1. Uhlolojikelele lwe-RSI Divergence

The Isihlobo Amandla Inkomba (RSI) Ukwehlukana umqondo osetshenziswa ngu traders nabatshalizimali ukuze bakhombe ukuhlehla okungaba khona kumathrendi emakethe. Ihlanganisa imiqondo ye-RSI, a umfutho i-oscillator ekala isivinini nokushintsha kokunyakaza kwentengo, ngomgomo wokuhlukana, isimo lapho intengo yempahla ihamba iye kolunye uhlangothi lwenkomba yobuchwepheshe. Lesi sigaba sihlose ukwethula abasaqalayo kwe-RSI Divergence, sichaza izisekelo zayo, ukuthi isebenza kanjani, nokubaluleka kwayo ekuhwebeni.

1.1 Yini i-RSI?

Ngaphambi kokungena ekwehlukaneni kwe-RSI, kubalulekile ukuqonda i-Relative Strength Index (RSI) uqobo. Yathuthukiswa ngu-J. Welles Wilder Jr. ngo-1978, i-RSI iyi-oscillator esheshayo esukela ku-0 kuye ku-100 futhi isetshenziselwa ukukala izimo ezithengiwe kakhulu noma ezidayiswe ngokweqile ngentengo yempahla. Ukuhumusha okuvamile ukuthi impahla ibhekwa njengethengwe ngokweqile uma i-RSI ingaphezu kuka-70 futhi idayiswa ngokweqile uma ingaphansi kuka-30.

1.2 Ukuqonda Ukuhlukana

Ukwehlukana kwenzeka lapho intengo yempahla ihamba iye kolunye uhlangothi lwenkomba yobuchwepheshe noma elinye iphuzu ledatha. Kumongo we-RSI, ukwehlukana kungaba isignali enamandla ebonisa ukuthi inkambiso yamanje yentengo ingase ibe buthakathaka futhi ukuguqulwa okungenzeka kube khona emkhathizwe.

- I-Bullish Divergence: Lokhu kwenzeka uma intengo idala okuphansi okuphansi, kodwa i-RSI yenza okuphansi okuphezulu. Iphakamisa ukuthi ngenkathi intengo yehla, umfutho ophansi uyehla, okubonisa ukuhlehla okungaba khona.

- I-Bearish Divergence: Ngokuphambene, ukuhlukana kwe-bearish kwenzeka lapho intengo ifinyelela phezulu, kodwa i-RSI yenza ukuphakama okuphansi. Lokhu kukhombisa ukuthi naphezu kwentengo ekhuphukayo, umfutho okhuphukayo uya ngokuya uphela, okungase kuholele ekuhlehleni emuva.

1.3 Ukubaluleka Kokwehluka kwe-RSI Ekuhwebeni

I-RSI Divergence ihlonishwa ngu traders ngezizathu ezimbalwa:

- Inani Lokubikezela: Inganikeza izimpawu eziyisixwayiso zangaphambi kwesikhathi zokuhlehla kwethrendi okungaba khona, okuvumelayo traders ukulungisa izikhundla zabo ngokufanele.

- Risk Ukuphathwa: Ngokuhlonza ukuguqulwa okungenzeka kusenesikhathi, tradeI-rs ingasetha ukulahlekelwa kokuma okuqinile futhi ilawule ubungozi babo ngempumelelo.

- yizinhlobonhlobo: I-RSI Divergence ingasetshenziswa ezimeni zemakethe ezihlukahlukene futhi isebenza kumathuluzi ezezimali anhlobonhlobo, okuhlanganisa Amasheya, forex, izimpahla, kanye ne-cryptocurrencies.

| Isici | Incazelo |

| Uhlobo Lwenkomba | I-Momentum Oscillator |

| Inhloso Eyinhloko | Khomba ukuguqulwa kwethrendi okungaba khona ngokuthola ukuhlukana phakathi kokunyakaza kwentengo nokufundwa kwe-RSI. |

| Ama-Threshold ajwayelekile | Kuthengwe Kakhulu (>70), Kudayiswe Kakhulu (<30) |

| Uhlobo Lokuhlukana | I-Bullish (Intengo ↓, RSI ↑), I-Bearish (Intengo ↑, RSI ↓) |

| Ukusebenza | Inventory, Forex, Izimpahla, Ama-Cryptocurrencies |

| Ukubaluleka | Inani lokuqagela lokuhlehla, ukuphathwa kwengozi, ukuguquguquka |

