1. Yini i-Moving Average Ribbon?

A Ukuhambisa esijwayelekile Ribbon is a analysis technical ithuluzi elakhiwe ama-avareji amaningi anyakazayo obude obuhlukene ahlelwe eshadini elifanayo. Le nqubo yokubuka ibonisa uchungechunge lwemigqa eyenza ukubukeka okufana neribhoni, okuyinto traders isebenzisa ukukhomba kokubili isiqondiso namandla.

Iribhoni iqukethe izilinganiso ezihambayo ngokuvamile ezibalwa esikhathini esifushane, esimaphakathi, nesesikhathi eside. Lokhu kungasukela ezilinganisweni zesikhathi esifushane kakhulu njengezinsuku ezi-5 ukuya kokumaphakathi kwesikhathi eside njengezinsuku ezingama-200. Uma izilinganiso ezihambayo zesikhathi esifushane zingaphezu kwama-avareji esikhathi eside, kuphakamisa ukuthi phezulu. Ngokuphambene, lapho ama-avareji esikhathi esifushane engaphansi, kukhombisa a downtrend.

Trader ibona ukwehlukana noma ukuhlangana kwemigqa ngaphakathi kweribhoni. A iribhoni ebanzi kusho ukuthambekela okunamandla, kuyilapho a iribhoni elincane noma leyo eqala ukuhlangana iphakamisa ukuthambekela okubuthakathaka noma ukuhlehla kwethrendi okungaba khona. I-Ribbon Emaphakathi Enyakazayo ingenziwa ngendlela oyifisayo ngokukhetha izikhathi ezihlukile nezinhlobo zezilinganiso ezihambayo, ezifana nokulula, okuchazile, noma okukaliwe, ukuze ivumelane namasu ahlukahlukene okuhweba.

I-Ribbon Eyisilinganiso Esihambayo ayiyona nje inkomba elandela izitayela; ingase futhi inikeze ukwesekwa okuguquguqukayo namazinga okumelana. Traders angase abheke ukusebenzisana kwentengo nemigqa yeribhoni ukuze enze izinqumo ezinolwazi mayelana nezindawo zokungena nokuphuma, kanye nokusetha ukuyeka-ukulahlekelwa oda.

2. Lingasetha Kanjani Isu Leribhoni Elimaphakathi Elihambayo?

Ukukhetha Okumaphakathi Okuhambayo Okulungile

Ukusetha isu le-Moving Average Ribbon kuqala ngokukhetha izilinganiso ezihambayo ezifanele ukuze zifakwe iribhoni. Okukhethiwe kufanele kufake ububanzi bezikhathi ezizimele ezibonisa i trader isitayela esithile sokuhweba kanye nomkhathizwe wabo trades. Indlela evamile iwukusebenzisa ukulandelana kwezilinganiso ezihambayo ezikhathini ezikhuphukayo, njengezikhathi ezi-5, 10, 20, 30, 40, 50, kanye nezingu-60. Ama-avareji ahambayo amakhulu (EMA) zivame ukuthandwa kunezilinganiso ezihambayo ezilula (ama-SMA) njengoba zinikeza isisindo esengeziwe esenzweni samanani sakamuva futhi zingasabela ngokushesha ekushintsheni kwentengo.

Ilungiselela Ishadi

Uma izilinganiso ezihambayo sezikhethiwe, isinyathelo esilandelayo ukusebenzisa lezi eshadini lentengo. Amapulatifomu amaningi okuhweba angangeza ama-avareji amaningi ahambayo futhi enze ngezifiso amapharamitha awo. Qinisekisa ukuthi isilinganiso ngasinye esinyakazayo sisethelwe ohlotsheni olulungile (olulula, oluchazayo, noma olunesisindo) kanye nesikhathi. Kuyasiza futhi ukwabela imibala ehlukene kusilinganiso ngasinye esinyakazayo ukuze kucace.

Ukuhunyushwa kweribhoni

Ngemuva kokuthi kusetshenziswe izilinganiso ezihambayo, i-ribbon izokwakhiwa. Traders kufanele iqaphe umumo nokuhleleka kwama-avareji ahambayo. Okwe isignali ye-bullish, isilinganiso esifushane esinyakazayo kufanele sibe phezulu kuribhoni, sibe side kunazo zonke ngezansi, futhi imigqa kufanele ihambisane noma iphumele ngaphandle. Okwe Isiginali ye-bearish, isilinganiso eside kunazo zonke esinyakazayo kufanele sibe phezulu nomfushane kakhulu ngezansi, futhi kube nemigqa ehambisanayo noma ephephezelayo ngaphakathi.

Amaphuzu Okungena Nokuphuma

Amaphoyinti okungena abonwa uma intengo ihamba ngaphezu noma ngaphansi kweribhoni, noma uma izilinganiso ezihambayo ziqondana ngendlela ephakamisa ukuqala kwethrendi. Amaphoyinti okuphuma noma ama-oda okulahlekelwa kokuyeka angasethwa kumaleveli eribhoni, ikakhulukazi uma intengo iqala ukwephula okumaphakathi okunyakazayo ngokuphambene nethrendi ekhona.

| Isimo | Action |

|---|---|

| Intengo ihamba ngaphezu kweribhoni | Cabangela isikhundla eside |

| Intengo ihamba ngaphansi kweribhoni | Cabangela isikhundla esifushane |

| Ukuhambisa okumaphakathi kuphume ifeni | Amandla ethrendi ayakhula |

| Izilinganiso ezihambayo ziyahlangana | Ukuguqulwa kwethrendi okungenzeka |

Ukulandela le mihlahlandlela, traders ingasetha ngempumelelo futhi isebenzise isu le-Moving Average Ribbon. Njengawo wonke amasu okuhweba, ukuhlanganisa i-Moving Average Ribbon nezinye izinkomba nezindlela zokuhlaziya kubalulekile ukuqinisekisa amasignali nokuphatha. ingozi.

2.1. Ukukhetha Okumaphakathi Okuhambayo Okulungile

Ukuhambisana Nezimo Zemakethe

Ukusebenza kwe-Moving Average Ribbon kuncike kakhulu ekukhetheni ama-avareji ahambisana nezimo zemakethe zamanje. Imakethe eguquguqukayo ebonakala ngokuguquguquka ngokushesha kwentengo, ingase idinge izilinganiso ezihambayo ezifushane ukuze ithwebule ingqikithi yethrendi. Ngokuphambene, ama-avareji ahambayo amade anganikeza isithombe esicacile emakethe ebonisa ukuguquguquka okuncane namathrendi abonakala kakhudlwana, ehlunga umsindo kanye nokuguquguquka kwesikhashana.

Ukujwayela Isitayela Sokuhweba

The tradeIsitayela somuntu ngamunye sika-r sinomthelela kakhulu ekukhethweni kwezilinganiso ezihambayo. Day traders ingase incike kuribhoni ehlanganisa izilinganiso ezihambayo zesikhathi esifushane kakhulu, njengezikhathi ezingu-5, 10, nezingu-15, ukuze kutholwe izinguquko ezisheshayo zethrendi. swing traders, efuna ukuthwebula amathrendi ezinsukwini ezimbalwa noma amaviki, ingase ikhethe ukuhlanganisa okuhlanganisa okumaphakathi ukusuka ezikhathini ezingama-30 kuye kwezingu-60. Isikhundla traders, enombono wesikhathi eside, ingathola inani lokufaka izilinganiso ezihambayo ukusuka ezikhathini eziyi-100 kuye kwezingu-200 ukuze kuqinisekiswe ukuphikelela kwethrendi ngokuhamba kwesikhathi.

Ukucabangela Ukuzwela Kwentengo

Ukuzwela kwezilinganiso ezihambayo ekunyakazeni kwentengo kungenye into ebalulekile. Ama-EMA zizwela kakhulu ngenxa yokugxila kwazo emananini akamuva, okuwenza afaneleke traders abadinga izinkomba zethrendi ngokushesha. Kodwa-ke, lokhu kuzwela kungaholela kumasiginali angamanga ezimakethe eziguquguqukayo. Ngokuphambene, Ama-SMA hlinzeka ngesethi yedatha ebushelelezi, okungaba isikhangisovantageous for traders efuna ukugwema ukuqubuka okungamanga.

I-Synergy nge-Market Instruments

Amathuluzi ezezimali ahlukene angase aphendule kangcono ezikhathini ezithile. Ipheya yemali ephezulu izimali, like EUR / USD, ingase ilandelele kahle ngezilinganiso ezihambayo ezifushane. Ngesikhathi esifanayo, a lezimpahla ngamathrendi esizini, njengowoyela ongahluziwe, angase ahambisane kangcono nezikhathi ezinde. Traders kufanele i-backtest ama-avareji abawakhethile ngokumelene nedatha yomlando yemakethe yabo ethile ukuze bacwengisise ukukhetha kwabo.

