1. Iyini i-Ultimate Oscillator?

Emkhakheni wokuhweba, i ukuhlukana phakathi kwe-Ultimate Oscillator kanye nesenzo samanani kuyisignali ebalulekile traders. Ukwehlukana kwe-bullish kwenzeka lapho intengo irekhoda iphansi eliphansi, kodwa i-oscillator yakha inani eliphansi eliphakeme, okuphakamisa ukwehla kwehla. umfutho. Ngokuphambene, ukuhlukana kwe-bearish kulapho intengo ifinyelela phezulu kuyilapho i-oscillator idala ukuphakama okuphansi, okubonisa ukuwohloka komfutho okhuphukayo. Traders kufanele babheke la maphethini okuhlukana eduze, njengoba zivame ukwandulela ukuhlehliswa kwentengo okubalulekile.

Ifomula ye-Ultimate Oscillator iyinhlanganisela yezikhathi ezintathu ezihlukene ama-oscillators, ngokuvamile inkathi engu-7, 14-inkathi, kanye nenkathi engu-28. Inani lokugcina liyisamba esinesisindo salawa ma-oscillator amathathu, nezikhathi ezinde zithola isisindo esincane. Lokhu kulinganisa kusekelwe enkolelweni yokuthi idatha yakamuva ihlobene kakhulu nezimo zemakethe zamanje.

Nali uhlaka oluyisisekelo lwenqubo yokubala:

- Bala Ingcindezi Yokuthenga (BP) kanye Nobubanzi Bangempela (TR) enkathini ngayinye.

- Fingqa i-BP ne-TR ngesikhathi ngasinye kwezintathu.

- Dala isikolo esingahluziwe sesikhathi ngasinye ngokuhlukanisa isamba se-BP ngesamba esingu-TR.

- Faka isisindo esimisweni sesikhathi ngasinye (inkathi engu-7 inesisindo esiphezulu, ilandelwe yinkathi engu-14, bese kuba yinkathi engu-28).

- Ukufundwa kokugcina kwe-Ultimate Oscillator iyisamba esinesisindo sezikhathi ezimisiwe ezintathu.

Ukusetshenziswa ngempumelelo kwe-Ultimate Oscillator akubandakanyi nje ukuqaphela izimo ezithengiwe ngokweqile noma ezidayiswe ngokweqile, kodwa futhi nokuqonda ukuthi i-oscillator iziphatha kanjani maqondana nenani. Isibonelo, uma imakethe yenza ukuphakama okusha kodwa i-Ultimate Oscillator ingekho, kungase kube uphawu lokuthi imakethe iphelelwa umusi.

Ngaphezu kwalokho, traders ingase futhi iqashe abanye analysis technical amathuluzi ngokuhlanganyela ne-Ultimate Oscillator ukuqinisekisa amasignali. Isibonelo, ukusebenzisa imigqa yethrendi, amazinga okusekela nawokumelana, nokuhlaziywa kwevolumu kunganikeza isu lokuhweba eliqine kakhulu.

Amaphuzu abalulekile okufanele uwakhumbule lapho usebenzisa i-Ultimate Oscillator zihlanganisa:

- Gada umehluko phakathi kwe-oscillator nentengo ukuze uhlonze ukuguqulwa okungaba khona.

- Cabangela amazinga omkhawulo othenge kakhulu (>70) kanye nathengiswa ngokweqile (<30) njengezixwayiso kunokuthenga noma ukuthengisa amasignali ngokuphelele.

- Sebenzisa amathuluzi amaningi okuhlaziya ezobuchwepheshe ukuze uqinisekise amasiginali anikezwe i-Ultimate Oscillator ukuze uthole ukuthembeka okwengeziwe.

- Qaphela ingqikithi yemakethe futhi uqinisekise ukuthi amasignali avela ku-oscillator ahambisana nethrendi yemakethe ebanzi.

Ngokucabangela lezi zici, tradeI-rs ingasebenzisa i-Ultimate Oscillator ukuze ithole ulwazi mayelana nomfutho wemakethe futhi yenze izinqumo zokuhweba ezinolwazi.