2. Inqubo yokubala ye-RSI

Ukuqonda ukubala ngemuva kwe-Relative Strength Index (RSI) kanye nokukhomba ukuhlukana kudinga indlela yesinyathelo ngesinyathelo. Lesi sigaba sihlukanisa inqubo ibe izingxenye ezilawulekayo, siqinisekisa ukuthi abasaqalayo bangakwazi ukubala i-RSI futhi babone amasignali okuphambana kamuva. I-RSI ngokwayo iyi-oscillator esheshayo, ekala isivinini noshintsho lokunyakaza kwentengo phakathi nesikhathi esithile, ngokuvamile izinsuku eziyi-14.

2.1 Ukubala i-RSI

Ukubalwa kwe-RSI kuhilela izinyathelo ezimbalwa, okugxile enzuzweni emaphakathi nokulahlekelwa esikhathini esishiwo, ngokwesiko esisethelwa ezikhathini eziyi-14. Nakhu ukuhlukaniswa okwenziwe lula:

- Khetha Isikhathi: Isikhathi esijwayelekile sokubala kwe-RSI ngu-14, okungaba izinsuku, amasonto, nanoma yisiphi isikhathi trader uyakhetha.

- Bala Isilinganiso Sezinzuzo Nokulahlekelwa: Ngesikhathi esikhethiwe, bala isilinganiso sayo yonke inzuzo nokulahlekelwa. Esibalweni sokuqala, vele ufingqe zonke izinzuzo nokulahlekelwa, bese uhlukanisa ngesikhathi (14).

- Lungisa Ukubala: Ngemva kokuba inzuzo emaphakathi yokuqala ibaliwe, izibalo ezilandelayo zihamba kahle ngokuthatha isilinganiso sangaphambilini, siphindaphindeka ngo-13, kwengezwe inzuzo yamanje noma ukulahlekelwa, bese kuhlukaniswa isamba ngo-14.

- Bala Amandla Ahlobene (RS): Lesi isilinganiso senzuzo emaphakathi ukuya ekulahlekelweni okumaphakathi.

- Bala i-RSI: Sebenzisa ifomula (RSI = 100 – \frac{100}{1 + RS}), lapho i-RS Ingamandla Ahlobene.

| Isinyathelo | Incazelo |

| 1. Khetha Isikhathi | Ngokujwayelekile izikhathi eziyi-14; nquma isikhathi sesikhathi sokubala se-RSI. |

| 2. Isilinganiso Sezinzuzo/Ukulahlekelwa | Bala i-avareji yazo zonke izinzuzo nokulahlekelwa phakathi naleso sikhathi. |

| 3. Ukubala Okubushelelezi | Sebenzisa izilinganiso zangaphambilini kuzibuyekezo eziqhubekayo ze-RSI, wenze idatha ibe bushelelezi. |

| 4. Bala i-RS | Isilinganiso senzuzo emaphakathi kuya ekulahlekeni okumaphakathi. |

| 5. Bala i-RSI | Sebenzisa ifomula ye-RSI ukuze unqume inani lenkomba. |

3. Amanani Alungile Okusetha Ezinkathini Zesikhathi Ezihlukene

Ukukhetha amanani alungile we- RSI ukusethwa kuzo zonke izikhathi ezihlukene kubalulekile ukuze kukhuliswe ukusebenza kahle kwakho ku amasu ukuhweba. Lesi sigaba siqondisa abasaqalayo ngokukhetha amapharamitha angcono kakhulu e-RSI kanye nokuqonda ukuthi lezi zinketho zinethonya kanjani ekusebenzeni kwenkomba ezimeni ezihlukene zemakethe.

