1. Uhlolojikelele lwe-Bollinger Bands Width

1.1 Isingeniso ku-Bollinger Bands

I-Bollinger Amabhendi adumile analysis technical ithuluzi elakhiwa uJohn Bollinger ngawo-1980. Leli thuluzi lisetshenziselwa ngokuyinhloko ukukala Ukukhishwa kwemakethe futhi ihlonze izimo ezithengiwe ngokweqile noma ezidayiswe kakhulu ekuhwebeni kwamathuluzi ezezimali. Amabhendi eBollinger aqukethe imigqa emithathu: umugqa ophakathi ngu-a isilinganiso esihambayo esilula (SMA), ngokuvamile ngaphezu kwezikhathi ezingu-20, futhi amabhendi aphezulu naphansi ayizihlukaniso ezijwayelekile ngenhla nangaphansi kwalokhu. isilinganiso esihambayo.

1.2 Incazelo kanye Nenhloso Yobubanzi Bamabhendi Bollinger

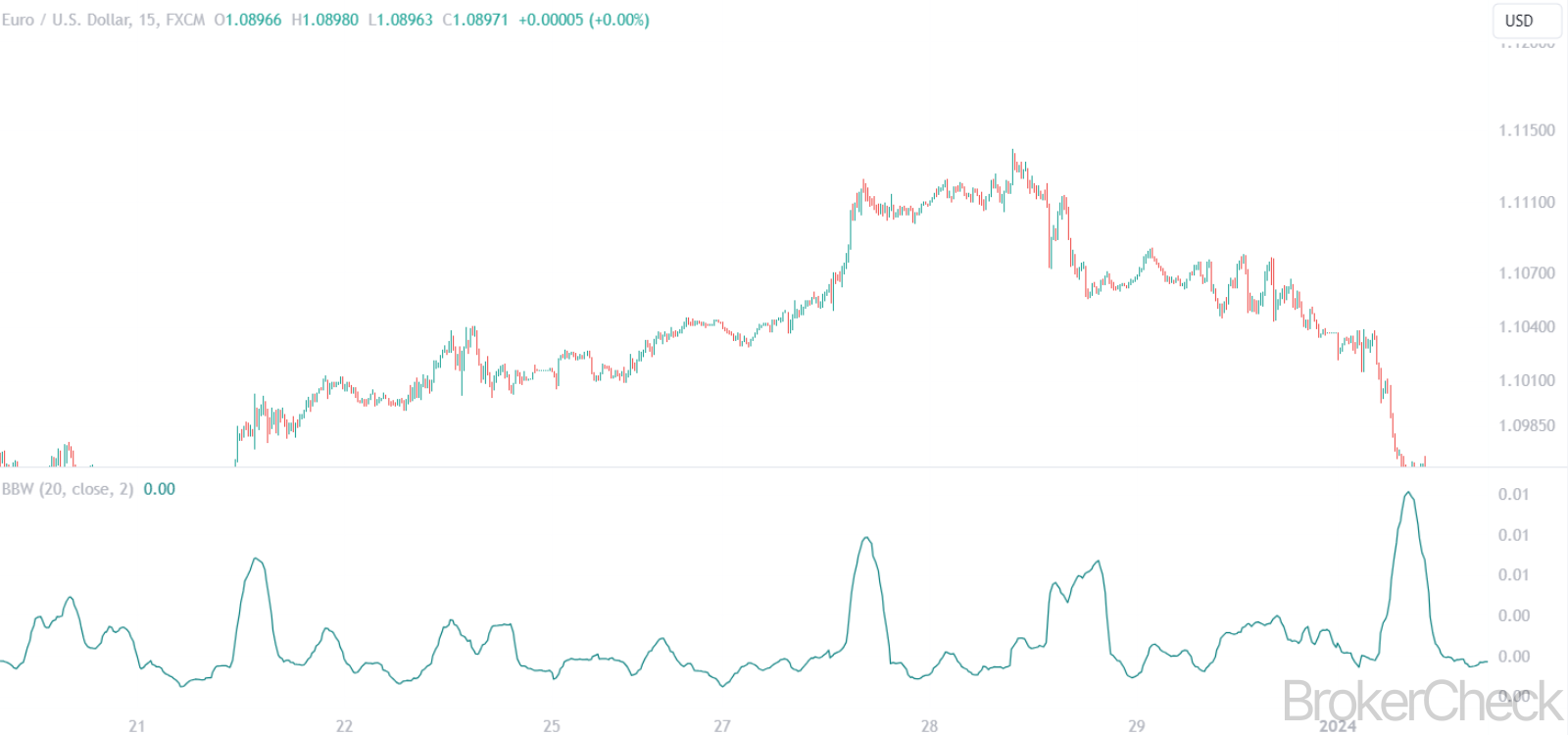

I-Bollinger Bands Width (BBW) iyinkomba etholakalayo elinganisa ibanga, noma ububanzi, phakathi kwamabhendi e-Bollinger aphezulu naphansi. I-BBW ibalulekile traders njengoba inikeza inani lenombolo kumqondo wokuntengantenga kwemakethe. Ibhendi ebanzi ibonisa ukuguquguquka kwezimakethe okuphezulu, kuyilapho ibhendi encane ikhombisa ukuguquguquka okuphansi. I-Bollinger Bands Width iyasiza traders ngezindlela eziningi:

- Ukuhlonza ama-Volatility Shifts: Ushintsho olubalulekile ebubanzini bamabhendi lungabonisa ushintsho ekuguquguqukeni kwezimakethe, ngokuvamile okwandulela ukunyakaza kwamanani okubalulekile.

- Ukuhlaziywa Kwethrendi: Izikhathi zokuntengantenga okuphansi, eziboniswa amabhendi amancane, zivame ukwenzeka phakathi nokuhlanganiswa kwethrendi yemakethe, okungase kuholele ekunqamukeni.

- Ukuhlonza Okudlulele Kwemakethe: Kwezinye izimo zemakethe, amabhendi abanzi kakhulu noma amancane kakhulu angabonisa ukunyakaza kwentengo okunwetshwe ngokweqile, okungahle kuhlehliswe noma kuhlanganiswe.

| aspect | Incazelo |

|---|---|

| Origin | Yathuthukiswa nguJohn Bollinger ngeminyaka yawo-1980. |

| Izingxenye | Amabhendi Aphezulu Naphansi (ukuchezuka okujwayelekile), Ulayini Ophakathi (SMA). |

| BBW Incazelo | Ikala ibanga phakathi kwamabhendi eBollinger aphezulu naphansi. |

| Injongo | Ikhombisa ukuntengantenga kwemakethe, isiza ekuhlaziyeni izitayela kanye nokuhlonza ukweqisa kwezimakethe. |

| Ukusetshenziswa | Ukuhlonza amashifu okuguquguquka, ukuhlaziya amathrendi emakethe, ukusayina ukunyakaza kwentengo okungaba khona. |

2. Inqubo yokubala ye-Bollinger Bands Width

2.1 Incazelo Yefomula

I-Bollinger Bands Width (BBW) ibalwa kusetshenziswa ifomula eqondile. Ububanzi bunqunywa ngokukhipha inani le-Bollinger Band ephansi kusuka ku-Bollinger Band ephezulu. Ifomula imi kanje:

BBW=Upper Bollinger Band−Lower Bollinger Band

kuphi:

- The I-Upper Bollinger Band ibalwa ngokuthi: I-Middle Band+(Ukuchezuka Okuvamile×2).

- The I-Lower Bollinger Band ibalwa ngokuthi: I-Middle Band−(Standard Deviation×2).

- The ibhande eliphakathi ngokuvamile iyinkathi engu-20 eyi-Simple Moving Average (SMA).

- emgomeni ibalwa ngokusekelwe ezikhathini ezifanayo ezingu-20 ezisetshenziselwa i-SMA.

2.2 Isinyathelo ngesinyathelo Ukubala

Ukuze ufanekise ukubala kwe-Bollinger Bands Width, ake sicabangele isibonelo sesinyathelo ngesinyathelo:

Bala i-Middle Band (SMA):

- Hlanganisa izintengo zokuvala zezikhathi zokugcina ezingu-20.

- Hlukanisa lesi samba ngama-20.

2. Bala Ukuchezuka Okujwayelekile:

- Thola umehluko phakathi kwentengo yokuvala yenkathi ngayinye kanye ne-Middle Band.

- Sikwele le mehluko.

- Fingqa lo mehluko oyisikwele.

- Hlukanisa lesi samba ngenani lezikhathi (20 kuleli cala).

- Thatha impande yesikwele yalo mphumela.

3. Bala amabhendi aphezulu naphansi:

- I-Upper Band: Engeza (Ukuchezuka Okujwayelekile × 2) ku-Middle Band.

- Ibhendi engezansi: Susa (Ukuchezuka Okujwayelekile × 2) ku-Middle Band.

3. Nquma Ububanzi Bamabhendi Bollinger:

- Khipha inani lebhendi eliphansi kunani le-Upper Band.

