukuhweba okuphumelelayo kuvame ukudinga a indlela ephelele, kucatshangelwa okuyisisekelo, imizwa yemakethe, nezinye izinkomba zobuchwepheshe eceleni kwe-StochRSI. Ngokwenza kanjalo, traders angenza izinqumo ezinolwazi kakhulu futhi azulazule ezimakethe ngokuzethemba okukhulu.

3.2. Ukuqaphela Ukwehluka kwe-Bullish kanye ne-Bearish

Ukuhlonza Ukuhlukana: Indlela Yesinyathelo Ngesinyathelo

- Gada Okuthrendayo: Qala ngokubheka inkambiso iyonke eshadini lentengo. Ingabe imakethe ithrenda phezulu, phansi, noma iboshelwe kububanzi?

- Thola Extremes in Price Action: Bheka iziqongo zakamuva kanye nemigodi eshadini lentengo. Lawa amaphuzu akho ayisithenjwa uma uwaqhathanisa ne-Stochastic RSI.

- Qhathanisa ne-Stochastic RSI: Qondanisa iziqongo nezinqola eshadini lamanani nokuphakama nokwehla okuhambisanayo kwe-Stochastic RSI. Ingabe zihamba ngokuzwana, noma kukhona ukuphambana?

- Khomba Uhlobo Lokwehlukana:

- I-Bullish Divergence: Intengo yenza okuphansi okuphansi, kodwa i-Stochastic RSI yenza okuphansi kakhulu.

- I-Bearish Divergence: Intengo yenza ukuphakama okuphezulu, kodwa i-Stochastic RSI yenza ukuphakama okuphansi.

- Funa Ukuqinisekisa: Ngaphambi kokuthi wenze ngokwehlukana, linda amasiginali angeziwe njenge-crossover ku-Stochastic RSI noma ukuphuma kwephethini eshadini lentengo.

- Linganisa Ngokuphikisana Nezinye Izinkomba: Qinisekisa ukwehlukana nezinye izinkomba zobuchwepheshe ezifana nezilinganiso ezihambayo, i-MACD, noma ivolumu yesignali yokuhweba eqinile.

Ukucatshangelwa Okubalulekile Lapho Ukuhweba Kwehlukana

- Ukubekezela Kusemqoka: Ukweqa isibhamu ngaphambi kokuqinisekisa okucacile kungaholela ekuqalweni okungamanga. Linda imakethe ukunikeza isignali ecacile.

- I-Trend Strength Matters: Ukwehluka akuthembeki kangako ezimakethe ezithrendayo ezinamandla lapho umfutho ungadlula isignali yokuhlukana.

- Risk Management: Njalo sebenzisa ama-stop-loss orders ukuze unciphise ubungozi uma kwenzeka ukwehlukana kungaphumeleli ekubuyiselweni kwentengo okulindelekile.

- Isimo Semakethe: Cabangela izimo zemakethe ezibanzi nezindaba zezomnotho ezingase zibe nomthelela emananini entengo yempahla futhi zenze ukusetha kokuhlukana kungasebenzi.

Ukusebenzisa Ukuhlukana Ngokuhambisana Namanye Amasu

- Amaphethini Amanani: Hlanganisa ukwehlukana namaphethini amanani akudala njengekhanda namahlombe, onxantathu, noma phezulu/phansi okukabili ukuze uthole ukuhlangana kwamasignali.

- I-Fibonacci Amazinga: Sebenzisa amaleveli okubuyisela e-Fibonacci ukuze uthole amaphuzu angahle ahlehliselwe aqondaniswe namasiginali wokuhluka.

- Ukufakela Amakhandlela: Bheka amaphethini wekhandlela e-bullish noma e-bearish ukuze uqinisekise amasiginali okubuyisela emuva aphakanyiswe ukwehluka.

Ngokuhlanganisa ukwehlukana kube isu eliphelele lokuhweba nokucabangela umongo wemakethe obanzi, traders ingathuthukisa inqubo yabo yokuthatha izinqumo futhi inyuse izinga lempumelelo yabo ezimakethe.

3.3. Ukuhlanganisa Nezinye Izinkomba Zobuchwepheshe

Ukufaka i I-Stochastic rsi ne Isilinganiso sokuhamba esiphezulu se-Exponential (EMA) anganikela traders indlela eguquguqukayo yokuqinisekisa ithrendi nokunemba kwesignali. I-EMA inikeza isilinganiso sentengo esishelelezi esisabela ngokushesha kakhulu ezinguqukweni zentengo zakamuva kunesilinganiso esihambayo esilula. Lapho i-Stochastic RSI iwela ngaphezulu noma ngaphansi kwe-EMA, kungaba inkomba yoshintsho kumfutho wethrendi.