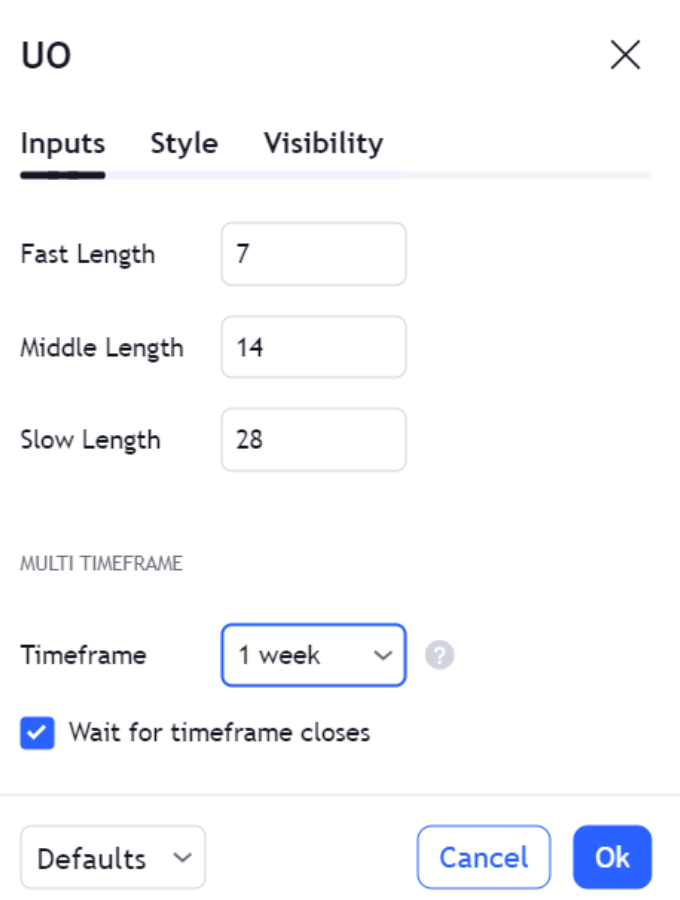

2. Ungayisetha kanjani i-Ultimate Oscillator?

Ilungiselela i-Ultimate Oscillator ukuze isebenze kahle

Lapho usetha i- Ultimate Oscillator, kubalulekile ukukuhlela ngokwesu lakho lokuhweba kanye nokuziphatha okuyingqayizivele kwemakethe oyihlaziyayo. Nansi inkomba yesinyathelo ngesinyathelo sendlela yokwenza ngendlela oyifisayo leli thuluzi elinamandla:

- Khetha izikhathi ezimisiwe:

- Isikhathi esifushane: Izinsuku ezingu-7

- Isikhathi esimaphakathi: Izinsuku ezingu-14

- Isikhathi eside: Izinsuku ezingu-28

Lezi zikhathi zingalungiswa ngokusekelwe ekuguquguqukeni kwempahla kanye ne trader ukukhetha ukuzwela okuningi noma okuncane.

- Lungisa i-Overbought/Oversold Thresholds:

- Izilungiselelo ezizenzakalelayo:

- Izinga lokuthenga ngokweqile: 70

- Izinga elidayiswe kakhulu: 30

- Izilungiselelo ezilungisiwe zokuguquguquka okuphezulu:

- Izinga lokuthenga ngokweqile: 80

- Izinga elidayiswe kakhulu: 20

Ukushintsha lawa mazinga kungasiza ekuzivumelaniseni nezimo zemakethe ezahlukene kanye nokunciphisa izimpawu ezingamanga.

- Izilungiselelo ezizenzakalelayo:

- Ukushuna Kahle Nokuhlehla:

- Sebenzisa idatha yomlando ukuze i-backtest izilungiselelo ezahlukene.

- Hlaziya imvamisa nokunemba kwezimpawu ezikhiqizwayo.

- Lungisa izikhathi nemikhawulo ukuze uthole okulingana okungcono kakhulu kwesitayela sakho sokuhweba.

Okucatshangelwayo Okubalulekile:

- Imijikelezo Yemakethe: Qinisekisa ukuthi izikhathi ezikhethiwe zimelela ngokwanele imijikelezo eyahlukene emakethe.

- Izici zefa: Cabangela amaphethini entengo ayingqayizivele nokuntengantenga kwempahla.

- Risk Ukubekezelelana: Qondanisa izilungiselelo ze-oscillator nesu lakho lokulawula ubungozi.

Ngokumisa ngokucophelela i- Ultimate Oscillator, tradeI-rs ingathuthukisa ukusebenza kwayo, okuholela ezinqumweni zokuhweba ezinolwazi. Khumbula, inhloso ukuhlanganisa i-oscillator kukho konke uhlelo lokuhweba, okuhambisana namanye amasu okuhlaziya nezinkomba.

| Ubude besikhathi | Ukusetha Okuzenzakalelayo | Isilungiselelo Esilungisiwe (Ukuguquguquka Okuphezulu) |

|---|---|---|

| Isikhathi esifushane | izinsuku 7 | Kungenziwa ngendlela oyifisayo ngokusekelwe empahleni |

| Okuphakathi | izinsuku 14 | Kungenziwa ngendlela oyifisayo ngokusekelwe empahleni |

| Isikhati eside | izinsuku 28 | Kungenziwa ngendlela oyifisayo ngokusekelwe empahleni |

| Ileveli Yokuthenga Ngokweqile | 70 | 80 |

| Ileveli Edayisiwe | 30 | 20 |

Kubalulekile ukubuyekeza njalo futhi ulungise izilungiselelo ze- Ultimate Oscillator njengoba izimo zemakethe zishintsha. Ukucwengwa okuqhubekayo kuzosiza ekugcineni ukuhambisana nokunemba kwezimpawu ezinikezayo.

2.1. Ukukhetha Izikhathi Ezifanele

Ezweni eliguquguqukayo lokuhweba, i Ultimate Oscillator igqama njengethuluzi eliguquguqukayo lokulinganisa umfutho wemakethe ngokuhlaziywa kwayo kwezikhathi eziningi. Ukuze usebenzise amandla ayo aphelele, traders kufanele lungisa kahle izilungiselelo ze-oscillator ukuvumelanisa isu labo lokuhweba kanye nezici zemakethe.

Day traders, ifuna ukwenza imali ngokunyakaza kwemakethe okusheshayo, ingase ithole izilungiselelo ezijwayelekile zivilapha kakhulu. Ngokulungisa izikhathi zibe 5, 10, no-15, bangathuthukisa ukuzwela kwe-oscillator ekushintsheni kwamanani asheshayo, ngaleyo ndlela bathole amasignali afika ngesikhathi abalulekile kulesi sitayela sokuhweba se-high-frequency.