3.1 Izilungiselelo ezijwayelekile ze-RSI

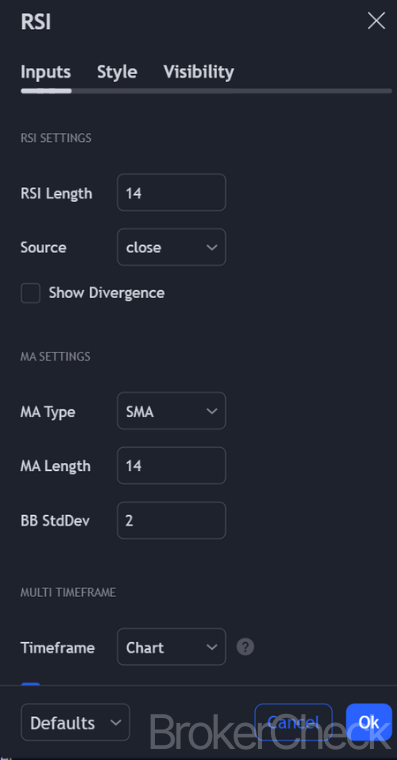

Ukusetha okujwayelekile kwe-Relative Strength Index (RSI) yizikhathi eziyi-14, eguquguqukayo futhi esetshenziswa kabanzi ezimpahleni eziningi nezikhathi. Nokho, ukulungisa isikhathi kungalungisa ukuzwela kwenkomba:

- Izikhathi ezimfushane (isb., 9 noma 10): Khulisa ukuzwela, okwenza i-RSI isebenze kakhulu ekushintsheni kwentengo. Lokhu kunenzuzo ekuhwebeni kwesikhathi esifushane noma ku-scalping, njengoba kungagqamisa amathrendi esikhathi esifushane kanye nokuguqulwa ngokushesha okukhulu.

- Izikhathi ezinde (isb., 20 noma 25): Yehlisa ukuzwela, yenza kube lula ukushintshashintsha kwe-RSI. Le ndlela ifanele amasu okuhweba esikhathi eside, enikeza umbono ocacile wendlela yonke yethrendi ngaphandle komsindo wokunyakaza kwentengo yesikhashana.

3.2 Ukulungiswa Kwezikhathi Ezihlukene

Izilungiselelo ezilungile ze-RSI zingahluka kuye ngesikhathi sokuhweba:

- Ukuhweba Kosuku (Isikhashana): Okwemini traders, ukusebenzisa isikhathi esifushane se-RSI (isb, 9 kuya ku-10) kungaba yimpumelelo kakhulu. Lesi silungiselelo sisiza ukuthwebula ukunyakaza okusheshayo, okubalulekile, njengalokhu traders banentshisekelo enkulu esenzweni senani lesikhashana.

- I-Swing Trading (Isikhathi esimaphakathi): Swayipha traders ingase ithole i-RSI evamile yenkathi engu-14 noma amanani alungiswe kancane (isb., 12 noma 16) afaneleka kakhulu. Lezi zilungiselelo zinikeza ibhalansi phakathi kokuzwela kanye nekhono lokuhlunga umsindo wemakethe, ukuvumelanisa kahle nemvelo yesikhathi esimaphakathi yokuhweba ngokushwibeka.

- Ukuhweba Ngesikhundla (Isikhathi eside): Ngesikhundla traders, isikhathi eside se-RSI (isb, 20 kuya ku-25) singanikeza amasignali angcono. Lezi zilungiselelo zehlisa ukuzwela kwe-RSI ekushintsheni kwentengo yesikhathi esifushane, igxile emandleni ethrendi ayisisekelo futhi inikeze amasignali acacile okulungiswa kwendawo yesikhathi eside.

3.3 Ukutholwa Kokwehluka Ngezikhathi Ezihlukene

Ukutholwa kokuhlukana kwe-RSI nakho kuncike esikhathini esikhethiwe nezilungiselelo:

- Izikhawu zesikhathi esifushane: Idinga ukuqapha kaningi kanye nokusabela okusheshayo kumasiginali wokuhluka, uma kubhekwa umsindo wemakethe okhuphukile kanye nenani eliphakeme lamasignali angamanga.

- Izikhawu zesikhathi eside: Izimpawu zokuhlukana ngokuvamile zithembeke kakhulu kodwa zenzeka kancane. TradeI-rs idinga ukubekezela futhi ingase isebenzise amathuluzi okuqinisekisa engeziwe ukuze uqinisekise amasiginali wokuhlukana ngaphambi kokuthatha isinyathelo.

3.4 Amathiphu Asebenzayo Wokusetha Ukuhlukana kwe-RSI

- Linga ngezilungiselelo: Traders kufanele izame izikhathi ezihlukile ze-RSI ukuze ithole isilungiselelo esilungile esifana nesitayela sabo sokuhweba kanye ne ukungazami yempahla abayihwebayo.

- Sebenzisa Ukuqinisekisa Okwengeziwe: Kungakhathalekile isikhathi esibekiwe, ukusebenzisa izinkomba ezengeziwe noma amasu okuhlaziya ukuze kuqinisekiswe kungathuthukisa ukwethembeka kwezimpawu zokuhlukana.