Izinkomba zevolumu, sesha njenge Ivolumu Yebhalansi (OBV), ingaphinda igcwalise i-Stochastic RSI ngokuqinisekisa amandla ethrendi. I-OBV ekhulayo kanye ne-Stochastic RSI ephuma endaweni edayiswe kakhulu ingase ibonise ukuthambekela okuqinile okukhuphukayo, kuyilapho i-OBV eyehlayo ingaqinisekisa isignali ye-bearish evela ku-Stochastic RSI.

Amazinga wokubuyiselwa kwe-Fibonacci nikeza esinye isendlalelo sokuhlaziya lapho sisetshenziswa ne-Stochastic RSI. TradeI-rs ingabukela i-Stochastic RSI ukuze ibonise ukuhlehla emazingeni abalulekile e-Fibonacci, avame ukusebenza njengokusekela noma ukumelana. Le nhlanganisela ingaba namandla ikakhulukazi ngesikhathi sokubuyisela emuva kumkhuba oqinile.

Amaphethini wamakhandlela, njenge-doji, izando, noma amaphethini ahlanganisayo, anganikeza isiqinisekiso esibonakalayo sokuhlehla okungaba khona noma ukuqhubeka kwethrendi. Uma lawa maphethini enzeka ngokuhlanganyela namasiginali we-Stochastic RSI, angathuthukisa i- trade ukwethembeka kokusetha.

Ukuhlanganisa i-RSI ye-Stochastic nezinye izinkomba zobuchwepheshe kuvumela indlela ehlukahlukene yokuhlaziya imakethe. Nali ithebula elifingqa ezinye zezinhlanganisela:

| Stochastic RSI + | Inhloso Yokuhlanganisa |

|---|---|

| MACD | Qinisekisa izimo ezithengiwe kakhulu/ezidayiswe kakhulu futhi uqinisekise ukuhlehliswa kwethrendi |

| RSI | Nikeza amasiginali ahambisanayo ukuze unciphise amaphozithizi amanga |

| Amabhodi we-Bollinger | Khomba ukuhlehla kwethrendi okungaba khona noma ukuqhubeka |

| Amazinga Okusekela/Ukumelana | Qinisekisa trade amasignali anamasu amashadi |

| EMA | Qinisekisa isiqondiso sethrendi namashifu omfutho |

| Ama-Volume Indicators | Qinisekisa amandla ethrendi kanye nokuhlehla okungaba khona |

| Fibonacci Retracement | Spot ukuhlehla kumazinga ayinhloko okusekela/ukumelana |

| lwezibani Patterns | Ukuqinisekiswa okubonakalayo kwamasiginali we-Stochastic RSI |

diversification yokuhlaziya futhi ukuqinisekiswa okuphambene ngalezi zinhlanganisela kungaholela ekuthathweni kwezinqumo okunolwazi ekuhwebeni. Nokho, traders kufanele ikwazi ukuthi kungenzeka yini inzima kakhulu isu labo elinezinkomba eziningi kakhulu, ezingaholela ku ukuhlaziywa ukukhubazeka. Ukulinganisa ubulula nokucophelela kuyisihluthulelo sesu elisebenzayo lokuhweba.

4. Yimaphi Amasu Angcono Kakhulu Okusebenzisa I-Stochastic RSI?

Izimakethe Zokuhlanganisa

Ngezikhathi zokuhlanganisa, i-Stochastic RSI ingasiza traders ukukhomba ukuqubuka okungenzeka. A ububanzi obuncane ku-RSI ye-Stochastic, efana nokuminyanisa intengo, ingase yandulele ukuphuma. Traders kufanele ihlole ukujika okubukhali ukusuka ebangeni elimaphakathi (izinga elingu-50), elingabonisa isiqondiso sokuphuma. Izikhundla zingaqalwa lapho i-Stochastic RSI iqinisekisa isiqondiso sokuphuma, ngokuqinisekiswa okwengeziwe okuvela esenzweni samanani.