Ngokolunye uhlangothi, swing traders ngokuvamile isebenza emkhathizwe obanzi, kuhloswe ukubamba ukushintshashintsha kwemakethe okukhulu. Kubo, ukucushwa kwe 10, 20, futhi 40 izikhathi kungase kufaneleke kakhudlwana. Lokhu kulungiswa kusiza ukushelela ukuguquguquka kwesikhashana, kunikeze umbono ocacile womfutho oyisisekelo wethrendi.

Inqubo yokulinganisa i-Ultimate Oscillator kufanele ifake ukubuyisela emuva, indlela yokusebenzisa i-oscillator kudatha yemakethe yangaphambilini ukuze kuhlolwe ukusebenza kwayo. Lesi sinyathelo sibalulekile ekuhlonzeni izilungiselelo ezikhiqiza kakhulu ze- trader izinjongo ezithile.

| Isitayela Sokuhweba | Isikhathi Esifushane | Isikhathi Esiphakathi | Isikhathi Eside |

|---|---|---|---|

| Usuku Ukuhweba | 5 | 10 | 15 |

| Ukuhweba kwe-Swing | 10 | 20 | 40 |

Imiphumela yokuhlehla ziqondise traders ekucwengisiseni izikhathi, ukuqinisekisa ukuthi izimpawu ze-oscillator zihambisana nesigqi semakethe. Akukhona nje ukuthola isilungiselelo esilingana nosayizi owodwa kodwa mayelana nokuthola inhlanganisela eyingqayizivele ehambisana nokushaya kwemakethe.

Imiphumela yokuhlehla ziqondise traders ekucwengisiseni izikhathi, ukuqinisekisa ukuthi izimpawu ze-oscillator zihambisana nesigqi semakethe. Akukhona nje ukuthola isilungiselelo esilingana nosayizi owodwa kodwa mayelana nokuthola inhlanganisela eyingqayizivele ehambisana nokushaya kwemakethe.

Idizayini ye-Ultimate Oscillator yoku nciphisa izimpawu zamanga inenzuzo ikakhulukazi ezimakethe eziguquguqukayo. Ngokuhlanganisa amasiginali asuka ezinkathini eziningi zesikhathi, inikeza umbono obanzi, onciphisa amathuba okudukiswa ukushintshashintsha kwentengo okungahleliwe.

Ekugcineni, ukusetshenziswa ngempumelelo kwe-Ultimate Oscillator kuncike ku-a trader ikhono loku ukuzivumelanisa nezimo zemakethe ezishintshayo. Ukubuyekeza njalo nokulungisa izikhathi kungasiza ukugcina ukuhambisana nokunemba kwamasiginali ewanikezayo. Le nqubo eqhubekayo yokucwenga iyona evumelayo traders ukuhlala uhambisana nokuguquguquka nokugeleza kwemakethe, ukwenza izinqumo ezinolwazi ezisekelwe ekuhlaziyeni okuphelele kokuthrendayo komfutho.

2.2. Ukulungisa Amazinga Athengwe Kakhulu Nama-Oversold

Ukulungisa amazinga athengwe ngokweqile nathengiswe ngokweqile ku-Ultimate Oscillator anganikeza a indlela ehambisanayo eyengeziwe yokukhiqiza trade amasignali. Izilungiselelo ezizenzakalelayo kungenzeka zingahambelani ngaso sonke isikhathi nezici ezihlukile zamathuluzi okuhweba ahlukene noma isimo sezulu esishintshashintshayo semakethe.

Ezimakethe eziguquguqukayo kakhulu, amathuba okushintsha amanani ngokushesha aphezulu, okungaholela kumasiginali angamanga anemikhawulo ejwayelekile. Ngu ukulungisa amazinga athengwe ngokweqile nathengiswe ngokweqile, traders inganciphisa lezi zimpawu ezingamanga:

- Umkhawulo wokuthenga ngokweqile: Ngaphansi kuya ku-65

- Umkhawulo odayiswe ngokweqile: Khuphukela ku-35

Lokhu kulungiswa kusiza ekuhlungeni umsindo nokugxila kumasignali aqine kakhulu.

Ezimakethe ezingaguquguquki kancane, lapho ukunyakaza kwentengo kwehle kakhulu, ama-threshold angalungiswa ukuze athwebule amathrendi amade ngaphandle kokusabela ekuguquguqukeni okuncane kwentengo:

- Umkhawulo wokuthenga ngokweqile: Khuphukela ku-75

- Umkhawulo odayiswe ngokweqile: Ngaphansi kuya ku-25

Lokhu kuvumela traders ukuthatha isikhangisovantage yobubanzi obugcwele bokunyakaza ngaphambi kokuba isignali yenziwe.

Ukubuyisela emuva kuyisinyathelo esibalulekile kule nqubo. Ngokuhlaziya ukuthi izilungiselelo ezihlukene bezizosebenza kanjani esikhathini esidlule, traders bangakala ukusebenza okungaba khona kokulungiswa kwabo. Kubalulekile uku cwenga ngokuqhubekayo lezi zilungiselelo, njengoba izimo zemakethe zingashintsha, okwenza amazinga angaphambilini alungile angasebenzi kahle.

Imicabango Ebalulekile Yokulungisa:

- Ukuguquguquka Kwemakethe: Ukuntengantenga okuphezulu kungase kudinge amazinga aqinile ukuze kugwenywe izimpawu ezingamanga.

- Ukubekezelelana Kwengozi: Ukonga kakhulu traders ingase ikhethe amabhendi abanzi ukuze kuqinisekiswe amasiginali aqinile.

- Izici Zensimbi: Amanye amathuluzi angase abe namaphrofayili ahlukene okuguquguquka adinga izilungiselelo ezihlukile.