- Cabangela Izimo Zemakethe: Ukusebenza kwezilungiselelo ezithile ze-RSI kungahluka ezimeni ezihlukene zemakethe (isb, ezihamba phambili uma ziqhathaniswa nezimakethe ezibophezelekile), ngakho-ke kubalulekile ukulungisa izilungiselelo ngokusekelwe kuguquguquko lwemakethe yamanje.

| Isitayela Sokuhweba | Inkathi ye-RSI ephakanyisiwe | Advantages | Ukubhekelwa |

| Usuku Ukuhweba | 9-10 | Iyashesha ukusabela, ithwebula ukunyakaza kwesikhashana | Amandla aphezulu amasignali amanga |

| Ukuhweba kwe-Swing | 12-16 | Ibhalansisa ukuzwela nokuhlunga umsindo | Idinga ukuqapha nokulungisa ngokucophelela |

| Isikhundla Ukuhweba | 20-25 | Ihlunga umsindo wesikhathi esifushane igxile kumathrendi | Izimpawu zingafika sekwephuzile; kudinga ukubekezela |

4. Ukuhunyushwa kanye Nokusetshenziswa Kwezimpawu Zokuhlukana kwe-RSI

Ukutolika nokusebenzisa amasiginali wokuhlukana kwe-RSI ngendlela efanele kubalulekile traders ibheke ukusebenzisa le nkomba ukuhlonza okungaba khona ukuhlehla kwethrendi. Lesi sigaba sihlose ukuqondisa abaqalayo ngenqubo yokutolika amasignali e-RSI ahlukene kanye nendlela yokuwasebenzisa ngokuphumelelayo ezinqumweni zokuhweba.

4.1 Ukuqonda Izimpawu Zokuhlukana kwe-RSI

Izimpawu ze-RSI Divergence ziza ngezinhlobo ezimbili eziyinhloko: ukwehlukana kwe-bullish kanye ne-bearish, ngayinye ikhombisa ukuguqulwa okungaba khona kumkhuba wamanje.

- I-Bullish Divergence: Kuvela uma intengo irekhoda phansi okuphansi, kodwa i-RSI imaka okuphansi okuphezulu. Lokhu kubonisa ukwehla komfutho kanye nokungahle kwenzeke okuzayo kwethrendi okubuyela emuva.

- I-Bearish Divergence: Kwenzeka uma intengo ifinyelela phezulu, kodwa i-RSI ibonisa ukuphakama okuphansi. Lokhu kusikisela ukuthi umfutho obheke phezulu uyancipha, okungase kuholele ekubuyeleni emuva kwethrendi.

4.2 Isicelo Kumasu Okuhweba

Ukusetshenziswa kwezimpawu zokwehlukana kwe-RSI kumasu okuhweba kuhilela izinyathelo ezimbalwa ezibalulekile:

- Ukukhonjwa Kwesiginali: Okokuqala, thola umehluko ocacile phakathi kwesenzo senani nokufundwa kwe-RSI. Lokhu kudinga umehluko obonakalayo esiqondisweni senani kanye nemigqa yethrendi ye-RSI.

- Ukuqinisekiswa kwe: Bheka ukuqinisekiswa okwengeziwe kokuhlehla kwethrendi. Lokhu kungaba iphethini yekhandlela elihlehlayo, ukuphuma kumugqa wethrendi, noma isiqinisekiso esivela kwenye inkomba.

- Indawo yokungena: Nquma indawo yokungena ngokusekelwe kumasiginali wokuqinisekisa. Traders ngokuvamile ulinda iphethini ethize yekhandlela ukuthi iqedwe noma inani lephule izinga elithile ngaphambi kokufaka a trade.

- Misa Ukulahlekelwa futhi Thatha Inzuzo: Setha ukulahleka kokuma ukuze ulawule ubungozi, ngokuvamile endaweni ephansi noma ephezulu yakamuva ngaphambi kwesignali yokuhlukana. Izinga lenzuzo yokuthatha lingasethwa ngokusekelwe emazingeni ayinhloko okumelana noma okusekela, noma kusetshenziswa isilinganiso somvuzo wengozi esihambisana tradeisu lika-r.