Le nqubo yokubala igqamisa imvelo eguquguqukayo ye-Bollinger Bands Width, njengoba ishintshashintsha ngokushintshashintsha kwentengo. Ingxenye yokuchezuka evamile iqinisekisa ukuthi amabhendi ayakhula lapho imakethe iguquguquka futhi inkontileka phakathi nezikhathi zokuguquguquka okuncane.

| Isinyathelo | Inqubo |

|---|---|

| 1 | Bala i-Middle Band (i-SMA yezikhathi ezingama-20). |

| 2 | Bala Ukuchezuka Okujwayelekile ngokusekelwe ezikhathini ezifanayo ezingama-20. |

| 3 | Nquma Amabhendi Aphezulu Naphansi (Ibhendi Ephakathi ± Ukuchezuka Okujwayelekile × 2). |

| 4 | Bala i-BBW (Upper Band - Lower Band). |

3. Amanani Alungile Okusetha Ezinkathini Zesikhathi Ezihlukene

3.1 Ukuhweba Kwesikhashana

Ngokuhweba kwesikhathi esifushane, njengokuhweba ngosuku noma ukusika izinwele, traders ngokuvamile zisebenzisa i-Bollinger Bands Width enesikhathi esifushane esimaphakathi esihambayo kanye nesiphindaphindi sokuchezuka esisezingeni eliphansi. Lokhu kusetha kuvumela amabhendi ukuthi asabele ngokushesha kakhulu ekushintsheni kwentengo, okubalulekile endaweni yokuhweba esheshayo.

Ukusethwa Okulungile:

- Isikhathi Esimaphakathi Sokuhambisa: Izikhathi eziyi-10-15.

- Isiphindaphindi Sokuchezuka Okujwayelekile: I-1 kuya ku-1.5.

- Ukutolika: Amabhendi amancane abonisa ukuguquguquka okuphansi kwesikhashana esifushane, okuphakamisa ukuhlanganiswa noma ukuphuma kwentengo okulindile. Amabhendi abanzi akhombisa ukuguquguquka okuphezulu, okuvame ukuhlotshaniswa nokunyakaza kwentengo okuqinile.

3.2 Ukuhweba Kwesikhathi Esimaphakathi

Isikhathi esimaphakathi traders, okuhlanganisa nokushwiba traders, ngokuvamile bakhetha ibhalansi phakathi kokuzwela nokusalela ezinkomba zabo. Ukusetha okujwayelekile kwe-Bollinger Bands Width kusebenza kahle kulesi sikhathi esibekiwe.

Ukusethwa Okulungile:

- Isikhathi Esimaphakathi Sokuhambisa: Izikhathi ezingama-20 (ezijwayelekile).

- Isiphindaphindi Sokuchezuka Okujwayelekile: 2 (okujwayelekile).

- Ukutolika: Izilungiselelo ezijwayelekile zinikeza umbono olinganiselayo wokuguquguquka kwezimakethe zesikhathi esimaphakathi. Ukwenyuka okungazelelwe kobubanzi bebhendi kungabonisa ukuqala kwamathrendi amasha noma ukuqiniswa kwalawo akhona.

3.3 Ukuhweba Kwesikhathi Eside

Ngohwebo lwesikhathi eside, njengokuhweba ngezikhundla, isikhathi esimaphakathi esinyakazayo kanye nesiphindaphindi sokuchezuka esisezingeni eliphezulu kuvame ukusetshenziswa. Lokhu kusetha kunciphisa umsindo futhi kwenza inkomba ibe bushelelezi, iyenze ifaneleke kakhulu ukuhlonza amathrendi esikhathi eside namashifu okuguquguquka.

Ukusethwa Okulungile:

- Isikhathi Esimaphakathi Sokuhambisa: Izikhathi eziyi-50-100.

- Isiphindaphindi Sokuchezuka Okujwayelekile: I-2.5 kuya ku-3.

- Ukutolika: Kulokhu kusetha, ukukhuphuka kancane kancane kobubanzi bebhendi kungase kubonise ukukhuphuka okuqhubekayo kokuntengantenga kwemakethe yesikhathi eside, kuyilapho ukuncipha kuphakamisa imakethe yokuzinza noma eguquguquka kancane.

| Ubude besikhathi | Isikhathi Esimaphakathi Sokuhambisa | Isiphindaphindi Sokuchezuka Okujwayelekile | Ukuhunyushwa |

|---|---|---|---|

| Ukuhweba Kwesikhashana | Izikhathi eziyi-10-15 | 1 ukuze 1.5 | Ukusabela okusheshayo ezinguqukweni zemakethe, kuwusizo ekuhlonzeni ukuntengantenga kwesikhashana kanye nokuqubuka okungenzeka. |

| Ukuhweba Kwesikhathi Esimaphakathi | 20 izikhathi (ezijwayelekile) | 2 (okujwayelekile) | Ukuzwela okunokulinganisela, okulungele ukuhweba ngokushwibeka kanye nokuhlaziywa komkhuba ojwayelekile. |

| Ukuhweba Kwesikhathi Eside | Izikhathi eziyi-50-100 | 2.5 ukuze 3 | Ithambisa ukuguquguquka kwesikhashana, ilungele ukuhlaziya izitayela zesikhathi eside nokuntengantenga. |