- Imiphumela yokuhlola i-Backtesting: Ukusebenza komlando kungaqondisa ukulungiswa kwamaleveli esikhathini esizayo trades.

- Izimo Zemakethe: Ukuzivumelanisa nezimo zemakethe zamanje kungathuthukisa ukuhambisana kwamasignali.

Ngokwenza ngendlela oyifisayo amazinga athengwe ngokweqile nathengiswe ngokweqile e-Ultimate Oscillator, traders ingakwazi ngcono izinga labo trade amasignali, okungase kuholele emiphumeleni engcono yokuhweba. Kodwa-ke, kubalulekile ukubhekana nalokhu kulungiselelwa ngomcabango wamasu, ucabangela izici ezihlukahlukene ezithonya ukusebenza kwalezi zinkomba zobuchwepheshe.

3. Ungabala kanjani i-Ultimate Oscillator?

Uma usebenzisa i Ultimate Oscillator in amasu ukuhweba, kubalulekile ukuthi ungaqondi nje ukubala kodwa nama-nuances okuthi ingabonisa kanjani amathuba okuhweba angaba khona. I-Divergence idlala indima ebalulekile lapha; uma intengo yempahla yenza ukuphakama okusha noma okuphansi okungaboniswa ku-oscillator, lokhu kungabonisa ukuthambekela okubuthakathaka kanye nokuhlehla okungaba khona.

Nakhu ukuhlukaniswa kwesinyathelo ngesinyathelo kwenqubo yokubala:

- Thola Okuphansi Kwangempela (TL):

- TL = Okuphansi Kwanamuhla Okuphansi noma Ukuvalwa Kwayizolo

- Bala Ingcindezi Yokuthenga (BP):

- BP = Kuvalwa Kwanamuhla - TL

- Misa Ububanzi Beqiniso (TR):

- TR = Okuphakeme Kwanamuhla Okuphakeme - Okuphansi Kwanamuhla, Okuphakeme Kwanamuhla - Kuvalwa Izolo, noma Ukuvalwa Kwayizolo - Okuphansi Kwanamuhla

- Bala Izilinganiso Ezimaphakathi isikhathi ngasinye:

- Isilinganiso esingu-7 = (Isamba se-BP sezikhathi ezingu-7) / (Isamba se-TR sezikhathi ezingu-7)

- Isilinganiso esingu-14 = (Isamba se-BP sezikhathi ezingu-14) / (Isamba se-TR sezikhathi ezingu-14)

- Isilinganiso esingu-28 = (Isamba se-BP sezikhathi ezingu-28) / (Isamba se-TR sezikhathi ezingu-28)

- Faka Izisindo:

- Isilinganiso Esinesisindo = (4 x Isilinganiso7 + 2 x Isilinganiso14 + Isilinganiso28)

- Yenza i-Oscillator ibe evamile:

- UO = 100 x (Isikali Esimaphakathi / 7)

Ukutolika i-Ultimate Oscillator kuhlanganisa ukubheka amaphethini athile namasignali:

- Izimo ezithengiwe kakhulu nezithengiswa kakhulu: Njengoba kushiwo, ukufundwa okungaphezulu kuka-70 nangaphansi kuka-30 kungabonisa izimo ezithengiwe kakhulu nezidayiswe ngokweqile, ngokulandelana.

- I-Divergence: Uma intengo yenza okusha okuphezulu noma okuphansi okungaqinisekisiwe yi-oscillator, iphakamisa ukuguqulwa kwentengo okungenzeka.

- I-Threshold Breaks: Ukuhamba ngaphezu komkhawulo ongaphezulu kungabonisa ukuqala kwesigaba se-bullish, kuyilapho ikhefu elingaphansi komkhawulo ophansi lingabonisa ukuqala kwesigaba se-bearish.

Ukucatshangelwa okusebenzayo kwe traders zihlanganisa:

- Ukulungisa Ama-Threshold: Kuye ngokuguquguquka kwempahla, traders kungase kudingeke ukuthi kulungiswe imingcele ethengwe ngokweqile futhi edayiswe kakhulu ukuze ivumelane kangcono nezici zemakethe.

- Ukuqinisekiswa kwe: Ukusebenzisa i-Ultimate Oscillator ngokuhambisana namanye amathuluzi okuhlaziya ezobuchwepheshe kunganikeza isiqinisekiso esinamandla samasiginali okuhweba.

- Ukuzwela Kohlaka Lwesikhathi: I-oscillator ingasetshenziswa kumafreyimu wesikhathi ahlukene, kodwa traders kufanele yazi ukuthi ukuzwela kwayo namasiginali kungahluka ngokufanele.

Ngokuhlanganisa i-Ultimate Oscillator isu eliphelele lokuhweba, tradeI-rs ingakala kangcono umfutho kanye namaphuzu okushintsha okungenzeka emakethe. Kuyithuluzi elengeza ukujula ekuhlaziyeni kwezobuchwepheshe futhi lingasiza ekwenzeni izinqumo zokuhweba ezinolwazi.

3.1. Ukuqonda Ingcindezi Yokuthenga

Lapho kuhlolwa izimo zemakethe, traders bavame ukubheka amaphethini ekuthengeni ingcindezi yokwazisa amasu abo. Ngokwesibonelo, okwandayo ukuthenga ingcindezi ngezikhathi ezilandelanayo kungase kuphakamise umuzwa onamandla we-bullish, okungase kuholele ekuqhekekeni. Ngokuphambene, ukuncipha kwengcindezi yokuthenga ingase ibonise ukuthambekela okubuthakathaka noma ukulungiswa kwentengo okuzayo.