Ngokukhetha ngokucophelela ama-avareji ahambayo ahambisana nokuguquguquka kwemakethe, isitayela sokuhweba, ukuzwela kwentengo, nokuziphatha kwethuluzi lezezimali elikhethiwe, traders bangathuthukisa ukusebenza kwesu labo le-Moving Average Ribbon. Kubalulekile ukukhumbula ukuthi ayikho inhlanganisela eyodwa yezilinganiso ezihambayo ezizoba sezingeni eliphezulu; ukuhlola okuqhubekayo kanye nokulungiswa kubalulekile ekugcineni ukuhambisana kwaleli thuluzi lokuhlaziya lobuchwepheshe.

2.2. Ukwenza ngokwezifiso Izilinganiso Zokuhambisa ku-TradingView

Ukwenza ngokwezifiso Izilinganiso Zokuhambisa ku-TradingView

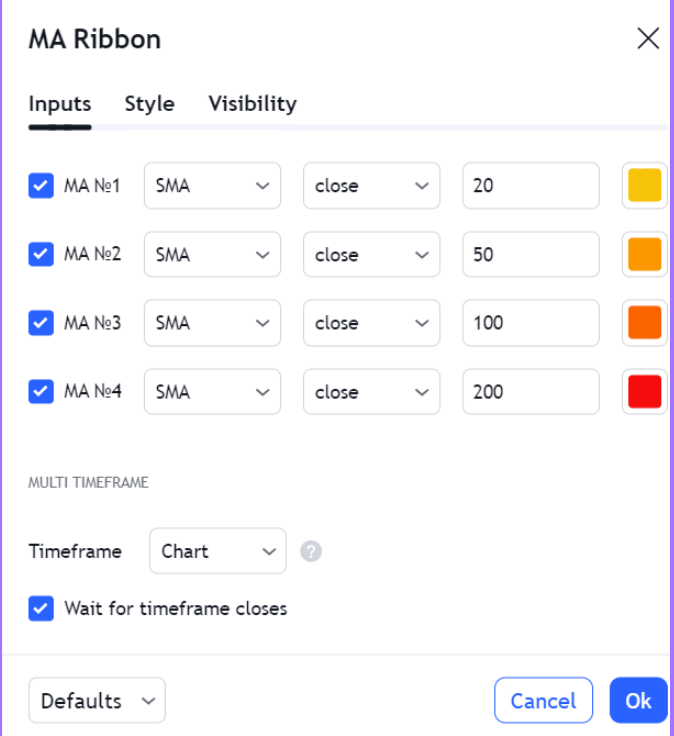

I-TradingView inikeza inkundla eqinile ye traders efuna ukusebenzisa isu le-Moving Average Ribbon elinesixhumi esibonakalayo esisebenziseka kalula sokwenza ngendlela oyifisayo okumaphakathi. Ukuze uqale, finyelela ku- izinkomba imenyu bese ukhetha Ukuhambisa esijwayelekile izikhathi eziningi ukwengeza ubude obuhlukahlukene. Isenzakalo ngasinye singalungiswa ngasodwa ngokuchofoza i-cog yezilungiselelo eduze kwegama lesikhombisi eshadini.

In the Okufakwayo ithebhu, cacisa isikhathi sesilinganiso ngasinye esinyakazayo, uqinisekise ukuthi ukulandelana kukhombisa i tradeizintandokazi zesikhathi se-r. I isitayela ithebhu ivumela ukwenziwa ngokwezifiso kombala nokujiya kwesilinganiso ngasinye esinyakazayo, kube lula umehluko ocacile phakathi kwezikhathi ezihlukene. Ukuze uthole iribhoni esabelayo, traders angakhetha Ama-EMA ngaphakathi MA Indlela imenyu yokudonsa.

Ukwenza ngokwezifiso okuthuthukile, traders angasebenzisa ipulatifomu I-Pine Script umhleli ukuze udale inkomba yeRibhoni Emaphakathi Ehambayo. Lolu limi lokubhala lunika amandla incazelo yemingcele ethile nezimo, njengokufiphaza okuzenzakalelayo phakathi kwezilinganiso ezihambayo ukuze ubone amandla ethrendi ngokubonakalayo.

| Isici | Inketho yokwenza ngokwezifiso |

|---|---|

| Ukukhetha Inkomba | Engeza izilinganiso ezihambayo eziningi |

| Izilungiselelo zesikhathi | Chaza ubude be-MA ngayinye |

| Ukwenza ngokwezifiso Isitayela | Lungisa umbala nokujiya komugqa |

| MA Indlela | Khetha phakathi kwe-SMA, EMA, i-WMA, njll. |

| I-Pine Script | Bhala imibhalo yangokwezifiso ngezidingo ezihlukile |

Ngokusebenzisa lezi zici, traders bangamisa i-Moving Average Ribbon yabo ukuze ihambisane nendlela yabo yokuhweba ngokunemba. Kubalulekile ukuthi ngezikhathi ezithile ubuyekeze futhi ulungise lezi zilungiselelo ukuze uvumelane nezimo zemakethe ezishintshayo futhi ugcine ukusebenza kwesu.

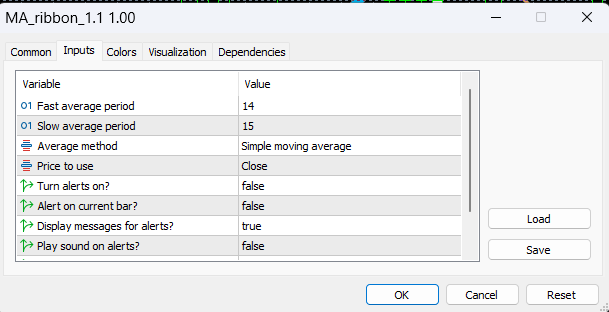

2.3. Ilungisa izilungiselelo ku-MetaTrader

Ilungisa izilungiselelo ku-MetaTrader

MetaTrader, inkundla esetshenziswa kabanzi phakathi traders, ivumela ukucushwa kwe-Ribbon Emaphakathi Enyakazayo kalula ngokuhlobene. Ukuze ulungise izilungiselelo, vula i Navigator iwindi bese uhudula i Ukuhambisa esijwayelekile inkomba eshadini lenkathi ngayinye oyifunayo. Ukuchofoza kwesokudla okulandelayo emugqeni ngamunye we-MA bese ukhetha Izakhiwo ivula iwindi lokwenza ngendlela oyifisayo.

Kuleli windi, traders ungashintsha ifayela Isikhathi, Shift, MA Indlela, Futhi Faka isicelo imingcele. I MA Indlela inikeza izinketho ezifana ne-Simple, Exponential, Smoothed, ne-Linear Weighted. Indlela ngayinye yokusabela esenzweni senani iyahlukahluka, nge Exponential kuncanyelwa indlela eguquguqukayo. I Faka isicelo isilungiselelo sinquma ukuthi iyiphi idatha yenani—vala, evuliwe, ephezulu, ephansi, emaphakathi, evamile, noma enesisindo esiseduze—ibalwa esibalweni se-MA.

Ukuhlukaniswa okubonakalayo kwenziwa lula yi- Colors ithebhu, lapho imibala eyingqayizivele ingabelwa umugqa ngamunye omaphakathi onyakazayo. Ngaphezu kwalokho, i- Amazinga ithebhu inika amandla ukungezwa kwemigqa evundlile ngamanani ashiwo, okungase kube omaka bosekelo noma bokumelana.

Kulabo abafuna inqubo eyenziwe lula, izinkomba zangokwezifiso ziyatholakala ukuze zilandwe noma zingafakwa ikhodi ngolimi lwe-MQL4. Lezi zinkomba zingaqinisa i-ribbon yonke ngamapharamitha asethwe ngaphambilini, ukunciphisa isikhathi sokusetha kanye namandla okuba nephutha.

| Ipharamitha | Izinketho | Injongo |

|---|---|---|

| Isikhathi | Yenza ngokwezifiso | Isetha inani lamabha esibalo se-MA |

| Shift | Yenza ngokwezifiso | Ilungisa i-MA offset ngokuhlobene nebha yamanje |

| MA Indlela | SMA, EMA, SMMA, LWMA | Inquma uhlobo lwesilinganiso esinyakazayo |

| Faka isicelo | Idatha yentengo ehlukahlukene | Ikhetha iphoyinti lentengo lokubala kwe-MA |

| Colors | Yenza ngokwezifiso | Ivumela umehluko obonakalayo phakathi kwemigqa ye-MA |

Ngokulungisa kahle lezi zilungiselelo, i-MetaTrader abasebenzisi bangakwazi ukuhlanganisa i-Moving Average Ribbon ukuze ihambisane nezintandokazi zabo zokuhweba, izimo zemakethe, nezici zamathuluzi abawahlaziyayo. Njengoba izimo zemakethe zishintsha, ukuhlolwa kabusha ngezikhathi ezithile nokulungiswa kwale mingcele kubalulekile ukuze kugcinwe ukusebenza kwesu.