4. Ukuhunyushwa kwe-Bollinger Bands Width

4.1 Ukuqonda Ububanzi Bamabhendi Bollinger

I-Bollinger Bands Width (BBW) iyithuluzi lokuhlaziya lobuchwepheshe elisuselwa ku-Bollinger Bands, yona ngokwayo eyinkomba yokuguquguquka. I-BBW ikala ngokukhethekile umehluko phakathi kwamabhendi eBollinger aphezulu naphansi. Le metric ibalulekile traders ngoba inikeza ukuqonda mayelana nokuntengantenga kwezimakethe. Ibhendi ebanzi ibonisa ukuguquguquka okuphezulu, kuyilapho ibhendi encane iphakamisa ukuguquguquka okuphansi.

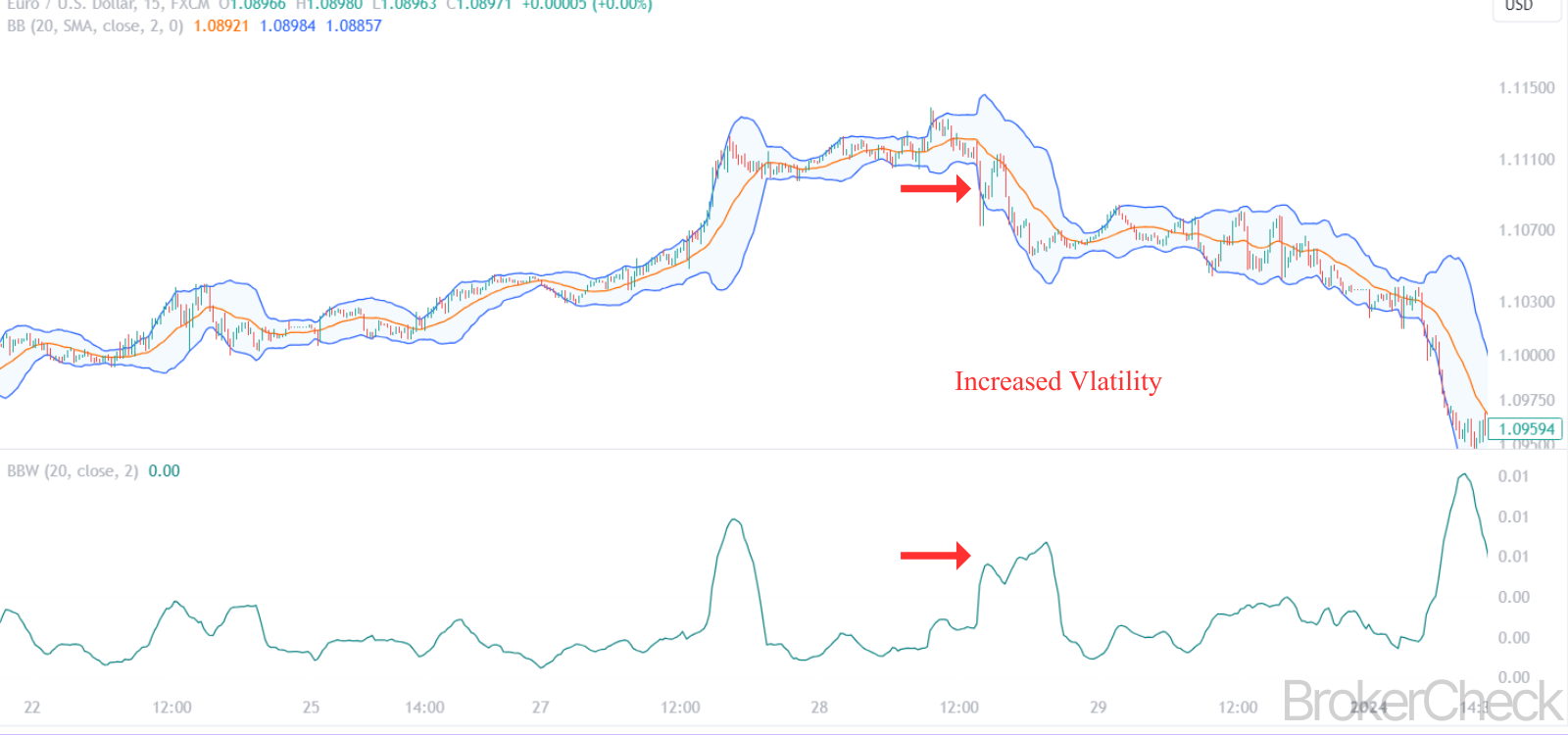

4.2 Ukufunda Izimpawu

- Amanani aphezulu e-BBW: Uma i-BBW iphezulu, ikhombisa ukuthi kunebanga elibalulekile phakathi kwama-Bollinger Band aphezulu naphansi. Lesi simo sivamise ukwenzeka ngezikhathi zokuntengantenga kwezimakethe eziphezulu, njengalapho kunemicimbi emikhulu yezindaba noma ukukhishwa kwezomnotho. Trader ihumusha amanani aphezulu e-BBW njengesandulela esingase sibe khona ekuhlanganisweni kwezimakethe noma ukuguqulwa, njengoba izimakethe zingakwazi ukugcina amazinga aphezulu okuguquguquka unomphela.