Izinkomba ezibalulekile zokuthenga ingcindezi zihlanganisa:

- Okuphezulu Okuphezulu: Lapho intengo ivaleka njalo kumaleveli aphezulu kunamaseshini adlule.

- Ivolumu Ekhuphukayo: Ukwenyuka kwevolumu yokuhweba kungahambisana nokukhuphuka kwengcindezi yokuthenga, kuqinise umkhuba.

- Amaphethini Amanani: Amaphethini ama-bullish afana 'nendebe nesibambo' noma 'unxantathu okhuphukayo' angabonisa ingcindezi yokuthenga isakhiwo.

TradeI-rs ivame ukuhambisana ne-Ultimate Oscillator namanye amathuluzi okuqinisekisa ukuthenga amasiginali wengcindezi:

| Isikhombi Sobuchwepheshe | Injongo |

|---|---|

| Ukuhambisa Okumaphakathi | Ukuhlonza isiqondiso sokuthambekela |

| I-Volume Oscillator | Ukukala izinguquko zevolumu, ezingaqinisekisa ukucindezela kokuthenga |

| RSI (Isihlobo Amandla Inkomba) | Ukulinganisa amandla okucindezela kokuthenga |

| MACD (Ukuhambisa Isilinganiso Sokwehluka Okuphakathi) | Ukuqinisekisa umfutho ngemuva kwengcindezi yokuthenga |

Ukusetshenziswa okuphumelelayo kwe-Ultimate Oscillator kuhlanganisa ukubheka umehluko phakathi kwe-oscillator nesenzo samanani. Uma i-oscillator yenza ukuphakama okuphezulu kuyilapho intengo ingekho, ingase ibonise amandla angaphansi angaholela ekukhuphukeni kwentengo.

Traders kufanele njalo aqaphele umongo wemakethe lapho etolika ingcindezi yokuthenga. Imicimbi yezindaba, ukukhishwa kwedatha yezomnotho, nomuzwa wemakethe konke kungaba nomthelela ekucindezelweni kokuthenga futhi, ngokwandisa, ukwethembeka kwamasiginali avela ku-Ultimate Oscillator. Kunconywa ukusebenzisa inhlanganisela yokuhlaziywa kobuchwepheshe, ukuhlaziywa okuyisisekelo, kanye namasu okulawula ubungozi ukwenza izinqumo zokuhweba ezinolwazi.

3.2. Sifingqa Isilinganiso Sezinzuzo Nokulahlekelwa

Lapho usebenzisa i Ultimate Oscillator, inqubo yokufingqa izinzuzo nokulahlekelwa okumaphakathi idlala indima ebalulekile ekukhiqizeni amasignali athembekile. Amaholo kwenzeka lapho intengo yokuvala yenkathi yamanje iphakeme kuneyenkathi edlule, futhi ukulahleka zirekhodwa uma intengo yokuvala yenkathi yamanje iphansi.

Traders isamba sezinzuzo nokulahlekelwa ezikhathini ezinqunywe kusengaphambili, ngokuvamile kusetshenziswa izikhathi ezimisiwe ze 7, 14, Futhi 28 izikhathi. Lezi zimele izitayela zemakethe zesikhathi esifushane, ezimaphakathi, nezesikhathi eside, ngokulandelana. Indlela yokubala ama-avareji iqondile: hlanganisa izinzuzo noma ukulahlekelwa ngesikhathi ngasinye bese uhlukanisa ngenani lezikhathi.

Nansi indlela yokubala ehlukaniswa ngayo ngesikhathi ngasinye:

| Isikhathi (Izinkathi) | Ukubalwa kwenzuzo emaphakathi noma yokulahlekelwa |

|---|---|

| 7 | (Isamba Sezinzuzo noma Ukulahlekelwa) / 7 |

| 14 | (Isamba Sezinzuzo noma Ukulahlekelwa) / 14 |

| 28 | (Isamba Sezinzuzo noma Ukulahlekelwa) / 28 |

Lawa ma-avareji abe eselinganiswa futhi ahlanganiswe kufomula ye-Ultimate Oscillator, enikeza inani elishintshashintshayo phakathi kuka-0 no-100. Kubalulekile ukuze traders ukubuyekeza lezi zilinganiso ngesikhathi esisha ngasinye ukuze kugcinwe ukunemba kwe-oscillator. Ngokufingqa ngenkuthalo izinzuzo nokulahlekelwa okumaphakathi, i-Ultimate Oscillator ihlala iyithuluzi elithembekile lokuhlonza amaphuzu okungenzeka athengwa noma adayiswe endaweni yokuhweba.

3.3. Ukusebenzisa Ifomula

Lapho usebenzisa i- Ultimate Oscillator kumasu okuhweba, kubalulekile ukuqaphela umehluko phakathi kwe-oscillator nesenzo senani. A umehluko we-bullish kwenzeka lapho inani lenza liphansi eliphansi, kodwa i-oscillator yenza okuphansi okuphezulu, okuphakamisa ukuguqulwa kwentengo okungaba phezulu. Ngokuphambene, a divergence ye-bearish kulapho intengo ifinyelela phezulu phezulu kuyilapho i-oscillator yenza ukuphakama okuphansi, okubonisa ukunyakaza kwentengo okungenzeka kwehle.