3. Isetshenziswa Kanjani Iribhoni Elimaphakathi Elinyakazayo ukuze uthole Isu Lokungena?

Ukuhlonza Ukuqinisekisa Okuthrendayo

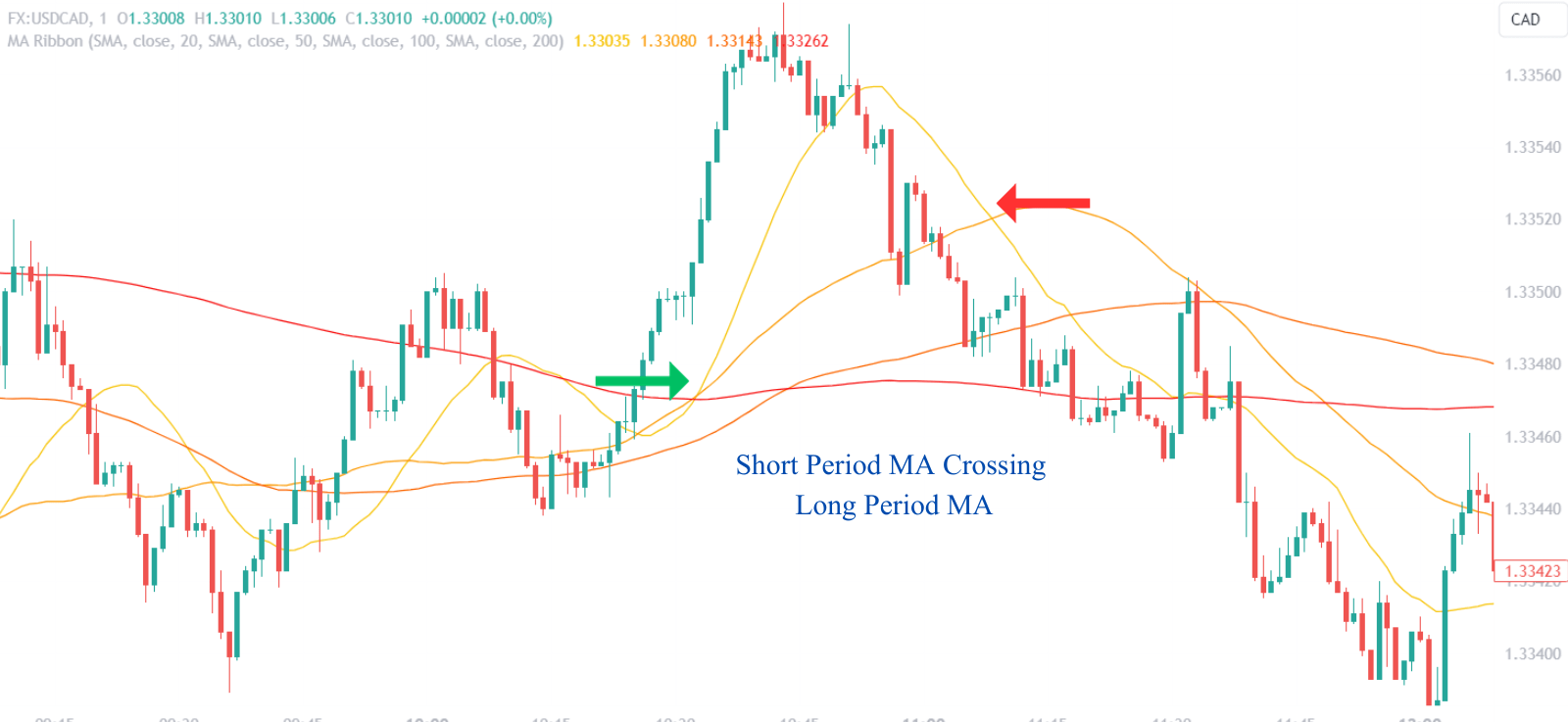

Traders sebenzisa i-Moving Average Ribbon ukukhomba izindawo zokungena ngokuhlonza iziqinisekiso zethrendi. An iribhoni ekhuphukayo, lapho ama-average ahambayo esikhathi esifushane abekwe ngaphezu kwawesikhathi eside, abonisa umfutho we-bullish. Ngokuphambene, a iribhoni eyehlayo iphakamisa izimo ze-bearish. Ukufaka kucatshangelwa lapho isenzo senani siqinisekisa isiqondiso esikhonjiswe ngokuma kweribhoni.

Isibonelo, a trader ingase ingene endaweni ende lapho isenzo senani sivala ngaphezu kweribhoni, ikakhulukazi uma izilinganiso ezihambayo zesikhashana esifushane zisanda kweqa izilinganiso zesikhathi eside. Le crossover ingabonwa njengokuqinisekisa umfutho okhuphukayo. A tight stop-ukulahlekelwa ivamise ukubekwa ngaphansi nje kweribhoni noma umugqa wesilinganiso wakamuva onyakazayo ngaphakathi kweribhoni osebenze njengokusekela.

Ukusebenzisa Izandiso zeRibhoni

Ukwandiswa kweribhoni, lapho ibanga eliphakathi kwama-avareji anyakazayo livuleka, kukhombisa ukukhuphuka kwamandla ethrendi. Traders bheka lezi zandiso njengophawu lokungena trades ekuqondeni kokuthambekela. Ukunwetshwa okulandela inkathi yokuhlanganisa noma ukuhlangana kweribhoni kunganikeza isignali yokungena eqinile, njengoba iphakamisa ukuphuma kokungazinqumeli kuya kuthrendi entsha.

| Isimo seRibhoni | Okushiwo | Isenzo Esingenzeka |

|---|---|---|

| Iribhoni elikhuphukayo | Isiqinisekiso se-Bullish Trend | Qalisa Isikhundla Eside |

| Iribhoni eyehlayo | Isiqinisekiso se-Bearish Trend | Qalisa Isikhundla Esifushane |

| Ukunwetshwa kweribhoni | Ukwandisa Amandla Ethrendi | Ngena ku-Trend Direction |

Ukusebenzisa i-Price Pullbacks

Ukudonswa kwentengo kuribhoni kungasebenza njengamaphuzu okungena abalulekile, ikakhulukazi uma ukudonsa kwenzeka ngevolumu ephansi, okuphakamisa ukuntula ukuqiniseka ekubuyiselweni kwentengo. Traders ingase ifune ukungena endaweni lapho intengo ithinta noma ingena kancane kuribhoni kodwa ithola usekelo, okubonisa ukuthi ithrendi eyinhloko isamile.

Ukuqapha Okuhambayo Okumaphakathi Kwama-Crossovers

Ama-crossovers amaphakathi ahambayo ngaphakathi kweribhoni anikezela ngezimpawu zokungena ezengeziwe. A ukuwela okumaphakathi kwesikhashana esifushane ngaphezu kwesilinganiso sesikhathi eside ngaphakathi kweribhoni kungaba yi-bullish entry trigger, ikakhulukazi uma kwenzeka ngemva kwesikhathi sokuhlanganiswa kwentengo. Ngokuphambene, ukuwela okumaphakathi kwesikhathi esifushane ngezansi kubonisa ukungena okufushane okungaba khona. Lawa ma-crossovers abaluleke kakhulu uma ehambisana nokukhuphuka kwevolumu yokuhweba, okuthuthukisa ukwethembeka kwesignali.

Isabela kuma-Momentum Shifts

Ekugcineni, traders kufanele iphendule ekushintsheni komfutho okuboniswa isivinini kanye nemvelo yezinguquko zokuqondanisa okumaphakathi ezihambayo. Ukuqondanisa ngokushesha okumaphakathi okufushane okuhambayo kuya phezulu kweribhoni kungandulela umnyakazo wentengo oqinile, okufakazela ukungena okufika ngesikhathi. Ngokuphambene, ukwehla koshintsho lokuqondanisa noma ukuhlehla ngokulandelana kungase kudinge isixwayiso noma ukubuyekezwa kwesu lokufaka.