| Isimo Semakethe | I-Stochastic RSI Isu | Ukuqinisekiswa kwe |

|---|---|---|

| Ukuhlanganiswa | Gada ukuminyanisa kwe-RSI | Ukukhishwa kwesenzo senani |

Izimakethe Eziguquguqukayo

Ezimakethe eziguquguqukayo, i-Stochastic RSI ingasetshenziswa ukukala amashifu umfutho. Ukunyakaza okusheshayo ku-Stochastic RSI kungabonisa ingcindezi yokuthenga noma yokuthengisa eqinile. Ngezikhathi ezinjalo, traders ingase isebenzise isikhathi esifushane se-Stochastic RSI ukuze ithwebule lezi zinguquko ezisheshayo. Trades ngokuvamile ezesikhathi esifushane, zisebenzisa ukunyakaza kwentengo okubukhali.

| Isimo Semakethe | I-Stochastic RSI Isu | Trade Ubude besikhathi |

|---|---|---|

| oluyingozi | Izinguquko zesikhathi esifushane | Isikhathi esifushane |

I-Divergence Trading

Ukwehlukana phakathi kwe-Stochastic RSI kanye nesenzo samanani kungaba isignali enamandla traders. A umehluko we-bullish kwenzeka lapho izintengo zenza ukwehla okusha, kodwa i-Stochastic RSI yenza iphansi kakhulu, iphakamisa ukwehla komfutho ophansi. Ngokuphambene, a divergence ye-bearish kulapho izintengo zifinyelela phezulu okusha nge-Stochastic RSI yenza i-high low, ekhombisa ukwehla komfutho okhuphukayo. Lokhu kwehluka kungandulela ukuhlehla kwethrendi.

| Uhlobo Lokuhlukana | Price Action | I-Stochastic rsi | Umphumela Olindelwe |

|---|---|---|---|

| Isi-Bullish | Okuphansi okusha | Iphansi kakhulu | Ukuhlehla ukuya phezulu |

| Bearish | Okuphezulu okusha | Okuphezulu okuphansi | Ukuhlehla kuya phansi |

Ukuhlanganisa i-RSI ye-Stochastic nezinye Izinkomba

Ukuhambisa Okumaphakathi

Ukuhlanganisa i-Stochastic RSI ne ukuhamba ngamaphesenti ingahlunga amasignali futhi inikeze umongo wethrendi. Isibonelo, ukuthatha amasiginali okuthenga kuphela lapho intengo ingaphezu kwesilinganiso esinyakazayo kungathuthukisa amathuba okuba yimpumelelo trade ku-uptrend. Ngokuphambene, ukuthengisa lapho intengo ingaphansi kwesilinganiso esinyakazayo ku-downtrend kuqondana nesiqondiso semakethe esikhona.

Amabhodi we-Bollinger

Ukuhlanganisa i-Stochastic RSI ne Amabhodi we-Bollinger inikeza imininingwane yokuguquguquka kanye nokweqisa kwentengo. Ukufundwa kwe-Stochastic RSI ngaphezu kuka-80 lapho intengo ithinta i-Bollinger Band ephezulu ingase ibonise isimo esithengiwe ngokweqile, kuyilapho ukufunda okungaphansi kuka-20 nenani lentengo ebhendi ephansi kungabonisa isimo esidayiswe ngokweqile.

Ama-Volume Indicators

Izinkomba zevolumu eceleni kwe-Stochastic RSI zingaqinisekisa noma ziphikise amandla ngemuva komnyakazo. Isibonelo, ukukhuphuka kwentengo okukhuphukayo nge-RSI ephezulu ye-Stochastic kanye nevolumu ekhulayo kungaqinisekisa umuzwa we-bullish. Ngokuphambene, uma ivolumu yehla ngesikhathi sokuphumula, kungase kubonise ukuntula ukuqiniseka.

Ukujwayela i-RSI ye-Stochastic kuya Izitayela Zokuhweba

Usuku Ukuhweba

Day traders bangazuza ku- izimpawu ezisheshayo inikezwe yi-Stochastic RSI. Ukusebenzisa uhlaka lwesikhathi olufushane nokulihlanganisa nekhefu leleveli noma amaphethini ekhandlela kungaholela ekusebenzeni kahle trade okufakiwe nokuphuma kulo lonke usuku lokuhweba.

Ukuhweba kwe-Swing

swing traders angakhetha a isikhathi eside ukuze i-Stochastic RSI ilungise isimo esishintshashintshayo sesikhashana. Ukuhweba nge-Swing kuhilela ukubamba izikhundla izinsuku ezimbalwa noma amasonto, ngakho-ke ukuqondanisa i-Stochastic RSI nokuphakama nokwehla kwamasonto onke kungaba yinzuzo kakhulu kunokuguquguquka kwansuku zonke.