- Amanani aphansi e-BBW: Ngokuphambene, inani eliphansi le-BBW lisho ukuthi imakethe isesikhathini sokuntengantenga okuphansi, amabhande aphezulu naphansi asondelene. Lesi simo sivame ukuhlotshaniswa nesigaba sokuhlanganiswa kwemakethe, lapho ukunyakaza kwentengo kunomkhawulo. Traders angase abuke lokhu njengenkathi ye ukuqongelela noma ukusatshalaliswa ngaphambi kokunyakaza kwamanani okubalulekile.

- Ukwandisa i-BBW: Inani elikhulayo le-BBW lingabonisa ukuthi ukuguquguquka kuyenyuka. Traders ivamise ukubuka lolu shintsho njengesandulela sokuqubuka okungaba khona. Ukwenyuka kancane kancane kungase kubonise ukukhula okuqhubekayo kwenzalo yemakethe nokubamba iqhaza.

- Ukunciphisa i-BBW: Ukwehla kwe-BBW, ngakolunye uhlangothi, kuphakamisa ukwehla kokuntengantenga kwezimakethe. Lesi simo singase senzeke ngemva kokuhamba kwentengo okubalulekile njengoba imakethe iqala ukuqina.

4.3 Imijikelezo yokuguquguquka

Ukuqonda imijikelezo yokuguquguquka kuyisihluthulelo sokutolika i-BBW ngempumelelo. Izimakethe zivame ukudlula ezikhathini zokuguquguquka okuphezulu (ukunwetshwa) okulandelwa ukuguquguquka okuphansi (ukufinyela). I-BBW iyasiza ekuboneni lezi zigaba. Unekhono traders sebenzisa lolu lwazi ukulungisa zabo amasu ukuhweba ngokufanelekile, njengokusebenzisa amasu okubopha uhla ngesikhathi sokuguquguquka okuphansi kanye namasu okuphuma ngesikhathi sokuntengantenga okuphezulu.

4.4 Ukubaluleka Komongo

Ukuhunyushwa kwe-BBW kufanele kwenziwe njalo ngokwezimo zemakethe ezikhona kanye nokuhambisana nezinye izinkomba. Isibonelo, ngesikhathi sokukhuphuka okuqinile noma ukwehla, i-BBW ekhulayo ingase ivele iqinisekise amandla ethrendi, kunokuba iphakamise ukuguqulwa.

4.5 Isibonelo Sesimo

Cabanga ngesimo lapho i-BBW isezingeni eliphansi ngokomlando. Lesi simo singase sibonise ukuthi imakethe icindezelwe ngokweqile futhi kungenzeka ngenxa yokunqamuka. Uma i-BBW iqala ukukhula ngokushesha ngemva kwalesi sikhathi, kungaba isignali yokunyakaza kwentengo okubalulekile kunoma iyiphi indlela.

| Isimo se-BBW | Umphumela Wemakethe | Kungenzeka Trader Isenzo |

|---|---|---|

| Inani eliphakeme kakhulu lama-BBW | Ukuguquguquka okuphezulu, ukuguqulwa okungenzeka kwemakethe noma ukuhlanganiswa | Gada amasignali okungenzeka ahlehliselwe emuva, cabangela izinyathelo zokuvikela ezifana ukuyeka-ukulahlekelwa Ama-oda |

| Inani eliphakeme kakhulu lama-BBW | Ukuguquguquka okuphansi, ukuhlanganiswa kwemakethe | Bheka ukuqongelela noma ukusatshalaliswa, lungiselela ukuphuma |

| Ukushintsha kwe-BBW | Ukuguquguquka okukhulayo, ukuqala okungenzeka kwethrendi noma ukuqubuka | Buka amasiginali wokuphuma, lungisa amasu ukuze uthwebule amathrendi angaba khona |

| Ukunciphisa i-BBW | Ukwehla kokushintshashintsha, ukuxazulula imakethe ngemuva kokuthutha | Ukuhweba okungenzeka okuboshelwe ezinhlobonhlobo, kunciphisa okulindelwe ukunyakaza kwamanani amakhulu |

5. Ukuhlanganisa I-Bollinger Bands Width nezinye Izinkomba

5.1 Ukusebenzisana namanye Amathuluzi Obuchwepheshe

Nakuba i-Bollinger Bands Width (BBW) iyinkomba enamandla iyodwa, ukusebenza kwayo kungathuthukiswa kakhulu uma isetshenziswa ngokuhambisana namanye amathuluzi okuhlaziya obuchwepheshe. Le ndlela yezinkomba eziningi inikeza umbono ophelele wemakethe, isiza ezinqumweni zohwebo ezinembe kakhudlwana futhi ezicashile.