Empeleni, i-Moving Average Ribbon kufanele isetshenziswe ngokuhambisana nezinye izinkomba nezindlela zokuhlaziya ukuze kuhlungwe amasignali futhi kuncishiswe amathuba okufakwa okungamanga. Ingqikithi yemakethe kanye nokuntengantenga kufanele kucatshangelwe, njengoba kungaba nomthelela omkhulu ekusebenzeni kweribhoni njengethuluzi lokungena.

3.1. Ihlonza i-Trend Direction

Ukuhlola Ukuma kweRibhoni

I-orientation ye-Ribbon Emaphakathi Enyakazayo ibalulekile ekunqumeni inkomba yethrendi ekhona. Iribhoni lapho izilinganiso ezihambayo zesikhathi esifushane zibekwe ngaphezu kwalezo zesikhathi eside kuyinkomba yokukhuphuka kwentengo. Lolu hlelo luphakamisa ukuthi isenzo sakamuva senani sibe namandla kunokusebenza kwangaphambilini, okuvame ukuholela ekubukekeni kwe-bullish.

Ngokuphambene, nini izilinganiso ezihambayo zesikhathi eside zikhuphukela phezulu kweribhoni, kukhombisa ukubusa kwe-bearish motion. Lapha, intengo ibilokhu yehla, noma okungenani ingasebenzi kahle uma iqhathaniswa nesilinganiso sayo somlando, ikhomba ukwehla okungenzeka.

Ukuhlola Ukuziphatha Kweribhoni

Ukuziphatha kweribhoni ngokuhamba kwesikhathi kunikeza izinkomba ezibalulekile mayelana nokusimama komkhuba. A iribhoni engaguquki, eyehlela phezulu okugcina izingqimba ezi-odwe zama-avareji anyakazayo kusho ukuphakama okuzinzile. Ngakolunye uhlangothi, a iribhoni eyehlela phansi okugcina isakhiwo sayo siqinile kuphakamisa ukwehla okuqhubekayo.

Ihlaziya Ukuhlangana KweRibhoni Nokuhlukana

Kuhlangana wezilinganiso ezihambayo ngaphakathi kweribhoni, lapho imigqa isondelana khona, ngokuvamile yandulela ukuthambekela okubuthakathaka noma uguquko olungase lube khona endleleni. Ngokungqubuzanayo, ukuhlukana noma ukuhlukaniswa kwama-avareji ahambayo amasignali ethrendi. Izinga lokuhlukana linganikeza imininingwane mayelana nomfutho wethrendi, ngegebe elibanzi eligcizelela ukuthambekela okuqinile.

| Isici seribhoni | Isiboniso |

|---|---|

| I-oda, eyehlela phezulu | I-uptrend ezinzile |

| I-oda, eyehlela phansi | Ukwehla kwesimo esiqhubekayo |

| Ukuhlanganiswa kwama-MAs | Ukuthambekela okubuthakathaka noma ukuhlehla |

| Ukwehlukana kwe-MAs | Isitayela esiqinile esinomfutho |

Iribhoni Njengesihlungi Esithrendayo

Iribhoni isebenza njengesihlungi, isiza ukuhlukanisa phakathi kwamathrendi angempela nomsindo wemakethe. Traders ingase ingakunaki ukuguquguquka kwentengo yesikhathi esifushane okungaphazamisi ukuma kweribhoni iyonke, esikhundleni salokho igxile ekunyakazeni okuqhubekayo okushintsha ukwakheka kweribhoni. Le ndlela isiza ekwehliseni umthelela wokuguquguquka kanye nokubuyela emuva okuncane ekuhlaziyweni kwethrendi.

3.2. Spotting Entry Points

Ukuhlola Ukuma Okumaphakathi Okunyakazayo

Isici esibalulekile sokubona izindawo zokungena kusetshenziswa i-Moving Average Ribbon ukubona ukuma kwezilinganiso ezihambayo ngokuhlobene nokuhambisana nesenzo senani. Crossovers ziphawuleka ngokukhethekile; ukuwela okumaphakathi kwesikhashana okunyakazayo ngenhla kwesikhathi eside kungase kubonise isikhathi esikahle sokungena endaweni ende, kuyilapho isimo esiphambene singaphakamisa ukungena okufushane. Ukubaluleka kwalawa ma-crossover kuyandiswa uma kwenzeka ngevolumu enkulu, okuhlinzeka ngesignali yokungena eqinile.

Ukubona Ukusebenzelana Kwamanani NeRibhoni

Traders kufanele inake kakhulu indlela amanani ahlangana ngayo ne-Moving Average Ribbon. Intengo ehlala njalo ohlangothini olulodwa lweribhoni igcizelela isiqondiso sethrendi. Indawo yokungena ivamise ukukhonjwa lapho intengo, ngemva kokuhlehla, ithinta noma yephula kancane iribhoni kodwa ingavali ngakolunye uhlangothi, okubonisa ukuthi inkambiso ekhona ingase iqhubeke.

Ukusebenzisa Ububanzi BeRibhoni Ukuze Ufake Isikhathi

Ububanzi BeRibhoni Emaphakathi Enyakazayo bungaba inkomba enamandla yamaphoyinti okungena esikhathi. Amaribhoni amancane asikisela ukuhlanganiswa kanye nethuba lokuqhuma, ngenkathi amaribhoni anda khombisa ukwanda kwethrendi. Traders ingase isebenzise isandiso njengenkomba yokufaka u-a trade ohlangothini lokunwetshwa, silindele ukuthi inkambiso ikhule ngesivinini.

Ukusebenzisa Ivolumu Njengethuluzi Lokuqinisekisa

Ivolumu isebenza njengethuluzi lokuqinisekisa lapho ubona izindawo zokungena. Ukwenyuka kwevolumu okuhambisana nokuhamba kwentengo kuribhoni noma i-crossover ngaphakathi kweribhoni kwengeza ukuqina kusiginali. Ngokuphambene, ukunyakaza kwentengo ngevolumu ephansi kungase kuntule ukuqiniseka futhi ngaleyo ndlela kudinga ukucutshungulwa okwengeziwe ngaphambi kokuzibophezela ekungeneni.

Ukuqapha Izimpawu Zamanga

Ukuqapha ngokumelene nezimpawu zamanga kubalulekile. Akuwona wonke ukusebenzelana ne-Moving Average Ribbon ogunyaza ukungena, ikakhulukazi ezimakethe eziguquguqukayo lapho inani likwazi ukuwela iribhoni njalo ngaphandle kwethrendi eqhubekayo. Izinkomba ezengeziwe, njenge Isihlobo Amandla Inkomba (RSI) noma Ukuhambisa Isilinganiso Sokwehluka Okuphakathi (MACD), ingasetshenziswa ngokuhambisana ukuze kuhlungwe amasiginali angathembeki kangako.

| Uhlobo Lwezimpawu | Isimo | Ukuqinisekiswa Kwevolumu | Action |

|---|---|---|---|

| Ukungena kweCrossover | I-MA emfushane inqamula ngaphezu kwe-MA ende | Umthamo ophezulu | Cabangela isikhundla eside |

| Ukungena kweCrossover | I-MA emfushane iwela ngaphansi kwe-MA ende | Umthamo ophezulu | Cabangela isikhundla esifushane |

| Ukusebenzelana Kwamanani | Inani lithinta/lingena kabusha iribhoni | Ivolumu ephansi | Qapha |

| Ukuqinisekisa Okuthrendayo | Intengo ihlala ohlangothini olulodwa lweribhoni | Ivolumu engaguquki | Qinisekisa isiqondiso sethrendi |

| Ukunwetshwa kweribhoni | Ama-MA aphuma ekhombisa umfutho | Ukwandisa ivolumu | Ukungena kwesikhathi nethrendi |

Ngokuhlola ngokuhlelekile lezi zici, traders angabona amaphuzu okungena ngokuzethemba okuphezulu, aqondanise awo trades ngomfutho wemakethe okhona kanye nokunciphisa ukuchayeka ekuqubukeni okungamanga noma amathrendi abuthakathaka.

3.3. Iqinisekisa Ukungena Ngezikhombi Ezengeziwe

Ukusebenzisa i-RSI yokuqinisekisa i-Trend

The I-Relative Strength Index (RSI) iyi-oscillator yomfutho engaqinisekisa izindawo zokungena ezisayinwe yi-Moving Average Ribbon. Ngokuqhathanisa ubukhulu bezinzuzo zakamuva nokulahlekelwa kwakamuva, i-RSI isiza ukukhomba izimo ezithengiwe kakhulu noma ezidayiswe kakhulu. Ukufundwa kwe-RSI ngaphezulu kwama-70 kukhombisa imakethe ethengwe ngokweqile, kuyilapho ukufunda okungaphansi kuka-30 kuphakamisa imakethe edayiswe ngokweqile. Uma i-Moving Average Ribbon iphakamisa okufakiwe, kuqinisekise ngamavelu e-RSI aqondana nesiqondiso ngaphandle kokusayina izimo ezimbi kakhulu. Isibonelo, ukungena kwe-bullish kufanele kusekelwe i-RSI ngaphezu komkhawulo othengiswe ngokweqile, okungcono ikhuphuke iye endaweni emaphakathi (50), okukhombisa ukukhuphuka komfutho.