Isikhundla Ukuhweba

Isikhundla traders angasebenzisa i-Stochastic RSI ukukhomba amandla omkhuba ngezinyanga noma ngisho neminyaka. Ukusebenzisa ukulungiselelwa kwe-Stochastic RSI yesikhathi eside kungasiza ekunqumeni izindawo ezingcono kakhulu zokungena nokuphuma ezikhundleni ezenza imali eningi ekuhambeni kwemakethe enkulu.

Amathiphu Asebenzayo we-Stochastic RSI Traders

- Amasu we-Backtest ngaphambi kokuzisebenzisa ezimakethe bukhoma ukuze baqonde ukusebenza kahle kwazo ezimeni ezihlukene zemakethe.

- Sebenzisa izikhathi eziningi ozimele ukuze uqinisekise amasignali futhi uthole umbono obanzi wemakethe.

- Faka isicelo njalo ukulawulwa kwezinhlekelele amasu, njengama-stop-loss orders, ukuvikela umnyakazo wemakethe ongemuhle.

- Qaphela ukukhishwa kwezomnotho kanye nemicimbi yezindaba lokho kungabangela ukushintsha okungazelelwe komuzwa wemakethe, okungaba nomthelela ekufundweni kwe-Stochastic RSI.

- Ngokuqhubekayo hlolisisa futhi ucwenge isu lakho lokuhweba elisekelwe ekusebenzeni nasekuguquleni amandla emakethe.

4.1. Amasu Okulandela Okuthrendayo

Ukufaka i I-Stochastic rsi kuthrendi elandelayo isu libandakanya izinyathelo ezimbalwa. Okokuqala, thola ukuthambekela okuphelele usebenzisa isilinganiso sesikhathi eside esinyakazayo. Uma intengo ingaphezu kwesilinganiso esihambayo, gxila ezikhundleni ezinde; uma ngezansi, izikhundla ezimfushane zingcono kakhulu.

| Uhlobo Lwethrendi | Isikhundla senani | I-Stochastic RSI Isu |

|---|---|---|

| I-uptrend | Ngaphezulu kwe-MA | Thenga lapho i-Stochastic RSI ihamba ngaphezu kuka-80 ngemva kokucwiliswa |

| I-Downtrend | Ngezansi kwe-MA | Thengisa/Imfushane uma i-Stochastic RSI ihamba ngaphansi kwama-20 ngemva kokukhuphuka |

Uma inkombandlela yethrendi isimisiwe, linda i-Stochastic RSI ukuze ibonise ukuhlehla ngaphakathi komkhuba. Lokhu kuvamise ukuba lapho i-Stochastic RSI iphuma endaweni ethengiwe ngokweqile (>80) noma edayiswe ngokweqile (<20).

Ukuphazamiseka phakathi kwentengo kanye ne-Stochastic RSI inganikeza nemininingwane ebalulekile. Ukwehlukana kwe-bullish kwenzeka lapho inani lentengo lirekhoda eliphansi eliphansi, kodwa i-Stochastic RSI yakha izinga eliphansi eliphezulu, elibonisa ukuhlehla kwenkambiso engase ibe khona noma ukuba buthaka kwe-downtrend. Ngakolunye uhlangothi, ukuhlukana kwe-bearish kwenzeka lapho intengo ifika phezulu, kodwa i-Stochastic RSI yenza ukuphakama okuphansi, okungabonisa ukwehla okuzayo.

Ukuze ulawule ngempumelelo ingozi, traders kufanele abeke ama-oda wokuyeka ukulahleka. Ezikhundleni ezinde, ukulahlekelwa kokuma kungabekwa ngaphansi kokushwibeka okuphansi kwakamuva, nasezikhundleni ezimfushane, ngaphezu kokushwibeka okuphezulu kwakamuva. Le nqubo iqinisekisa lokho traders zivikelwe ekuguqukeni kwemikhuba kungazelelwe.

| Uhlobo Lwesikhundla | Stop-Loss Placement |

|---|---|

| Long | Ngezansi ukushwibeka kwakamuva okuphansi |

| Short | Ngaphezulu kwakamuva jika phezulu |

Ukulahlekelwa kokuma okulandelanayo ziwusizo ikakhulukazi kumasu alandelayo okuthrendayo njengoba ewavumela traders ukuhlala ku trade inqobo nje uma ithrendi iqhubeka, ngenkathi isathola izinzuzo uma ithrendi iqala ukuhlehla.