Izimo ezithengiwe ngokweqile nezidayiswe kakhulu yizimpawu ezibalulekile ezinikezwa yi-Ultimate Oscillator. Traders ivame ukubheka:

- Izimo ezithengiwe ngokweqile (UO > 70): Lokhu kungase kusho ukuthi impahla ingase ibe nkulu ngokweqile, futhi ukulungiswa kwentengo kungase kuseduze.

- Izimo ezidayiswe ngokweqile (UO < 30): Lokhu kungase kubonise ukuthi impahla ibukelwa phansi, futhi ukukhuphuka kwentengo kungase kusondele.

Ukuqinisekisa ngesenzo senani indlela ehlakaniphile. TradeI-rs kufanele ibheke ukuthi intengo inqamule kumugqa wethrendi noma izinga lokumelana/losekelo ngemuva kokuthi i-oscillator isayine ukuhlehla okungaba khona.

Ukuqondanisa kwesikhathi futhi kuyisici esibalulekile. Ukuqondanisa amasiginali we-oscillator nenkambiso yemakethe ebanzi kungakhuphula ukuthembeka kwezimpawu zokuhweba.

| Uhlobo Lwezimpawu | Isimo se-Oscillator | Price Action | Isenzo Sokuhweba esingase sibe khona |

|---|---|---|---|

| I-Bullish Divergence | Inani eliphakeme kakhulu lama-UO | Intengo Ephansi Ephansi | Cabangela Isikhundla Eside |

| I-Bearish Divergence | Okuphezulu Okuphansi ku-UO | Intengo Ephakeme | Cabangela Isikhundla Esifushane |

| Kukweqile | UO > 70 | - | Gada Ukuze Uthengise Amasignali |

| Okuphindwe kabili | UO <30 | - | Gada ukuze Thenga Amasignali |

Ukuphathwa kweengozi ngaso sonke isikhathi kufanele ihambisane nokusetshenziswa kwe-Ultimate Oscillator. Ukusetha ukuyeka-ukulahlekelwa ama-oda kanye nokuthatha inzuzo emazingeni anqunywe kusengaphambili kungasiza ukuphatha ukulahlekelwa okungase kube khona futhi kukhiye enzuzweni.

Ukuhlanganisa i-Ultimate Oscillator nezinye izinkomba inganikeza izendlalelo ezengeziwe zokuqinisekisa. Isibonelo, ukusebenzisa ama-avareji anyakazayo, ivolumu, noma amaphethini eshadini lentengo kungathuthukisa ukusebenza kwamasiginali akhiqizwe i-Ultimate Oscillator.

Ukufaka i-Ultimate Oscillator ohlelweni lokuhweba kudinga ukuzijwayeza nokunaka izici zemakethe. Njenganoma iyiphi inkomba yezobuchwepheshe, ayiyona into engenangqondo futhi kufanele isetshenziswe ngokuhambisana nohlelo lokuhweba oluyindilinga kahle.

4. Yimaphi Amasu Angcono Kakhulu Okusebenzisa I-Ultimate Oscillator?

Ukusetha ama-threshold alungile kubalulekile uma usebenza ne-Ultimate Oscillator. Nakuba amaleveli avamile asethwe kokuthi 70 ngokuthengwa kakhulu futhi 30 ngokudayiswa ngokweqile, ukulungisa le mikhawulo ukuze ilingane kangcono nokuntengantenga kwempahla kungathuthukisa ukunemba kwesignali. Impahla eguquguqukayo kakhulu ingase idinge umkhawulo ophakeme ukuze igweme izimpawu ezingamanga, kuyilapho engaguquguquki kancane ingase idinge umkhawulo ophansi ukuze izwele ngokwanele ukuze ithole ukunyakaza okunengqondo.

Okufakiwe kwesikhathi nokuphuma esinye isici lapho i-Ultimate Oscillator ingaba usizo olukhulu. Traders kufanele ibheke izikhathi lapho i-oscillator iphuma endaweni ethengiwe ngokweqile noma edayiswe kakhulu, okungabonisa ukushintsha komfutho. Ukungena a trade njengoba i-oscillator inqamula emuva ngezinga lama-70 noma lama-30 kungaba isu lokubamba ukuqala kwethrendi engaba khona.

Amapharamitha we-Ultimate Oscillator:

| Ipharamitha | Incazelo |

|---|---|

| Isikhathi Esifushane | Ngokuvamile izikhathi ezingu-7 |

| Isikhathi Esiphakathi | Ngokuvamile izikhathi ezingu-14 |

| Isikhathi Eside | Imvamisa isethelwa kuzinkathi ezingama-28 |

| I-Overbought Threshold | Ngokuvamile 70 (iyalungiseka) |

| I-Oversold Threshold | Ngokuvamile 30 (iyalungiseka) |

Ukuphathwa kweengozi kubalulekile uma usebenzisa i-Ultimate Oscillator. TradeI-rs kufanele ihlale ibeka ama-stop-loss orders ukuze ivikele ekuguqulweni kwemakethe okungenzeka ngisho nangemva kokuba isignali isinikiwe. Ngokulawula ubungozi kanye nokugcina imali, traders bangaqinisekisa ukuthi bahlala emdlalweni noma ngabe a trade ayihambi njengoba bekuhleliwe.

Ukufaka i-Ultimate Oscillator ku-a uhlelo oluphelele lokuhweba okubangela ukubekezelelana kwabantu engozini kanye nesitayela sokuhweba kubaluleke kakhulu. Traders kufanele bahlehlise amasu abo besebenzisa idatha yomlando ukuze baqonde ukuthi i-oscillator isebenza kanjani ngaphansi kwezimo zemakethe ezahlukahlukene. Lo mkhuba ungasiza ekulungiseni ukusetshenziswa kwe-Ultimate Oscillator futhi uyivumelanise ne trader izidingo ezithile.