4.3 Izibonelo Ezisebenzayo

- I-Bullish Divergence Isibonelo: Cabanga ngesimo lapho intengo yesitoko yehla ibe phansi okusha, kodwa i-RSI yakha inani eliphansi eliphezulu. Uma lokhu kulandelwa i-bullish engulfing candlestick iphethini, a trader ingase ingene endaweni ende ekuvaleni kwekhandlela, ibeke ukulahlekelwa kokuma ngaphansi kwezinga eliphansi lakamuva kanye nenzuzo yokuthatha ezingeni langaphambilini lokumelana noma isebenzisa isilinganiso esingu-2:1 somvuzo wengozi.

- Isibonelo se-Bearish Divergence: Ngokuphambene nalokho, uma intengo yesitoko ifinyelela phezulu entsha ne-RSI eyenza ukuphakama okuphansi futhi ilandelwa iphethini ye-bearish reversal candlestick, lokhu kungase kubonise ithuba elihle lokungena endaweni emfushane. I trader ingasetha ukulahlekelwa kokumiswa ngaphezu kokuphezulu kwakamuva kanye nenzuzo yokuthola ezingeni elaziwayo lokusekela noma ngokusekelwe kulokho abakuncamelayo komvuzo wobungozi.

| Isinyathelo | Incazelo |

| Ukukhonjwa Kwesiginali | Bheka ukungezwani phakathi kokwehla/ukuphakama kwentengo kanye nokwehla/ukuphakama kwe-RSI okubonisa ukwehlukana. |

| Ukuqinisekiswa kwe | Funa amasignali engeziwe (isb, amaphethini ezithi zamakhandlela, ezinye izinkomba) ukuze uqinisekise ukuhlehla kwethrendi. |

| Indawo yokungena | Faka trade ngokusekelwe kumasiginali wokuqinisekisa, kucatshangelwa isikhathi esifanelekile kanye nesimo semakethe. |

| Misa ukulahlekelwa futhi uthathe inzuzo | Setha ukulahlekelwa kokuma endaweni ephansi/phezulu yakamuva ngaphambi kokuhlukana futhi uthathe inzuzo emazingeni abalulekile. |

5. Ukuhlanganisa I-RSI Divergence Nezinye Izinkomba

Ukuthuthukisa ukusebenza kahle kwamasiginali we-RSI Divergence, traders ngokuvamile ukuwahlanganisa nezinye izinkomba zobuchwepheshe. Le ndlela enezici eziningi isiza ekuqinisekiseni amasiginali, inciphise amaphuzu angamanga, futhi ithuthukise inqubo yokuthatha izinqumo iyonke. Lesi sigaba sizoqondisa abasaqalayo ukuthi bangahlanganisa kanjani ngempumelelo i-RSI Divergence nezinye izinkomba ukuze kwakhiwe isu lokuhweba eliqine kakhulu.

5.1 Izinkomba Ezibalulekile Zokuhlanganisa Nokuhlukana kwe-RSI

- Izilinganiso ezihambayo (MAs): Ukuhambisa okumaphakathi kushelelanisa idatha yentengo ukuze udale umugqa owodwa ogelezayo, okwenza kube lula ukuhlonza isiqondiso sethrendi. Ukuhlanganisa i-RSI Divergence nama-MA (njengezinsuku ezingu-50 noma ezingu-200 ze-MA) kungasiza ukuqinisekisa amandla okuguqulwa kwethrendi.

- MACD (Ukuhambisa Isilinganiso Sokwehluka Okuphakathi): I-MACD ikala umfutho wempahla ngokuqhathanisa okumaphakathi okuhambayo okubili. Umehluko phakathi kwe-MACD nesenzo senani, uma kwenzeka eduze kwe-RSI Divergence, kunganikeza isignali eqinile yokuhlehla kwethrendi okungaba khona.

- oscillator Stochastic: Ngokufanayo ne-RSI, i-Stochastic Oscillator ikala umfutho wokunyakaza kwamanani. Uma zombili izinkomba ze-Stochastic ne-RSI zibonisa ukwehluka ngentengo ngesikhathi esisodwa, zingabonisa amathuba aphezulu okuguqulwa kwethrendi.

- Ama-Volume Indicators: Izinkomba zevolumu, njenge-On-Balance Volume (OBV), zingaqinisekisa amandla okuguqulwa kwethrendi okusayinwe yi-RSI Divergence. Ukwenyuka kwevolumu ngakundlela yokuhlehla kwengeza ukwethembeka kusiginali.