Kubandakanya i-MACD Yokuqinisekisa Ukungenela

The Ukuhambisa Isilinganiso se-Convergence Divergence (i-MACD) ingelinye ithuluzi elihambisana ne-Moving Average Ribbon. Iqukethe ama-avareji amabili anyakazayo (esheshayo nehamba kancane) kanye ne-histogram ekala ibanga eliphakathi kwazo. Isignali ye-bullish iyaqiniswa lapho umugqa we-MACD (i-MA esheshayo) uwela ngaphezu komugqa wesignali (i-MA ehamba kancane), ikakhulukazi uma le crossover yenzeka ngaphezu kwesisekelo se-histogram, okusho umfutho omuhle. Ngokuphambene, kumasiginali we-bearish, umugqa we-MACD oweqa ngaphansi komugqa wesignali ngenkathi imigoqo ye-histogram yehla ngaphansi kwesisekelo iqinisa ukufaneleka kwe-downtrend.

Ukusebenzisa amabhendi e-Bollinger we-Market Volatility Insights

I-Bollinger bands nikeza ukuqonda Ukukhishwa kwemakethe kanye namazinga entengo ahlobene nezilinganiso ezihambayo. Amabhendi aba banzi ngezikhathi zokuguquguquka okuphezulu kanye nenkontileka phakathi nokuguquguquka okuphansi. Intengo ephuka ngaphezu kwebhendi ye-Bollinger engenhla ingase ibonise ukunyakaza okuqinile okuya phezulu, ikakhulukazi uma i-Moving Average Ribbon iqondana ngokushintshashintsha. Ngokufanayo, ukucwiliswa kwentengo ngezansi kwebhendi ephansi kungaqinisekisa ukungena kwe-bearish, inqobo nje uma iribhoni iqondiswe phansi. Umugqa omaphakathi wama-Bollinger Bands, ngokuvamile a isilinganiso esihambayo esilula, iphinda isebenze njengendawo yesithenjwa eyengeziwe yamasiginali we-Moving Average Ribbon.

Ukusebenzisa Izinkomba Ezisekelwe Kwivolumu Ukuze Uqinisekise

Izinkomba ezisekelwe kuvolumu njenge Ivolumu Yebhalansi (OBV) or I-Volume-Weighted Average Price (VWAP) ingaqinisekisa amasignali asuka ku-Moving Average Ribbon. I-OBV yengeza ivolumu ngezinsuku ezikhuphukayo futhi iyisuse ngezinsuku eziphansi, inikeze isilinganiso esikhulayo esingaqinisekisa amandla ethrendi. I-OBV ekhuphukayo eduze kweribhoni ekhuphukayo iqinisa ukungena kwe-bullish. I-VWAP ihlinzeka ngenani elimaphakathi nevolumu yosuku, esebenza njengophawu lokuma. Lapho izintengo zingaphezulu kwe-VWAP ngokuhlangana neribhoni ye-bullish, iphakamisa ukuphakama okuqinile, okuvuna okufakiwe okude.

| inkomba | Ukuqinisekisa Okuthrendayo | Isimo esihle |

|---|---|---|

| RSI | Iqondana ne-Ribbon Direction | Igwema Ukufundwa Kwe-Overshought/Oversold |

| MACD | I-Crossover Isekela I-Ribbon Signal | I-Histogram iqinisekisa i-Momentum Direction |

| Amabhodi we-Bollinger | Ukuhlukana Kwentengo Kuqondanisa neRibhoni | Amabhendi Avumelana Nokuhlola Ukuguquguquka |

| I-OBV | I-Volume Trend Ifanisa iribhoni | Ivolumu Ehlanganisiwe Ukukhula Kusekela Ithrendi |

| I-VWAP | Intengo Ehlobene ne-VWAP Ifanisa Iribhoni | Amanani Ngenhla/Ngezansi VWAP Qinisekisa Ithrendi |

Ngokuhlanganisa lezi zinkomba ekuhlaziyeni, traders angathola umbono wemakethe onezinhlangothi eziningi, okuthuthukisa ukuthembeka kokufakiwe okushiwo ku-Moving Average Ribbon. Inkomba ngayinye yengeza isendlalelo sokuqinisekisa, inciphisa ingcuphe yemibono engamanga futhi ivumele ukuthathwa kwezinqumo okunobuhlakani.

4. Yiziphi Izinqubo Ezingcono Kakhulu Zokuhambisa Isu Elimaphakathi Leribhoni?

Lungiselela Izilungiselelo Zenkathi Yezimo Zemakethe

Izinqubo ezingcono kakhulu zesu Leribhoni Elimaphakathi Elinyakazayo libandakanya ukuthuthukisa izilungiselelo zesikhathi ezimweni ezithile zemakethe. Izikhathi ezimfushane zingasabela ekushintsheni kwentengo, zinikeze amasignali afika ngesikhathi ezimakethe ezishintshashintshayo. Ngokuphambene, izikhathi ezinde zingase zifaneleke kakhulu ezimakethe ezithrendayo ukuze kugwenywe umsindo wemakethe nokuguquguquka kwesikhashana. TradeI-rs kufanele ihlole njalo izinhlanganisela zezikhathi ezihlukene ukuze inqume izilungiselelo ezilungile zesitayela sabo sokuhweba kanye nesimo semakethe samanje.

Ibhalansi Phakathi Kokuphendula Nokwethenjelwa

Ukufinyelela ibhalansi phakathi kokuphendula nokwethembeka kubalulekile. Sebenzisa ama-avareji ahlukahlukene anyakazayo ukuze udale iribhoni ebanzi engabonisa ngokunembile amandla emakethe ahlukahlukene. Indlela ejwayelekile ukufaka ingxube yezilinganiso ezihambayo ezimfushane, ezimaphakathi, nezesikhathi eside. Lokhu kusetha kuvumela ukutholwa kwakho kokubili ukunyakaza kwentengo okusheshayo kanye namathrendi asungulwe kakhudlwana, okuhlinzeka ngombono onengqimba mayelana nomfutho wemakethe.

Sebenzisa Ukuhlaziya Okubonakalayo Okungaguquki

Ukuhlaziya okubonakalayo okungaguquki kubalulekile lapho utolika Iribhoni Elimaphakathi Elinyakazayo. Naka ukuhlukaniswa nokuhleleka kwezilinganiso ezihambayo. Isakhiwo esihlelekile, esifana nefeni ngokuvamile sibonisa ithrendi ecacile, kuyilapho isethi yemigqa ephithene noma eguqukayo ingase ibonise ithrendi elahlekelwa amandla ayo noma imakethe ekuhlanganisweni. Izimpawu ezibonakalayo kufanele zihlale zihlolwa kumongo wesenzo sakamuva senani ukuze kugwenywe ukutolika okungalungile.

Hlanganisa Nezinye Izinkomba Zobuchwepheshe

Faka ezinye izinkomba zobuchwepheshe ukuze uqinisekise amasignali. Nakuba i-Moving Average Ribbon iyithuluzi elinamandla iyodwa, iphumelela kakhulu uma isetshenziswa ngokuhambisana nezinye izinkomba ezifana ne-RSI, MACD, noma i-Bollinger Bands. Lawa mathuluzi ahambisanayo angasiza ukuqinisekisa amandla ethrendi, umfutho, nokuhlehla okungaba khona, okuholela ezinqumweni zokuhweba ezinolwazi.

Qapha Isimo Semakethe futhi Ulungise Ngokufanele

Hlala ucabangela umongo wemakethe obanzi. Ukukhishwa kwedatha yezomnotho, imicimbi yezwe, kanye nomuzwa wemakethe konke kungaba nomthelela esenzweni senani kanye nempumelelo yesu le-Moving Average Ribbon. Hlala unolwazi mayelana nezimo zemakethe ezibanzi futhi uzilungiselele ukulungisa isu ngendlela efanele. Lokhu kungase kuhlanganise ukuqinisa ama-oda okulahlekelwa kokuyeka ngaphambi kwezimemezelo ezinkulu noma ukuhlola kabusha izikhathi ezimaphakathi ezikhethiwe zokusabela ekushintsheni kokuntengantenga kwemakethe.

Ngokunamathela kule mikhuba emihle kakhulu, tradeI-rs ingathuthukisa ukusebenza kwesu le-Moving Average Ribbon, okungase kuholele emiphumeleni yokuhweba eyimpumelelo.