5.2 Ukuhlanganisa Nezilinganiso Ezinyakazayo

- Isilinganiso Sokuhambisa Esilula (SMA): Isu elivamile ukusebenzisa i-BBW eduze kwe-Simple Moving Average. Ngokwesibonelo, a trader ingase ibheke i-BBW enciphayo (ekhombisa ukuntengantenga okuphansi) ehambisana nenani elihlanganisayo elizungeze izinga elingukhiye le-SMA. Lokhu ngokuvamile kungandulela ukuqubuka.

- Isilinganiso sokuhamba esiphezulu se-Exponential (EMA): Ukusetshenziswa kwe-EMA ne-BBW kungasiza ekuboneni amandla ethrendi. Isibonelo, uma i-BBW ikhula futhi intengo ihlala ingaphezulu kwe-EMA yesikhashana, ingase iphakamise ukuphakama okuqinile.

5.3 Ukufaka Izinkomba Zomfutho

- Isihlobo Amandla Inkomba (RSI): I-RSI ingasetshenziswa ukuqinisekisa amasiginali aphakanyiswe yi-BBW. Isibonelo, uma i-BBW ikhula futhi i-RSI ikhombisa izimo ezithengiwe ngokweqile, ingabonisa ukuguqulwa okungaba khona kokukhuphukayo.

- Ukuhambisa Isilinganiso Sokwehluka Okuphakathi (MACD): I-MACD, elandela umkhuba inkomba yomfutho, ingaphelelisa i-BBW ngokuqinisekisa ukuqala kwezitayela ezintsha noma ukuqhubeka kwalezo ezikhona. Lapho amasiginali we-MACD ne-BBW eqondana, amathuba okuba kube yimpumelelo trade ingakhula.

5.4 Izinkomba zevolumu

Ivolumu idlala indima ebalulekile ekuqinisekiseni amasiginali anikezwe yi-BBW. Ukwenyuka kwevolumu okuhambisana ne-BBW ekhulayo kungaqinisekisa amandla okuqhuma. Ngokuphambene, ukuphuma kwevolumu ephansi kungase kungapheli, okubonisa isignali engamanga.

5.5 Ama-Oscillator Ezimakethe Ezibophezelekileyo

Ezikhathini eziphansi zokuguquguquka ezikhonjiswe i-BBW encane, ama-oscillators njenge-Stochastic Oscillator noma i- I-Index yesiteshi sezimpahla (CCI) ingasebenza kakhulu. Lawa mathuluzi asiza ukukhomba izimo ezithengiwe ngokweqile noma ezidayiswe ngokweqile phakathi kwebanga, ukuhlinzeka trade amathuba emakethe eseceleni.

5.6 Isibonelo Isu Lokuhweba

Cabangela isimo lapho i-BBW iqala ukwanda ngemva kwesikhathi sokufinyela, okubonisa ukuguquguquka okungaba khona. A trader ingasebenzisa i-RSI ukuhlola izimo ezithengiwe ngokweqile noma ezidayiswe ngokweqile. Ngesikhathi esifanayo, ukubheka i-MACD ukuze kuqinisekiswe ukuguqulwa kwethrendi kunganikeza isignali eqinile. Le ndlela yezinkomba eziningi inciphisa amathuba ezimpawu ezingamanga.

| Inhlanganisela yenkomba | Injongo | Ukusetshenziswa ne-BBW |

|---|---|---|

| BBW + SMA/EMA | Ukuqinisekisa Okuthrendayo | Khomba ukuqubuka okungaba khona kumaleveli amaphakathi ahambayo |

| BBW + RSI | Ukuqinisekiswa Kwe-Momentum | Sebenzisa i-RSI ukuze uqinisekise izimo ezithengiwe kakhulu/ezidayiswe kakhulu phakathi nezinguquko zokuntengantenga |

| BBW + MACD | Ukuqinisekiswa Kwethrendi kanye Nomfutho | Qinisekisa ukuqala noma ukuqhubeka kwamathrendi |

| BBW + Izinkomba zevolumu | Amandla Okunyakaza | Qinisekisa amandla okuphuma ngokuhlaziywa kwevolumu |

| I-BBW + Oscillator (isb., Stochastic, CCI) | Ukuhweba ngamaRange | Khomba trade ukungena nokuphuma ezimakethe ezihlanganisa uhla |

6. Ukulawulwa Kwengozi nge-Bollinger Bands Width

6.1 Iqhaza le-BBW Ekulawuleni Ubungozi

Risk ukuphatha kuyisici esibalulekile sokuhweba, futhi i-Bollinger Bands Width (BBW) ingadlala indima ebalulekile kukho. Nakuba i-BBW ngokuyinhloko iyinkomba yokuguquguquka, ukuqonda imithelela yayo kuyasiza traders ukuphatha ubungozi ngempumelelo enkulu ngokulungisa amasu abo ngokwezimo zemakethe ezikhona.