Ukusebenzisa i-Ultimate Oscillator ukuze kuqinisekiswe ithrendi inganikeza isendlalelo esengeziwe sokuqinisekisa traders. Uma imakethe ithrenda, i-oscillator kufanele ijwayele ukuthambekela ohlangothini olufanayo. Uma i-oscillator iqala ukwehlukana nethrendi yentengo, ingase ibonise ukuthi ukuthambekela kuba buthaka futhi ukuguqulwa kungase kusondele.

4.1. Ukukhomba Izimpawu Zokuhlukana

Lapho uhlanganisa amasiginali wokuhlukana ohlelweni lokuhweba, kubalulekile ukuthi qapha ingqikithi yemakethe. Ukuhlukana kukodwa kungase kungabi inkomba eyanele yokuhlehla kwethrendi, njengoba ngezinye izikhathi kungaholela kumasignali angamanga. Traders kufanele icabangele lezi zici ezilandelayo ukuze kuthuthukiswe ukwethembeka kokuhlukana:

- Volume: Ivolumu yokuhweba ephezulu ekhandlelani lokuqinisekisa ukuhlehla kwethrendi ingaqinisa isignali yokuhlukana.

- Amazinga Wokusekela Nokumelana: Ukwehlukana okuhambisana nokusekela okuyinhloko noma ileveli yokumelana kunganikeza ukuqinisekiswa okwengeziwe.

- Isikhathi Sokuthrendayo: Ukwehlukana okwenzeka ngemva kwamathrendi esikhathi eside kungase kubonakale kakhulu kunalawo avela ngemva kwamathrendi wesikhashana.

TradeI-rs ingase futhi isebenzise ezinye izinkomba zobuchwepheshe ezifana nezilinganiso ezihambayo, I-Bollinger Amabhendi, noma i-Relative Strength Index (RSI) ukuze kuqiniswe amasiginali aphakanyiswe ukwehlukana ne-Ultimate Oscillator.

| Uhlobo Lokuhlukana | Price Action | Isenzo se-Ultimate Oscillator | Isiginali Yokuqinisekisa |

|---|---|---|---|

| Isi-Bullish | Okusha Okuphansi | Phezulu Phansi | I-Oscillator Ikhuphuka Ngenhla Inani Eliphakeme Lakamuva |

| Bearish | Okuphezulu Okusha | Phansi Phezulu | I-Oscillator iwela ngaphansi kweTrough yakamuva |

Ukuphathwa kweengozi iyingxenye ebalulekile uma uhweba ngamasignali ahlukene. Ukusetha ama-oda okulahlekelwa kokuyeka emazingeni abalulekile kungasiza ukunciphisa ukulahlekelwa okungaba khona uma imakethe inganyakazi njengoba bekulindelekile. Ngaphezu kwalokho, traders kufanele balinganise izindawo zabo ngokufanele futhi bagweme ukuchayeka ngokweqile kokukodwa trade.

Ngokuhlanganisa amasignali okuhlukana namanye amathuluzi okuhlaziya ezobuchwepheshe kanye nezinqubo zokulawula ubungozi ezizwakalayo, traders bangathuthukisa inqubo yabo yokuthatha izinqumo futhi balwele indlela yokuhweba elinganiselayo.

4.2. Ukuhweba nge-Breakout

Lapho uhlanganisa i- Ultimate Oscillator sibe yisu lokuqhamuka, traders kufanele iqaphe eduze ukuziphatha kwe-oscillator maqondana nokunyakaza kwentengo. I-Ultimate Oscillator ihlanganisa isilinganiso sesikhathi esifushane, esimaphakathi, nesesikhathi eside esinyakazayo ukuze inikeze isignali yomfutho ophelele.

| Price Action | Ultimate Oscillator | Ukuhunyushwa |

|---|---|---|

| Ukwephulwa kwentengo ngaphezu kokumelana | I-oscillator iphuka ngaphezu kokuphakama kwayo | Ukuqinisekiswa kwe-Bullish |

| Ukwephulwa kwamanani ngezansi kosekelo | I-oscillator iphuka ngaphansi kokuphansi kwayo | Ukuqinisekiswa kwe-Bearish |

| Intengo isondela ukumelana | I-oscillator isondela phezulu ngaphandle kokuqhuma | Umfutho we-bullish ongaba khona |

| Intengo isondela ekusekeleni | I-oscillator isondela phansi ngaphandle kokuqhuma | Umfutho we-bearish ongaba khona |

I-Divergence idlala indima ebalulekile ekuhloleni ukufaneleka kokuqubuka. Lapho intengo iphuma kodwa i-Ultimate Oscillator ingakuqinisekisi ukuthutha, kungaba uphawu lwe ukuqhuma okubuthakathaka noma isignali yamanga. Ukwehlukana lapho intengo yenza okusha phezulu noma phansi, kodwa i-oscillator ingenzi, ifulegi elibomvu le traders.