4.1. Ukucatshangelwa kwe-Time Frame

Ukucatshangelwa kwe-Time Frame

Uma uhlanganisa i-Moving Average Ribbon isu lokuhweba, ukukhethwa kozimele besikhathi kubalulekile. Izikhathi ezihlukene zingathinta kakhulu ukuchazwa kwamathrendi emakethe kanye nezinqumo zokuhweba eziwumphumela. Amafreyimu wesikhathi esifushane, njengamashadi eminithi elingu-1 ukuya kwemizuzu engu-15, ngokuvamile asetshenziswa ngu usuku traders abafuna ukuthwebula ukunyakaza kwentengo okusheshayo, kwansuku zonke. Lezi traders bathembele kuribhoni ukuze bathole ukuhlonzwa kwethrendi kanye nezindawo zokungena ezisheshayo nezokuphuma. Kodwa-ke, lokhu kuza nomsindo wemakethe owandayo, ongaholela emvamisa ephezulu yezimpawu ezingamanga.

Amafreyimu wesikhathi eside, njengamashadi wamahora angu-4, nsuku zonke, noma amasonto onke, athandwa kakhulu shwiba kanye nesimo traders. Lezi traders abakhathazekile kangako ngokuguquguquka kwesikhashana futhi bagxile kakhulu ekuthwebuleni umnyakazo omkhulu wemakethe phakathi nezinsuku, amasonto, noma ngisho nezinyanga. Kulezi zinhlaka zesikhathi, i-Moving Average Ribbon isiza ukuhlunga izinguquko ezincane zentengo futhi inikeza umbono ocacile wethrendi ekhona. Amafreyimu wesikhathi eside avame ukunikeza amasiginali athembeke kakhulu, njengoba abonisa amashifu abaluleke kakhulu emizweni yemakethe.

| Ubude besikhathi | Isitayela Sokuhweba | Izimpawu zeribhoni | Ukwethembeka Kwesiginali |

|---|---|---|---|

| Kufushane (1-15min) | Usuku Ukuhweba | Ukuhlonza ithrendi okusheshayo | Phansi (umsindo owengeziwe) |

| Yinde (4H-Daily) | Swing/Isikhundla | Ihlunga ukushintshashintsha kwentengo okuncane | Phezulu (umsindo omncane) |

Kubalulekile futhi ku traders ukuvumelanisa isikhathi nesitayela sabo sokuhweba ngabanye kanye nokubekezelela ubungozi. Ukungafani kungaholela ekuphatheni kabi futhi kungahambi kahle trades. Ngokwesibonelo, ingozi-averse trader ingase ithole ukulungiswa okuvamile kudingwa isu lohlaka lwesikhathi esifushane kucindezela kakhulu, kuyilapho kusebenza trader ingase ithole amafreyimu esikhathi eside anensa kakhulu futhi angaphenduli ezidingweni zawo.

Amapharamitha we-Ribbon Emaphakathi Enyakazayo kufanele alungiswe ukuze ahambisane nesikhathi esikhethiwe. Izikhathi ezimaphakathi ezihambayo ezimfushane ngokuvamile zingcono kumafreyimu esikhathi esifushane, kuyilapho izikhathi ezinde zifaneleka kakhulu kumafreyimu esikhathi eside. Lokhu ngokwezifiso kuqinisekisa ukuthi iribhoni ihlala izwela ku-dynamics yemakethe ethile edlalwayo phakathi nesikhathi esikhethiwe, okuthuthukisa trader ikhono lokwenza izinqumo ezinolwazi.

4.2. Amasu Okulawula Ubungozi

Usayizi Wesikhundla

Usayizi wesikhundla kuyindlela eyisisekelo yokulawula ubungozi. Kubandakanya ukunquma inani lemali okufanele yabelwe a trade ngokusekelwe ku trader ukubekezelela ubungozi kanye nosayizi we-akhawunti. Indlela evamile ukubeka engcupheni iphesenti elincane le-akhawunti ngeyodwa trade, ngokuvamile phakathi kuka-1% no-2%. Leli su liqinisekisa ukuthi uchungechunge lokulahlekelwa ngeke luyidonsele phansi kakhulu i-akhawunti, livumela trader ukuqhubeka nokusebenza ngisho nangesikhathi sokulahlekelwa.

Ama-Stop-Loss Orders

Ama-oda wokuyeka ukulahleka zibalulekile ekulawuleni ukulahlekelwa okungenzeka. Lawa ma-oda asethwa kuleveli enqunywe kusengaphambili futhi azovala ngokuzenzakalelayo indawo lapho intengo ifinyelela kulelo phuzu. Kumongo weRibhoni Emaphakathi Enyakazayo, ukulahleka kokuma kungase kubekwe ngaphansi nje kwesilinganiso sokhiye esinyakazayo ngaphakathi kweribhoni noma ngaphansi kokushwibeka okuphansi kwakamuva endaweni ende. Ngesikhundla esifushane, ukulahleka kokuma kungabekwa ngaphezu kwesilinganiso sokhiye onyakazayo noma ukushwibeka kwakamuva okuphezulu.

Ama-oda Wenzuzo

Zibaluleke ngokufanayo ama-oda wokuthatha inzuzo, okukhiya inzuzo ngokuvala isikhundla uma inani eliqondiwe selifinyelelwe. Ukusetha lawa ma-oda kudinga ukuqonda ukuguquguquka kwemakethe kanye nokunyakaza kwentengo okumaphakathi. Uma usebenzisa i-Moving Average Ribbon, amaleveli okwenza inzuzo angase ahambisane namazinga ayinhloko wokumelana ku-uptrend noma amaleveli okusekela ku-downtrend.

Ukulandela Ukuma

Ukuhlehlisa izitobhi nikeza indlela eguquguqukayo yokulawulwa kwezinhlekelele. Balungisa njengoba intengo ihamba ngokuvumelana ne trade, egcina ingxenye yenzuzo uma imakethe ihlehla. Isitobhi esilandelanayo singasethwa njengebanga eligxilile ukusuka enanini lemakethe noma ngokusekelwe kunkomba yezobuchwepheshe, njengesilinganiso esihambayo esivela kuribhoni.

diversification

Okokugcina, ukuhlukahluka kuzo zonke izigaba zempahla ezihlukene noma imikhakha yemakethe inganciphisa ubungozi obungahlelekile. Ngokungavezi ngokweqile emakethe eyodwa, traders kunganciphisa umthelela wokwehla okuqondene nomkhakha othile. Ukuhlanganisa isu le-Moving Average Ribbon nokuhlukahluka kusiza ukulinganisela iphothifoliyo, okungase kube bushelelezi ukubuyisela ngokuhamba kwesikhathi.

| I-Risk Management Technique | Injongo | Ukuqaliswa nge-Moving Average Ribbon |

|---|---|---|

| Usayizi Wesikhundla | Khawulela ukuchayeka ngakunye trade | Nikeza iphesenti elincane le-akhawunti |

| Ama-Stop-Loss Orders | Lawula ukulahlekelwa okungenzeka | Setha ngezansi/ngenhla kwama-MA angukhiye noma izindawo zokushwiba |

| Ama-oda Wenzuzo | Inzuzo evikelekile | Qondanisa namazinga okumelana/okusekela |

| Ukulandela Ukuma | Londoloza inzuzo njengoba intengo ihamba ngokuvuna | Lungisa ngokusekelwe ezinguqukweni zentengo noma ama-MA |

| diversification | Yehlisa ubungozi obuqondene nomkhakha othile | Spread trades kuzo zonke izimpahla ezahlukene |

Ngokusebenzisa lezi zindlela zokulawula ubungozi, traders ingasiza ukuvikela imali yabo ngenkathi isebenzisa isu le-Moving Average Ribbon ukuze uzulazule ezimakethe.

4.3. Ukuhlanganisa namanye amasu okuhweba

Ukuvumelana Namasu Okwenza Intengo

Ukuhlanganisa Iribhoni Elimaphakathi Elinyakazayo ne amasu isenzo samanani kuthuthukisa i trader ikhono lokubona izindawo zokungena ezisezingeni eliphezulu. Isenzo senani sigxile ekuhlaziyweni kokunyakaza kwentengo okumsulwa, amaphethini, nokwakheka ngaphandle kokuthembela ezinkomba ezengeziwe. Lapho i-Moving Average Ribbon ikhombisa okungaba khona ukungena, ukuqinisekiswa ngesenzo senani—njengephethini yokukhuphula i-bullish noma ukwehla kwezinga eliyinhloko lokumelana—kunganikeza izinga eliphezulu lokukholelwa trade.