6.2 Ukusetha I-Stop-Loss kanye ne-Take-Profit

- Ama-Stop-Loss Orders: Uma usebenzisa i-BBW, ama-oda okulahlekelwa kokuyeka angabekwa ngendlela ehlelekile. Isibonelo, endaweni eguquguqukayo ephezulu ekhonjiswa i-BBW ebanzi, amamajini abanzi okulahlekelwa kokumiswa angase adingeke ukuze kugwenywe ukumiswa ngaphambi kwesikhathi.

- Ama-oda Wokuthatha Inzuzo: Ngokuphambene, ezimweni eziphansi zokuguquguquka (i-BBW encane), tradeI-rs ingase ibeke izinhloso eziseduze zokuthatha inzuzo, ilindele ukunyakaza kwamanani amancane.

6.3 Usayizi Wendawo

Isikhundla singalungiswa ngokususelwa ekufundweni kwe-BBW. Ngezikhathi zokuguquguquka okukhulu, kungase kube ubuhlakani ukunciphisa osayizi bezikhundla ukuze unciphise ubungozi, kuyilapho ngezikhathi zokuguquguquka okuphansi, traders ingase ikhululeke kakhudlwana ngezikhundla ezinkulu.

6.4 Ukulungisa Amasu Okuhweba

- I-Volatility High (i-BBW ebanzi): Ezinkathini ezinjalo, amasu okuphuma angase asebenze kangcono. Kodwa-ke, ingozi yokuqhuma okungamanga nayo iyanda, ngakho traders kufanele isebenzise amasiginali wokuqinisekisa okwengeziwe (njenge ama-volume spikes noma inkomba yomfutho iziqinisekiso).

- Ukuguquguquka Okuphansi (I-BBW Encane): Kulezi zigaba, amasu ahlanganisa uhla ngokuvamile afaneleka kakhulu. Traders angabheka amaphethini oscillating ngaphakathi kwamabhendi futhi trade phakathi kwamazinga okusekela nawokumelana.

6.5 Ukusebenzisa Izitobhi Zokulandelana

Izitobhi ezilandelanayo zingaba usizo ikakhulukazi nge-BBW. Njengoba amabhendi ekhula futhi imakethe ishintshashintsha kakhulu, izitobhi ezilandelanayo zingasiza ukuvala inzuzo ngenkathi zivumela indawo trade ukuphefumula.

6.6 Ukulinganisa Ubungozi kanye Nomvuzo

Isici esibalulekile sokusebenzisa i-BBW ekulawuleni ubungozi ukulinganisa ingozi kanye nomvuzo. Lokhu kuhlanganisa ukuqonda ukuguquguquka okungaba khona kanye nokulungisa isilinganiso somvuzo wengozi ngendlela efanele. Isibonelo, endaweni eguquguqukayo ephezulu, ukufuna umvuzo ophezulu wokunxephezela ubungozi obukhulayo kungaba yindlela ephusile.

6.7 Isibonelo Sesimo

Ake sithi a trader ingena endaweni ende ngesikhathi sokuguquguquka okukhulayo (ukunweba i-BBW). Bangase babeke umyalelo wokulahlekelwa kokuyeka ngaphansi kwe-Bollinger Band ephansi futhi bamise isitobhi esilandelanayo ukuze bavikele inzuzo uma intengo iqhubeka nokukhuphuka. I trader futhi ilungisa usayizi wendawo ukuze uphendule ngengozi eyandayo ngenxa yokuguquguquka okukhulu.

| Isimo se-BBW | Isu Lokulawula Ubungozi | Implementation |

|---|---|---|

| I-BBW ephezulu (Amabhendi Abanzi) | Imajini Ebanzi Yokumisa-Ukulahlekelwa, Usayizi Wendawo Owehlisiwe | Lungisa ukuma kokulahlekelwa ukuze kuhambisane nokushintshashintsha, phatha trade usayizi wokulawula ubungozi |

| I-BBW ephansi (Amabhendi amancane) | Okuhlosiwe Okuseduze Kwenzuzo, Usayizi Wendawo Enkudlwana | Hlela ukuthatha inzuzo phakathi kwebanga elincane, khulisa usayizi wendawo uma ukuguquguquka kuphansi |

| Ukushintsha i-BBW (Ukunwetshwa noma Ukuhoxiswa) | Ukusetshenziswa kwe-Trailing Stops | Sebenzisa izitobhi zokulandela ukuze uvikele inzuzo ngenkathi uvumela ukuhamba kwemakethe |

| Ukulinganisa Ubungozi Nomvuzo | Lungisa Isilinganiso Sengozi Nomvuzo | Funa umvuzo ophezulu ekuguquguqukeni okuphezulu futhi ngokuphambene nalokho |