5.2 Uzihlanganisa Kanjani Izinkomba Nokuhlukana kwe-RSI

- Ukuqinisekisa Okuthrendayo: Sebenzisa i-Moving Averages ukuze uqinisekise isiqondisindlela sethrendi iyonke. I-bullish ye-RSI Divergence ku-uptrend noma i-bearish divergence ku-downtrend ingaba isignali eqinile.

- Ukuqinisekiswa Kwe-Momentum: I-MACD ingasiza ukuqinisekisa ukushintshwa komfutho okuphakanyiswe yi-RSI Divergence. Bheka umugqa we-MACD ukuze weqe umugqa wesignali yawo noma ubonise ukwehlukana okuhambisana nesiginali ye-RSI.

- Ukuqinisekisa nge-Stochastic Oscillator: Qinisekisa i-RSI Divergence ngokuhlukana ku-Stochastic Oscillator, ikakhulukazi ezindaweni ezithengwa kakhulu noma ezidayiswe kakhulu.

- Ukuqinisekiswa Kwevolumu: Hlola izinkomba zevolumu ukuze uqinisekise ukuthi ivolumu isekela isignali yokuhlehla. Ukwenyusa ivolumu ngakundlela yokuhlehla kunikeza isisindo kusignali yokuhlukana.

5.3 Ukusebenza Okusebenzayo Nezibonelo

- Ukuhlanganisa i-RSI ne-MACD: Uma i-RSI ibonisa ukuhlukana kwe-bullish ngesikhathi esifanayo i-MACD iwela ngaphezu komugqa wayo wesignali, lokhu kungase kube isignali yokuthenga eqinile.

- I-RSI Divergence kanye nezilinganiso ezihambayo: Ukubona i-RSI Divergence ngenkathi intengo isondela kokubalulekile isilinganiso esihambayo (njenge-MA yezinsuku ezingama-200) ingabonisa ukugxuma okungaba khona ku-MA, iqinisekise ukuhlehla kwethrendi.

5.4 Izindlela Ezinhle Kakhulu Zokuhlanganisa Izinkomba

- Gwema Ukweqa: Khetha izinkomba ezihlinzeka ngezinhlobo ezahlukene zolwazi (ithrendi, umfutho, ivolumu) ukuze ugweme amasignali angasebenzi.

- Bheka Ukuhlangana: Izimpawu ezingcono kakhulu zenzeka uma kunokuhlangana phakathi kwezinkomba eziningi, okuphakamisa amathuba aphezulu okuphumelela trade.

- Ukubuyela emuva: Njalo i-backtest isu lakho kudatha yomlando ukuze uqinisekise ukusebenza kwayo ngaphambi kokuyisebenzisa ezimweni zangempela zokuhweba.

| inkomba | Injongo | Ungahlanganisa kanjani ne-RSI Divergence |

| Ukuhambisa Okumaphakathi | Ukuqinisekiswa kwethrendi | Qinisekisa isiqondiso sethrendi ngama-MA. |

| MACD | Ukuqinisekiswa komfutho | Bheka ama-crossovers womugqa we-MACD kanye nokuhlukana. |

| oscillator Stochastic | Umfutho kanye namazinga athengwe ngokweqile/okuthengiswa ngokweqile | Qinisekisa ukwehlukana ikakhulukazi emazingeni adlulele. |

| Ama-Volume Indicators | Qinisekisa amandla okuguqulwa kwethrendi | Hlola ukukhushulwa kwevolumu ohlangothini lokuhlehla. |

6. Ukulawulwa Kwengozi nge-RSI Divergence Trading

Ukulawulwa kobungozi okusebenzayo kubalulekile lapho uhweba ne-RSI Divergence, njenganoma yiliphi isu lokuhweba. Lesi sigaba sizoxoxa ngokuthi kanjani traders bangasebenzisa amasu okulawula ubungozi ukuze bavikele ukutshalwa kwezimali kwabo ngenkathi besebenzisa amasiginali we-RSI Divergence. Inhloso ukusiza abasaqalayo baqonde ukubaluleka kokulawula ubungozi futhi banikeze izindlela ezisebenzayo zokusebenzisa lezi zimiso emisebenzini yabo yokuhweba.

6.1 Ukusetha ukulahlekelwa kokuyeka

Esinye sezici ezibalulekile zokulawulwa kobungozi ukusetshenziswa kwe-stop-loss orders. Lapho uhweba kumasiginali we-RSI Divergence:

- Nge-Bullish Divergence: Beka ukulahlekelwa kokuma ngaphansi nje kokuphansi kwakamuva kakhulu esenzweni senani elihambisana nesignali yokuhlukana.