I-synergy enamaphethini eshadi

Amaphethini eshadi, njenge ikhanda namahlombe, onxantathu, or amafulegi, ingabuye ihlanganiswe ne-Moving Average Ribbon. Lawa maphethini ngokuvamile abonisa ukuqhubeka noma ukuhlehla, futhi lapho eqondana nesiqondiso sethrendi esiboniswa iribhoni, amathuba okuba yimpumelelo. trade ingakhula. Isibonelo, ukwakheka kwefulegi okwenzeka ngenhla kwe-Bullish-oriented Moving Average Ribbon kungaqinisa amathuba okuphuma phezulu.

Ukuhlanganiswa Kwamasu nokubuyiswa kwe-Fibonacci

I-Fibonacci ukulandelela ayithuluzi elidumile lokuhlonza ukwesekwa okungaba khona kanye namazinga okumelana ngokusekelwe ekushintsheni kwezimakethe kwangaphambilini. Lapho iribhoni iphakamisa ukuthambekela kwe-bullish futhi intengo ibuyela ezingeni elibalulekile le-Fibonacci, elifana nokubuyisela emuva okungu-61.8%, futhi libamba, ukuhlangana kwalezi zimpawu kungasebenza njengendawo yokungena eqinile yesikhundla eside. Ngokuphambene, ku-downtrend, ukubuyisela ezingeni lokumelana ne-Fibonacci elihambisana nesiqondiso seribhoni kungaba yiphuzu elilungile lokuqalisa isikhashana.

Ukusebenzisana ne-Elliott Wave Theory

Izimiso ze I-Elliott Wave Theory ingahlanganiswa ne-Moving Average Ribbon ukuze ulindele ukuqhubeka kwethrendi noma ukuguqulwa. Uma i-ribbon ikhomba ukuthambekela okuqinile futhi ukuhlaziywa kwe-Elliott Wave kubonisa ukuqedwa kwegagasi lokulungisa, elingena ekuqaleni kwegagasi lomfutho elilandelayo liqondana nomfutho okhona, okungase kuholele kumphumela onenzuzo eyengeziwe.

Ukuhlangana Nokwakheka Kwekhandlela

Okokugcina, ukwakheka kwamakhandlela njengezando, izinkanyezi ezidubulayo, noma i-doji ingaba namandla uma ihlanganiswe neribhoni. Ukwakheka kwekhandlela le-doji emaphethelweni eribhoni ngesikhathi sokudonsela emuva kungase kubonise ukungabi nasinqumo kanye nokuqalisa kabusha okungenzeka kwethrendi. Uma lezi zimpawu zekhandlela zivela ngokuvumelanisa nethrendi yeribhoni, zingasebenza njenge-catalyst yokungena noma ukuphuma. trades.

Ngokuhlanganisa ngobuchule i-Moving Average Ribbon nalawa masu ahlukene okuhweba, traders ingakha indlela enezici eziningi esebenzisa amandla ezindlela ezimbalwa zokuhlaziya. Lokhu kuhlanganiswa kungaholela ekuqondeni okuhlukahlukene kwemakethe, okuvumelayo traders ukwenza izinqumo ngokuzethemba okukhulu nangokunemba okukhulu.

5. Yini Okufanele Ucabangele Ngaphambi Kokusebenzisa Iribhoni Elimaphakathi Elinyakazayo?

Ukuhlola Uhlobo Nezimo Zemakethe

Ngaphambi kokusebenzisa i-Moving Average Ribbon, khomba uhlobo lwemakethe—ibanga noma elithrendayo—njengoba lokhu kuthinta ukusebenza kahle kwenkomba. Phakathi ku imakethe ethrendayo eqinile, iribhoni inikeza amasignali acacile kanye nezilinganiso zayo eziningi ezihambayo zinikeza ukwesekwa okunamandla noma amazinga okumelana. Nokho, ku-a esukela emakethe, izilinganiso ezihambayo zingase zikhiqize ama-crossovers amaningi, okuholela kumasignali angamanga kanye nokulahlekelwa okungenzeka.

Ukwenza ngokwezifiso Izinkathi Ezimaphakathi Ezinyakazayo

Ukwenza ngokwezifiso ama-avareji anyakazayo ngaphakathi kweribhoni kubalulekile ukuze kuhambisane nezinhloso zokuhweba nezici zempahla ethile. Izimakethe eziguquguqukayo kakhulu ingadinga okumaphakathi okufushane okuhambayo ukuze uthole izimpendulo ezisheshayo, kanti izimakethe ezingaguquki kancane zuza ezikhathini ezinde ezihluza umsindo. Ukuhlehla okuqhubekayo nokulungiswa kuqinisekisa ukuthi izikhathi zeribhoni zihlala zihambisana nezimo zemakethe zamanje.

Ukuxhumana Nesu Lokuhweba

Qinisekisa ukuthi i-Moving Average Ribbon ihambisana nesu lakho lonke lokuhweba. Kufanele ihambisane nesitayela sakho sokuhweba, ukubekezelela ubungozi, kanye nokuncamelayo kohlaka lwesikhathi. Ngokwesibonelo, ama-scalpers nosuku traders ingase isebenzise iribhoni eliqinile kumasignali esikhathi esifushane, kuyilapho swing traders ingase ikhethe iribhoni ebanzi yokuqinisekiswa kwethrendi yesikhathi eside.

Ukuhlanganiswa Namanye Amathuluzi Obuchwepheshe

Ngenkathi i-Moving Average Ribbon iyithuluzi elibanzi, akufanele isetshenziswe yodwa. Ukuyihlanganisa namanye amathuluzi okuhlaziya obuchwepheshe kuthuthukisa ukunemba kwesignali. Qinisekisa ukuthi lawa mathuluzi awanikezi ulwazi olunganele kodwa anikeza imibono ehlukene, njengevolumu, umfutho, noma ukuguquguquka.

Ukuqwashisa Ngemicimbi Yezomnotho kanye Nokukhishwa Kwezindaba

Hlala wazi ngemicimbi yezomnotho nokukhishwa kwezindaba, njengoba lokhu kungathinta kakhulu izimo zemakethe kanye nokusebenza kwezinkomba zobuchwepheshe ezifana ne-Moving Average Ribbon. Ukuhamba kwemakethe okuzumayo okubangelwa izehlakalo zezindaba kungase kungabonakali ngokunembile yinkomba, okungaholela kumasiginali adukisayo. Kutuswa ukugwema ukuhweba ngesikhathi sokukhishwa kwezindaba ezinkulu noma ukulungisa isu ukuze libhekane nokunyuka kokushintshashintsha.

Ngokucabangela lezi zici, tradeI-rs ingathuthukisa ukusetshenziswa kwe-Moving Average Ribbon kunqolobane yabo yokuhweba, ithuthukise ikhono labo lokuzulazula ezimeni ezihlukahlukene zemakethe ngempumelelo.

5.1. Izimo Zemakethe Nokuguquguquka

Ukuhlola Ukuguquguquka NgeRibhoni Emaphakathi Enyakazayo

I-Volatility idlala indima ebalulekile ekusebenzeni kwe-Moving Average Ribbon. Ukuguquguquka okuphezulu kuvame ukuphumela ekusakazweni okubanzi phakathi kwezilinganiso ezihambayo, okubonisa amathrendi aqinile kodwa futhi ingozi enkulu yokuhlehla ngokushesha. Ngokuphambene, ukwehla kwezinga eliphansi kungase kuholele ekusakazweni okuncane kanye nama-crossovers avamile, okubonisa imakethe ehlanganisayo enomfutho ophansi wokuqondisa.

TradeI-rs ingakala ukuguquguquka ngokubheka ukunwetshwa nokufinyela weribhoni. Iribhoni ekhulayo iphakamisa ukuguquguquka okukhulayo kanye nethrendi engase ibe namandla. Ngakolunye uhlangothi, iribhoni yenkontileka ingase ibonise ukuncipha kokushintshashintsha, ngokuvamile okuhlotshaniswa noshintsho oluzayo lwendlela yethrendi noma ukuya emakethe eboshelwe kububanzi.

| I-Volatility Level | Ukusabalala kweribhoni | Umphumela Wemakethe |

|---|---|---|

| High | Wide | I-Trend Eqinile, Ingozi Ephakeme |

| ongaphakeme | Nqena | Ukuhlanganisa, Ingozi Ephansi |

Ukuze uzulazule ezimakethe eziguquguqukayo nge-Moving Average Ribbon, kuyancomeka ukuthi ulungise Ukuzwela wezilinganiso ezihambayo. Izikhathi ezimfushane zingasetshenziswa ukuze kusabele ngokushesha ekushintsheni kwentengo, kuyilapho izikhathi ezinde zingehlisa umthelela wokuguquguquka, kunikeze umugqa wethrendi oshelelayo ongajwayeleki kakhulu kuma-whipsaws.