Ukuze traders ifuna ukukhulisa ukusebenza kahle kwe-Stochastic RSI kuthrendi elandelayo, cabanga ukusebenzisa a ukuhlaziya izikhathi eziningi. Ngokuqinisekisa amathrendi namasiginali wokungena kukho kokubili isikhathi esiphezulu nesiphansi, traders ingakhuphula amathuba okungena ku-a trade ngomfutho oqinile wokuthambekela.

Khumbula, nakuba i-Stochastic RSI iyithuluzi elinamandla, akufanele isetshenziswe yodwa. Ukuyihlanganisa namanye amathuluzi okuhlaziya ezobuchwepheshe kanye nezinqubo ezifanele zokulawula ubungozi kubalulekile ukuze kube nesu eliphelele lokuhweba.

4.2. Isho Amasu Okubuyisela

Lapho uhlanganyela kusho amasu okubuyisela emuva, kubalulekile ukuhlanganisa ukulawulwa kwezinhlekelele. Njengoba kungewona wonke amasiginali athengwe ngokweqile noma athengiswe ngokweqile azoholela ekuguqukeni ngokushesha kwencazelo, traders kumele ilungiselelwe izimo lapho intengo iqhubeka nokuthambekela kude nenani.

I-Divergence phakathi kwe-RSI ye-Stochastic kanye nentengo ingasebenza njengethuluzi elinamandla lokuguqulwa kwencazelo traders. Ukwehlukana kwenzeka lapho intengo yenza okusha okuphezulu noma okuphansi, kodwa i-Stochastic RSI ayikuqinisekisi lokhu kuthutha. Lokhu kuntuleka kokuqinisekisa kungasikisela ukuthi umfutho uyancipha nokuthi ukuhlehla kwencazelo kungase kusondele.

Ukubuyela emuva kuyisinyathelo esibalulekile ekucwengisiseni amasu okubuyisela emuva. Ngokuhlaziya idatha yomlando, traders anganquma ukusebenza kwesu lawo ngaphansi kwezimo zemakethe ezahlukahlukene. Le nqubo ingasiza ekulungiseni amapharamitha afana nobude besilinganiso esinyakazayo kanye nezilungiselelo ze-Stochastic RSI ukuze zivumelane kangcono nempahla. traded.

I-volatility esinye isici esisho ukuguqulwa traders kufanele icabangele. Phakathi nezikhathi zokungaguquguquki okuphezulu, izintengo zingase zichezuke ngokuqhubekayo kuncazelo, futhi ukuguqulwa kungase kuvele kungazelelwe. Ngokuphambene, izindawo ezintengantengayo eziphansi zingase zinikeze amathuba okuhweba acashile anengozi ephansi.

Ithebula: Izingxenye Ezibalulekile Zamasu Okubuyisela Incazelo

| Uphiko | Incazelo |

|---|---|

| Amazinga we-Stochastic RSI | Ukufundwa kwe-Overbought (>80) nokudayiswa ngokweqile (<20) kungabonisa amathuba okungenzeka asho ukuhlehliswa. |

| I-Average Price Range | Sebenzisa ama-avareji anyakazayo ukuze unqume inani ‘elivamile’ lempahla. |

| Amaprosesa futhi Resistance | Hlanganisa amasiginali we-Stochastic RSI namazinga entengo abalulekile ukuze uqinise trade ingqondo. |

| Risk Management | Sebenzisa ngokuqinile ayeke ukulahleka kanye nezinhloso zenzuzo zokuphatha ukulahlekelwa okungenzeka kanye nokuthola izinzuzo. |

| I-Divergence | Qaphela umehluko phakathi kwentengo ne-Stochastic RSI njengenkomba yokuhlehliswa kwentengo okungaba khona. |

| Ukubuyela emuva | Hlola ukuphumelela kwesu kudatha yomlando ukuze wenze ngcono amapharamitha nendlela. |

| Ukuhlola Ukuguquguquka | Lungisa ukuzwela kwesu ngokusekelwe kumazinga wamanje wokuntengantenga kwezimakethe. |

Kusho amasu okubuyisela azikho iziwula futhi zidinga indlela eqondile yokuhweba. Ngokuhlanganisa ukufundwa kwe-Stochastic RSI namanye amathuluzi okuhlaziya nokugcina umthetho olandelwayo wokulawula ubungozi, tradeama-rs angakwazi ukuzulazula kangcono ezinseleleni zokuhweba okushintshile.