7. Isikhangisovantages kanye Nemikhawulo Bollinger Bands Ububanzi

7.1 Isikhangisovantages of Bollinger Bands Ububanzi

- Inkomba Yokuguquguquka Kwemakethe: I-BBW iyithuluzi elihle kakhulu lokulinganisa ukuntengantenga kwemakethe. Ikhono layo lokukala ibanga phakathi kwama-Bollinger Bands aphezulu naphansi ayasiza traders bayakuqonda ukuntengantenga kwezwe, okubalulekile ekukhetheni amasu.

- Ukuhlonza Izigaba Zemakethe: Izinsiza ze-BBW ekuhlonzeni izigaba zemakethe ezihlukene, njengokuntengantenga okuphezulu (izimakethe ezithrendayo noma ezisafufusa) kanye nokuntengantenga okuphansi (izimakethe eziboshelwe kububanzi noma ezihlanganisayo).

- Ukuvumelana nezimo Kuzo zonke izikhathi: I-BBW ingasetshenziswa ezikhathini ezihlukene, iyenze isebenziseke ngezindlela eziningi ezahlukene zokuhweba, kusukela ekuhwebeni kwasemini kuye ekujikeni nasekuhwebeni kwezikhundla.

- Ukuhambisana Nezinye Izinkomba: I-BBW isebenza kahle ngokuhlanganyela nezinye izinkomba zobuchwepheshe, ithuthukisa ukusebenza kahle kwayo ekwakheni isu lokuhweba eliphelele.

- Isisetshenziswa Ekulawuleni Ubungozi: Ngokunikeza imininingwane yokuntengantenga kwezimakethe, i-BBW iyasiza traders ekusebenziseni amasu okulawula ubungozi asebenzayo, afana nokulungisa ama-oda okulahleka kokuyeka kanye nosayizi bezikhundla.

7.2 Imikhawulo Yobubanzi Bamabhendi Bollinger

- I-Lagging Nature: Njengezinkomba eziningi zobuchwepheshe, i-BBW isala kancane. Ithembele kudatha yentengo edlule, okusho ukuthi ingase ingabikezeli ukunyakaza kwezimakethe esikhathini esizayo ngokunembile.

- Ubungozi Bezimpawu Zamanga: Phakathi nezimo zemakethe eziguquguqukayo kakhulu, i-BBW ingase inwebe, iphakamise ukuqubuka noma ukuthambekela okuqinile, okungase kube izimpawu ezingamanga.

- Ukutolika Okuncike Kokuqukethwe: Ukuhunyushwa kwamasiginali we-BBW kungahluka kuye ngomongo wemakethe nezinye izinkomba. Kudinga ukuqonda okuhlukene futhi akufanele kusetshenziselwe ukuzihlukanisa ukuze kuthathwe izinqumo.

- Akukho ukuchema kokuqondisa: I-BBW ayinikezi ulwazi mayelana nesiqondiso somnyakazo wemakethe. Ibonisa kuphela izinga lokuguquguquka.

- Kungaphansi Komsindo Wemakethe: Ezikhathini ezimfushane, i-BBW ingase ingene kalula emsindweni wemakethe, okuholela ezinkomba ezidukisayo zezinguquko zokuntengantenga.

| aspect | Advantages | Ukulinganiselwa |

|---|---|---|

| Ukuguquguquka Kwemakethe | Kuhle kakhulu ekulinganiseni amazinga okuguquguquka | Isalibele, ingase ingabikezeli ukunyakaza okuzayo |

| Izigaba zemakethe | Ikhomba izigaba zokuntengantenga okuphezulu neziphansi | Inganikeza amasignali angamanga ngesikhathi sokuguquguquka okukhulu |

| Ukuguquguquka kwesikhathi esibekiwe | Iwusizo kuzo zonke izikhathi ezibekiwe | Ukuhumusha kuyehluka ngokuya kwesikhathi; umsindo omningi kokufushane |

| Ukuhambelana | Isebenza kahle nezinye izinkomba | Idinga ukutolika okuqondile komongo |

| Risk Management | Izinsiza ekusetheni ukulahleka kokuma kanye nosayizi wendawo | Ayikhombisi isiqondiso semakethe |