- Ukuze Bearish Divergence: Setha ukulahleka kokumiswa ngenhla nje kwezinga eliphezulu lakamuva elihlotshaniswa nokwehlukana.

Leli su lisiza ukukhawulela ukulahlekelwa okungaba khona uma imakethe ingahambi ngendlela elindelwe ngemva kwesignali yokuhlukana.

6.2 Usayizi Wendawo

Ukulinganisa indawo kubalulekile ukuze ulawule inani lengozi ethathwe ngakunye trade. Kubandakanya ukunquma ukuthi ingakanani imali okufanele yabelwe a trade esekelwe ukulahlekelwa stop kanye tradeukubekezelelana kwengozi. Umthetho ojwayelekile ukubeka engcupheni ingabi ngaphezu kuka-1-2% wemali yokuhweba eyodwa trade. Ngale ndlela, ngisho nochungechunge lokulahlekelwa ngeke lube nomthelela omkhulu emalini eyinhloko.

6.3 Ukusebenzisa ama-Take Profit Orders

Nakuba ukulahlekelwa kokuyeka kuvikela ekulahlekelweni okukhulu, ama-oda wokuthatha inzuzo asetshenziselwa ukuvikela inzuzo ngezinga lentengo elinqunywe kusengaphambili. Ukusetha amaleveli okuthatha inzuzo kudinga ukuhlaziya ishadi ukuze likwazi ukumelana (ekumisweni kwe-bullish) noma amazinga okusekela (ngokusetha kwe-bearish) lapho intengo ingase ihlehle.

6.4 Ukuhlukahluka

diversification ezimpahleni ezahlukene noma amasu anganciphisa ubungozi. Uma uhweba ngokusekelwe kumasiginali we-RSI Divergence, cabanga ukusebenzisa isu kuzo zonke izimakethe noma amathuluzi ahlukahlukene. Le ndlela isakaza ubungozi futhi ingavikela iphothifoliyo ekuguquguqukeni kwempahla eyodwa.

6.5 Ukuqapha kanye Nokulungiswa Okuqhubekayo

Izimakethe ziyashintshashintsha, futhi izimo zingashintsha ngokushesha. Ukuqapha okuqhubekayo kwezikhundla ezivulekile kuvumela traders ukulungisa ukulahleka kokuyeka, ukuthatha ama-oda enzuzo, noma ukuvala izikhundla ngesandla ukuze uphendule olwazini olusha noma umnyakazo wemakethe. Lokhu kuzivumelanisa nezimo kungathuthukisa kakhulu ukuphathwa kwezinhlekelele.

6.6 Isibonelo Sokulawula Ubungozi

Ukucabanga a trader ine-akhawunti yokuhweba engu-$10,000 futhi ilandela umthetho wengozi ongu-2%, akufanele babeke engcupheni engaphezu kwama-$200 ngeyodwa. trade. Uma ukulahleka kokumisa kusethwe amapayipi angama-50 ukusuka endaweni yokungena ku-a Forex trade, usayizi wendawo kufanele ulungiswe ukuze ukunyakaza kwepayipi ngakunye kulingane nama-$4 (ingozi engu-$200 ihlukaniswe ngamapayipi angu-50).

| I-Risk Management Technique | Incazelo |

| Ukusetha ukulahlekelwa kokumisa | Beka ukulahlekelwa kokumiswa ukuze ukhawulele ukulahlekelwa okungaba khona, ngokusekelwe emazingeni aphansi/phezulu akamuva kusukela kusignali yokuhlukana. |

| Usayizi Wesikhundla | Nquma i- trade usayizi osuselwe ebangeni lokulahlekelwa kokuma kanye nokubekezelela ingozi, ngokuvamile i-1-2% yemali. |

| Ukusebenzisa ama-Take Profit Orders | Setha amaleveli enzuzo yokuthatha ezindaweni zamasu ukuze uvikele inzuzo ngaphambi kokuhlehla kwethrendi okungaba khona. |

| diversification | Sabalalisa ubungozi ngokusebenzisa isu kuzo zonke izimpahla noma amathuluzi ahlukene. |

| Ukuqapha Nokulungiswa Okuqhubekayo | Lungisa ukulahlekelwa kokuyeka, thatha inzuzo, noma uvale izikhundla njengoba izimo zemakethe zishintsha. |