Amaphuzu okungena kufanele kukhethwe ngokucophelela, kahle ngemuva kokuthi i-Ultimate Oscillator iqinisekisa ukuqubuka. Traders ingase ibheke ukuthi i-oscillator idlulele ngale kokweqisa kwayo kwakamuva njengophawu lomfutho oqinile.

| Isimo sokungena | Action |

|---|---|

| Ukwephula okuqinisekisiwe nesivumelwano se-oscillator | Cabangela ukungena trade |

| Ukuqhuma ngaphandle kokuqinisekiswa kwe-oscillator | Qaphela noma ugweme trade |

| Ukwehlukana kwe-oscillator | Hlola kabusha trade ukufaneleka |

Ukuphathwa kweengozi kubalulekile, futhi ukulahleka kokumiswa okubekwe kahle kungasiza ekwehliseni ukulahlekelwa okungaba khona. Traders ingasetha ukulahlekelwa kokuma ngaphansi nje kwezinga lokuphumula lezikhundla ezinde noma ngaphezulu nje kwezikhundla ezimfushane.

The Ubude besikhathi ngoba i-Ultimate Oscillator kufanele ihambisane ne- trader isu. Izikhathi ezimfishane zingase zibe bucayi kakhulu ekushintsheni kwentengo, kuyilapho ubude besikhathi bungase buhlunge umsindo.

| Ubude besikhathi | Ukuzwela | Ukufaneleka |

|---|---|---|

| Isikhathi esifushane | High | Ukuhweba okunolaka |

| Isikhati eside | ongaphakeme | Ukuhweba okulandelanayo |

Ukufaka i-Ultimate Oscillator ekuhwebeni kwe-breakout kungahlinzeka traders nge ithuluzi elinamandla ukuhlonza nokuqinisekisa izitayela ezingaba khona. Ngokunaka ukuqinisekiswa nokuhlukana kwe-oscillator, nangokuyihlanganisa nokuhlaziywa kwevolumu, traders ingenza okuningi unolwazi futhi unamasu trades.

4.3. Ukuhlanganisa Nezinye Izinkomba Zobuchwepheshe

I-Ultimate Oscillator + Izilinganiso ezihambayo

| Isimo Semakethe | Ukuhambisa esijwayelekile | Isiginali ye-Ultimate Oscillator | Isenzo Esingenzeka |

|---|---|---|---|

| I-uptrend | Inani elingaphezu kwe-MA | Kukweqile | Gada okungase kudayiswe |

| I-Downtrend | Inani elingaphansi kwe-MA | Okuphindwe kabili | Gada ukuze uthenge okungenzeka |

| Ukuqola | Amanani akhuphuka azungeze i-MA | I-Divergence | Cabangela ukuthenga/ukuthengisa ngokusekelwe ekuhlukeni |

I-Ultimate Oscillator + RSI

| Ultimate Oscillator | RSI | Isimo Semakethe | Isenzo Esingenzeka |

|---|---|---|---|

| Kukweqile | Kukweqile | Ukuguqulwa kwe-Bearish okungenzeka | Cabangela ukuthengisa |

| Okuphindwe kabili | Okuphindwe kabili | Ukuguqulwa kwe-Bullish okungenzeka | Cabangela ukuthenga |

| I-Divergence | I-Divergence | Ukuguqulwa Kwethrendi okungenzeka | Qinisekisa nezinye izinkomba |

Amabhendi e-Ultimate Oscillator + Bollinger

| Isiginali ye-Ultimate Oscillator | I-Bollinger Band Ukusebenzisana | I-volatility | Isenzo Esingenzeka |

|---|---|---|---|

| Phuma ekuthengeni ngokweqile | Intengo ithinta ibhendi ephezulu | High | Kungase kuthengiswe ngokuhlehliswa |

| Phuma ku-Oversold | Intengo ithinta ibhendi ephansi | High | Ukuthenga okungahle kwenzeke |

| sokungahlangene | Inani phakathi kwamabhendi | Normal | Linda ezinye izimpawu |

I-Ultimate Oscillator + I-Stochastic Oscillator

| Ultimate Oscillator | oscillator Stochastic | Umfutho Wemakethe | Isenzo Esingenzeka |

|---|---|---|---|

| I-Bullish Momentum | I-Bullish Crossover | Ukwandisa | Cabangela ukuthenga |

| I-Bearish Momentum | I-Bearish Crossover | Yehlisa | Cabangela ukuthengisa |

| I-Divergence | I-Divergence | Akuqinisekisiwe | Sebenzisa ukuhlaziya okwengeziwe |

I-Ultimate Oscillator + MACD

| Ultimate Oscillator | MACD | Ukuqinisekisa Okuthrendayo | Isenzo Esingenzeka |

|---|---|---|---|

| I-Bullish Crossover | I-MACD ngaphezu komugqa wesiginali | I-Uptrend eqinisekisiwe | Cabangela ukuthenga |

| I-Bearish Crossover | I-MACD ngaphansi Komugqa Wesiginali | I-Downtrend eqinisekisiwe | Cabangela ukuthengisa |

| I-Divergence | I-Divergence | Ubuthakathaka bethrendi | Hlola kabusha isikhundla |

Okucatshangelwayo Okubalulekile:

- Ukukholisa phakathi kwezinkomba kuqinisa trade izimpawu.

- I-Divergence kungaba isexwayiso sangaphambi kwesikhathi sokuhlehla kwethrendi okungaba khona.

- I-volatility ukuhlola kubalulekile ekunqumeni izindawo zokungena nezokuphuma.

- Ukuphathwa kweengozi kubalulekile, okuhlanganisa ukusetshenziswa kwe-stop-loss orders.

- Ama-oscillator akufanele asetshenziswe eyedwa; umongo wemakethe kubalulekile.

- Ngokuvamile ukubuyisela emuva amasu asiza ekucwengisiseni ukusebenza kwawo ngempumelelo.