Ukufaka i inkomba ye-volatility, njenge-VIX, noma a inkomba esekelwe ku-volatility, njenge Isilinganiso Ebangeni Langempela (ATR), inganikeza umongo owengeziwe. Lawa mathuluzi angasiza ukuqinisekisa ukuthi ukuntengantenga kwemakethe kwamanje kuhambisana namasiginali asuka ku-Moving Average Ribbon, okuvumela ukungena nokuphuma okunemicikilisho eyengeziwe.

Ngokuqapha ngenkuthalo nokuzivumelanisa nokushintshashintsha okukhona, traders ingakwazi ukulungisa kahle ukuphendula kwe-Moving Average Ribbon, ithuthukise ukusetshenziswa kwayo njengengxenye yesu eliphelele lokuhweba.

5.2. Imikhawulo Yeribhoni Elimaphakathi Elihambayo

I-Lagging Nature

Iribhoni Elimaphakathi Elinyakazayo, ngokuklama, iyi- inkomba esalela emuva. Ngokwemvelo incike kudatha yentengo edlule ukuze ikhiqize imigqa yayo, okusho ukuthi inikeza umbono ongokomlando futhi ingase ingabikezeli ukunyakaza kwamanani okuzayo ngokunembile. Lokhu kubambezeleka kungabangela ukubambezeleka ekukhiqizeni isignali, okuholela ku ukungena sekwephuzile noma ukuphuma ezimakethe ezihamba ngokushesha.

Ukucaca Kwesignali Ezimakethe Ezisemaceleni

I-Moving Average Ribbon ingakhiqiza amasiginali angaqondakali emaceleni noma ezimakethe ezihlukene. Ama-avareji ahambayo ajwayele ukuhlangana futhi anqamule kaningi, okungaholela ochungechungeni lweziqalo ezingamanga noma izinkomba zethrendi ezidukisayo. Lokhu kungaholela ekwenyukeni kwezindleko zokuhweba kanye nokuncipha kwenzuzo ngenxa ye-whipsaw trades.

Ukwethembela ngokweqile kanye Nokunethezeka

TradeI-rs ingase ithembele kakhulu ku-Moving Average Ribbon, sicabange ukuthi iyithuluzi elingaphumeleli lokuhlaziya imakethe. Lokhu ukuzethemba ngokweqile kungaholela ukugcabha, lapho traders azinaki ezinye izici ezibalulekile zokuhlaziya lobuchwepheshe, njenge isenzo intengo or ivolumu. Asikho inkomba eyodwa okufanele isetshenziswe yodwa, futhi iribhoni nayo ayihlukile.

Ukuzwela Izimo Zemakethe

Ukulungisa ukuzwela kwe-Moving Average Ribbon inkemba esika nhlangothi zombili. Setha ama-avareji ahambayo abe mafushane kakhulu, futhi iribhoni izosabela kukho konke ukushintsha kwentengo okuncane, okwandisa ingozi izimpawu zamanga. Zisethe zibe zinde kakhulu, futhi iribhoni ingase ishelele ukunyakaza kwemakethe okubalulekile, kubangele ukusabela okubambezelekile ezinguqukweni zangempela zethrendi.

Umthelela Wokuguquguquka

I-Volatility spikes ingaba nomthelela omubi ekusebenzeni kwe-Moving Average Ribbon. Ukuntengantenga okuphezulu kungaholela kuribhoni enwetshiwe, engaphakamisa ithrendi enamandla lapho, empeleni, kungaba ukusabela okweqile kwemakethe kwesikhashana. Ngokuphambene, ukuguquguquka okuphansi kungabangela iribhoni ukuba inkontileka, okungenzeka kunciphise ukubaluleka kokuthuthuka kwethrendi kwangempela.

| Ukulinganiselwa | Umphumela |

|---|---|

| Inkomba yokubelesela | Ukungena/ukuphuma sekwephuzile, amathuba aphuthelwe |

| Sideways Market Signals | Izimpawu ezingaqondakali, ukwanda kokuphozithi okungamanga |

| Ukwethembela ngokweqile | Ukunganakwa kwamanye amathuluzi okuhlaziya, ukuzithiba |

| Ukulungiswa Kokuzwela | Ubungozi bezimpawu ezingamanga noma ukubonwa kwethrendi ukubambezeleka |

| I-Volatility Impact | Ukuchazwa kabi kwamandla noma ubuthakathaka bezitayela |

Ukuqonda le mikhawulo kubalulekile traders ukunciphisa ubungozi nokusebenzisa i-Moving Average Ribbon ngempumelelo ngaphakathi kwesu elibanzi lokuhweba.

5.3. Ukubaluleka Kokubuyela Emuva

I-Backtesting: Isidingo Sokuqinisekisa Isu

Ukubuyisela emuva kuyingxenye ebalulekile yokuthuthukisa kanye nokucwenga amasu okuhweba. Ngokusebenzisa i Iribhoni elimaphakathi elinyakazayo kudatha yomlando, traders angakwazi ukuhlola ngokulinganayo ukusebenza kwaleli thuluzi kuzo zonke izimo zemakethe ezihlukene. Le nqubo ivumela ukuthuthukiswa kwamapharamitha eribhoni, njengokukhethwa kwezikhathi ezimaphakathi ezihambayo eziqondana kangcono nesenzo senani lempahla kanye nokuntengantenga.

Inzuzo eyinhloko yokubuyisela emuva ilele ekukwazini kwayo ukugqamisa amandla nobuthakathaka besu ngaphandle kokufaka imali yangempela engozini. Ngokwesibonelo, a trader ingakwazi ukunquma ukuthi i-Moving Average Ribbon inikeza ngokuqhubekayo izimpawu zokungena ngaphambi kwesikhathi ezimakethe ezithrendayo noma uma ikhiqiza amaphozithivu amaningi kakhulu angamanga phakathi nezikhathi zokuhlanganisa ububanzi. Ngokukhomba la maphethini, traders ingasetha izihlungi ezifanele futhi lungisa amasu okulawula ubungozi, njengokufakwa kwe-stop-loss kanye nama-oda wokwenza inzuzo, ukuze kuthuthukiswe ukusebenza kahle okuphelele kwendlela yabo.

Ngaphezu kwalokho, i-backtesting iyasiza ukuhlolwa kwengcindezi ngaphansi kwezimo zemakethe ezahlukahlukene, okuhlanganisa izehlakalo zokuntengantenga okuphezulu kanye nokuphazamiseka kwemakethe okungavamile. Traders bathola ukuqonda kokuthi isu belingasebenza kanjani phakathi nezinkinga zemakethe ezedlule, okubenza bakwazi ukufaka izindlela zokuvimbela ezinhlelweni zabo zamanje zokuhweba.

Nakuba ukubuyisela emuva kungesona isiqinisekiso sokusebenza kwesikhathi esizayo ngenxa yokushintshashintsha njalo kwemakethe, kusebenza njengesinyathelo esibalulekile ekuthuthukisweni kwamasu. Kuyasiza traders ukwakha ukuzethemba endleleni yabo yokusebenza futhi inikeza isisekelo sokuthuthuka okuqhubekayo. Ukuhlola okuvamile, okuhlanganiswe nokuhlola phambili endaweni yedemo, kuqinisekisa ukuthi isu lihlala libalulekile futhi liqinile ngokumelene nesizinda semakethe ethuthukayo.

| I-Backtesting Aspect | Injongo | wesifundo |

|---|---|---|

| Ukuthuthukiswa Kwepharamitha | Izilungiselelo zeRibhoni Enyakazayo Enyakazayo | Ukuqondanisa kwamasu okuthuthukisiwe nokuthrendayo kwemakethe |

| Ukuhlolwa Kokusebenza | Hlola ukusebenza kwesu lomlando | Ukulungiswa okunolwazi endleleni yokuhweba |

| Risk Management | Ukuhlola ukusebenza kwezinyathelo zokuzivikela | Amaqhinga athuthukisiwe okulondoloza imali |

| Ukuhlolwa Kokucindezeleka | Lingisa ukusimama kwesu ezinkingeni | Ukulungiselela izimo zemakethe ezimbi kakhulu |

Ngokwamukela i-backtesting njengesisekelo sokuthuthukiswa kwamasu, tradebaqinisekisa ukuthi ukusebenzisa kwabo i-Moving Average Ribbon akusekelwe ekuqageleni okusezingqondweni kodwa kubufakazi obunamandla obungamelana nokuhlola kwesikhathi.