4.3. Breakout Trading Izindlela

Ukufaka i-Stochastic RSI kuqhinga lokuhweba le-breakout kuhilela uchungechunge lwezinyathelo zokuqinisekisa indlela eqinile:

- Khomba Ububanzi: Ngaphambi kokuthi kuqhamuke, kufanele kube nebanga elibonakalayo lokuhweba. Lokhu ngokuvamile kusungulwa ngokuhlonza ukusekela okucacile namazinga okumelana eshadini.

- Gada i-RSI ye-Stochastic: Njengoba intengo ihlola lawa maleveli, buka i-Stochastic RSI ukuze uthole amasiginali angahle abe khona. Ukuhamba ngale kwe-threshold engu-80 noma engu-20 kungaba inkomba yokuqala yokwanda komfutho.

- Qinisekisa ngesenzo senani: I-breakout iqinisekiswa uma intengo ihamba ngaphezu kobubanzi obuchaziwe ngokuqiniseka. Bheka a vala uthi lwekhandlela ngaphandle kwebanga lokuqinisekisa okwengeziwe.

- Hlola Ivolumu: Qinisekisa ukuthi ukuphuma kuhambisana ne-spike ngevolumu, okuphakamisa ukuvumelana phakathi traders futhi ingeza ukwethembeka ekuphumeni.

- Setha ama-Stop-Loss Orders: Ukuze ulawule ubungozi, nquma izinga lokulahlekelwa kokuma. Lokhu kuvamise ukubekwa ngaphakathi nje kwebanga okwenzeke kulo ukuphuka.

- Sebenzisa Izitobhi Zokulandelela: Uma ususendaweni enenzuzo, cabanga ukusebenzisa ukulahlekelwa kokumiswa okulandelayo ukuze uvikele izinzuzo kuyilapho usanikeza ukuguquguquka ukuze isikhundla sikhule.

- Phinda ubuyekeze ukufundwa kwe-Stochastic RSI: Qhubeka uqaphe i-Stochastic RSI ukuze uthole izimpawu zokuhlukana noma ubuyele kumazinga avamile, okungase kubonise ukuthi umfutho uyancipha.

Ithebula: Uhlu Lokuhlola Ukuhwebelana Kwe-Stochastic RSI

| Isinyathelo | Action | Injongo |

|---|---|---|

| 1 | Khomba Ububanzi | Misa amazinga okusekela nawokumelana |

| 2 | Gada i-RSI ye-Stochastic | Bheka amashifu omfutho |

| 3 | Qinisekisa ngesenzo senani | Qinisekisa ukuphuma ngokunyakaza kwentengo |

| 4 | Hlola Ivolumu | Qinisekisa amandla okuphuma ngokuhlaziywa kwevolumu |

| 5 | Setha ama-Stop-Loss Orders | Lawula ubungozi obubheke phansi |

| 6 | Sebenzisa Izitobhi Zokulandelela | Vikela inzuzo ngenkathi uvumela ukukhula |

| 7 | Phinda ubuyekeze ukufundwa kwe-Stochastic RSI | Gada ukuze uthole izimpawu zokukhathala komkhuba |

Ukuphathwa kweengozi iyingxenye ebalulekile yokuhweba okuphumayo nge-Stochastic RSI. Nakuba ithuluzi linganikeza amasignali abalulekile, alinaphutha. Ukuyihlanganisa nezinye izinkomba zobuchwepheshe, njengama-avareji ahambayo noma ama-Bollinger Bands, anganikeza umbono obanzi wezimo zemakethe futhi kusize ukuhlunga amasignali angamanga.

Ukubuyela emuva isu elibandakanya i-Stochastic RSI liyanconywa. Idatha yomlando inganikeza imininingwane yokuthi le ndlela ingenza kanjani ngaphansi kwezimo zemakethe ezahlukahlukene, okuvumayo traders ukuthuthukisa indlela yabo ngaphambi kokuyisebenzisa ezimakethe ezibukhoma.

Patience idlala indima ebalulekile ekuhwebeni kwe-breakout. Ilinde ukuthi zonke izimo ziqondane ngaphambi kokwenza a trade kungasiza ukugwema ukuqubuka okungamanga futhi kuthuthukise amathuba okungena ku- trade ngomfutho onamandla ngemuva kwayo.